The transportation industry accounts for roughly 21% of the global carbon dioxide (CO2) emissions and a lion’s share of these emissions is from road-based transportation, roughly amounting to 75% of the global transport emissions. Despite the COVID pandemic and the semiconductor shortage, the demand for new vehicles remains strong, with the industry expecting car sales of 80+ million units in 2022 itself. Hence, it is clear as day that countries won’t be able to meet climate targets without reforms and widespread decarbonization efforts in the transportation sector.

Automotive manufacturers must accelerate investments in viable alternatives to fossil fuel-based internal combustion engines (ICEs). When it comes to the automotive sector, one way to identify where the industry is headed is to look at the motorsports industry. In this article, we discuss the future of Sustainable Transportation in detail while studying the patent filing trend in the domain.

Sustainable Propulsion Technologies

Coming to the motorsports industry, motorsports giants have spent colossal amounts of money on R&D over the years. Some of the innovations in components like gearboxes, suspensions, and brakes have been perfected and distilled over the years, eventually finding their implementation in passenger vehicles.

This is also evidenced by the widespread commercial application of often-overlooked technologies like xenon and LED-based headlights, which were born on a race track, and these days find use in the majority of road cars. Based on this trend, it seems likely that the sector will play a vital role in defining the propulsion technology of the future.

When we look at the present-day motorsports industry, it appears that manufacturers are inclined towards three key propulsion technologies:

- Electric

- Sustainable / Renewable / Bio Fuels

- Hydrogen

- Electric/Battery technology is being spearheaded by industry giants like Porsche, Jaguar, Nissan, and Mahindra through their involvement in the EV-based racing series: Formula E.

- The pinnacle of motorsports, F1, has announced plans to develop a 100% sustainable fuel for the 2025 power unit, and the sport as a whole aims to achieve net-zero by 2030. Porsche has also made advancements in the sustainable fuel sector by investing in eFuels (synthetic methanol gasoline synthesized using renewable energy) technology in collaboration with Siemens.

- The Automobile Club de l’Ouest and GreenGT have also created a platform for hydrogen fuel cell-based prototype vehicles, which will be competing in the iconic 24 Hours of Le Mans from 2025.

Data from the motorsports industry is undeniably indicating an interest in all the major alternatives for ICEs. Like ICEs, none of these technologies are perfect and the widespread introduction will not transform the transportation sector’s emissions into net-zero, overnight. These propulsion technologies appear to exhibit some concerns like battery disposal/regeneration for EVs, non-net zero-emission concerns surrounding sustainable fuels, and the overall efficiency of hydrogen technology.

Companies and start-ups are aware of the opportunities that lie ahead as we transition toward sustainable mobility. EV manufacturers, led by Tesla have taken the market by storm and paved the way for new entrants like Nio and Rivian in the market. Sustainable transportation has the power to impact all sectors linked to mobility like EV powertrains, battery technology, HVAC OEMs, recycling, etc. According to Crunchbase, EV battery start-ups raised over $3.6 billion in 2021, with $3 billion being raised by China’s SVolt alone. Major manufacturers like GM, Ford, and BMW have also invested in some of these start-ups.

Even with the advent of hybrid technology, ICEs have commanded enormous popularity over the years. Now the curtains are falling on ICE tech as EV vehicle sales take a bigger chunk of the market year after year. It is evident that fossil fuel-based ICEs will be phased out sooner rather than later. As the chequered flag waves at the industry, sustainability must be kept in pole position moving forward. The industry needs to renew itself, ditch the smoke from tailpipes, and focus on cleaner propulsion technologies. This is where patent data might come in handy and provide a simplified answer to this complex problem.

What does IP indicate about the automotive sector’s predisposition towards the different propulsion techniques?

Propulsion Technology Wise Patent Filing Share

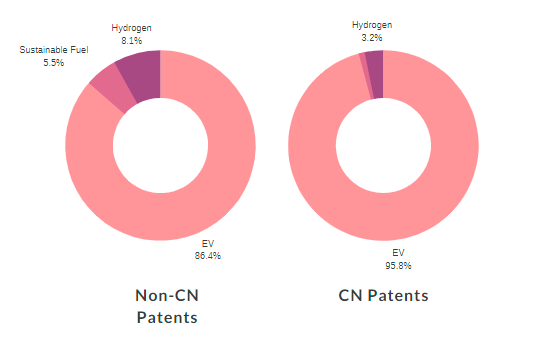

Note: The above chart merely illustrates an approximate version of the patent filing trends in the vehicle propulsion domain, fetched using sample search queries.

Patent data clearly suggests filing across all three – electric, sustainable fuel, and hydrogen-based propulsion. EV technology dominates the landscape in patent filings across both CN and non-CN jurisdictions. Patent filing across China predominantly illustrates an interest in EV technology, with hydrogen and sustainable fuels technology accounting for <5% of patent filings.

This reality extends beyond patent filings and is evidenced by China’s footprint in the global EV market share (including hybrid technology) and is forecasted to lead the way moving forward.

EV Patent Filing Share

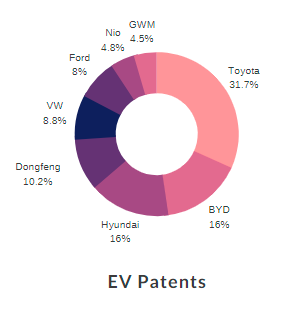

Note: The above chart illustrates the patent share of a select few companies. The patents considered for this study were classified under B60L and filed from 2019 onwards.

Although Toyota just rolled out its first fully electrified vehicle, the bZ4X, it has been active in filing patents under the CPC class B60L (Propulsion Of Electrically-Propelled Vehicles). In fact, Toyota seems to have filed almost double the number of patents (2019 onwards) as compared to China’s BYD and Korea’s Hyundai.

Manufacturers like BYD, Hyundai, and VW which already have launched mass-market EVs, account for a significant share of the EV-related patent filings. But with EVs amounting to less than 1% of the market share in Japan, Toyota seems to be gearing up for a bigger piece of the industry. Toyota has also committed around $70 billion to electrify its line-up and seems to be playing catch-up to the other manufacturers.

Hydrogen Technology Filing Share

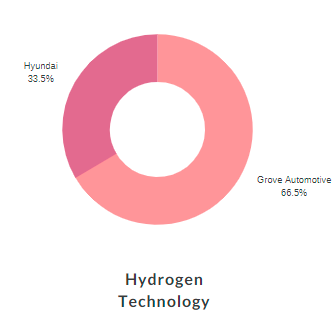

Note: The above chart illustrates the patent share of Korea’s Hyundai and China’s Grove Automotive in Hydrogen technology.

From a cursory glance at patent data, it seems to be evident that prominent manufacturers are steaming ahead with patent filings alongside market launches. EV patent data just for the last 3 years indicates a strong interest amongst players like Toyota, Hyundai, Nio, BYD, etc. Both Hyundai and Grove Automotive also seem to be propelling toward hydrogen technology as well.

Nevertheless, patent data for the three propulsion technologies listed above clearly indicates an inclination towards EVs. The EV patent filing share seems to account for approx 86% of filings across non-CN patents and a monumental 97% share in CN patents.

Since patent data shows an overwhelming interest in electric propulsion, let’s change gears and take a closer look at some of the common concerns/problems surrounding EVs and how innovation is shaping up to tackle these issues.

EV Problems and how industry leaders are solving them?

Range Anxiety – Present-day EV range anxiety is certainly a valid concern when consumers are in the market for a new car. With conventional hybrid technology or ICE-based vehicles, one can quickly fill up a tank of gas without ever worrying about the range of a full tank. According to the EV database, the average range of vehicles currently available in the market is a little over 300 km (187 miles). Manufacturers certainly seem to be cognizant of range anxiety and have filed patents to confront this problem using unique solutions.

- US8803470B2 – from Tesla, describes a vehicle power system comprising two battery packs (one being a metal-air battery). The second of these battery packs is utilized upon selection by a user, of an extended range mode. Such a switching configuration could help preserve battery life by reducing the number of charging cycles.

- US10059217B2 – by Hyundai, focuses on the electronics of the battery system in order to extend the driving mileage. This seems to be achieved by switching the configuration of cells in series and parallel based on whether acceleration is engaged or not. Such a cell balancing method is related to factors like battery lifespan and output power and hence is vital in ensuring range optimization.

Charging Time – In addition to range concerns, the amount of time needed to completely recharge a battery is also a question buyers might ask when in the market for an EV. Refueling ICE-based vehicles requires approx 5 minutes. The time for recharging EVs, however, varies widely based on the battery capacity and the charger type.

This problem can be addressed by fast-charging technologies, such as those being widely employed to recharge smartphones. But charging vehicles is a different game altogether due to both the battery capacity and the potential for heat generation.

- US9233618B2 – by Lightening Energy, talks about high-power DC charging systems (capable of delivering 300 kW per vehicle), resulting in a charging time of around 6 minutes for a 30 kWh battery. According to the patent, up to 50 kW of heat may be generated in a 6-12 minute timeframe. The inventors tried to address the heating problem by supplying coolant from the charging station as the battery was being charged.

- US10696174B2 – filed by Proterra, seems to be more relevant for heavy-duty EVs like buses. In order to overcome the time spent in parking the vehicle, carrying and attaching the charging cables (also long distances between the charging station and parking spots), the inventors seem to provide a charging system comprising a charging arm including a plurality of charging brushes. These charging brushes are then configured to contact a charging interface located on the vehicle. The patent also highlights the possibility of automating this process.

- DE102015004701A1 – assigned to Audi, tries to overcome problems such as overnight charging of vehicles. This is achieved by a dual storage system wherein the primary battery charges at a power less than a predetermined level and an auxiliary pack charges at a level greater than the threshold. The auxiliary pack may then transmit energy to the primary battery at a value lower than the threshold. Such a system results in a shorter charging time.

Recycling/End-of-Life – Talking in terms of circular economy, recycling battery materials like lithium & cobalt at the end of service life is crucial to ensure a sustainable operation. Under current estimates of a 10-20 year life span, battery recycling would have to be prioritized to maintain a closed-loop battery industry.

Several start-ups across the globe seem to be addressing the battery recycling conundrum and have been active on the IP front as well. Some of the prominent players include Sweden’s Northvolt, Canada’s Li-Cycle, Finland’s AkkuSer, and Germany’s Duesenfeld.

- EP3956487A1 – by Northvolt, tackles the process of recycling cathode active materials like Lithium, Manganese, and Cobalt. The patent focuses on the removal of iron and aluminum from the recycle stream. This is achieved by generating iron and aluminum phosphates which can be precipitated and removed from the process. The obtained leachate is rich in NMC materials and is suitable for recovery.

- WO2021174348A1 – by Li-Cycle, focuses on a method for processing Lithium Iron Phosphate (LFP) batteries. Due to the absence or low amounts of valuable Nickel and Cobalt elements, such batteries don’t seem to be favored from a recycling perspective. The inventors suggest the commercial suitability of recycling Lithium from LFP batteries. This seems to be achieved by acid leaching a black mass feed material, resulting in a leach solution. The leach solution may form an intermediary solution that is suitable for Iron and Phosphorus separation.

- US20210032721A1 – by Duesenfeld, is also related to the recycling of Lithium batteries. The patent claims digestion of comminuted material using concentrated sulfuric acid. This results in the production of waste gas and a digestion material. Wet chemical extraction is subsequently carried out to recover metallic components like Nickel and Cobalt. The Duesenfeld process enables the recovery of high purity graphite as well as results in the removal of fluoride (enhancing the process safety).

According to Duesenfeld: ‘The production of secondary raw materials with the Duesenfeld recycling process saves 8.1 tons of CO2 per ton of recycled batteries compared to the primary extraction of the raw materials. Compared to conventional melting processes, the Duesenfeld process saves 4.8 tons of CO2 per ton of recycled batteries, compared to mechanical processes with exhaust gas scrubbing, the saving is 1 ton of CO2 per ton of recycled battery.’

Thermal Management – Thermal management of EV battery temperatures is crucial in optimizing vehicle performance. Battery temperature has a significant impact on the charging and discharging rate of the cells. The cooling system is reported to contribute 10-20% of the cost of the battery pack. There are numerous ways to cool an EV battery with technology spanning from simple air-cooled systems to more complex liquid, refrigerant, and phase change material-based cooling solutions. Needless to say, vehicle manufacturers and automotive part suppliers have been dynamic in addressing these problems.

- US20210031654A1 – from Volvo, describes a predictive battery thermal management system (BTMS) for cooling a battery pack. This method takes into account a vehicle route to determine a battery cooling profile. Such a predictive system would enable the cooling system to be employed only when the predicted would result in an overheated battery. This system would enable a reduction in power required for operating the cooling system, thereby resulting in a net increase in vehicle range.

Interestingly, the EV manufacturer Nio has also filed a patent targeting the same technology. US10870368B2 focuses on a predictive model, to estimate the temperature at the end of a trip. Based on this information, a BTMS may determine whether active cooling would be needed or not. The inventors further suggest making use of data like the route from GPS, weather, and trip duration to predict the final state of the battery.

- Another innovation in the BTMS sector seems to revolve around the simplification of the cooling network. This is being addressed by the use of multi-directional coolant control valves to direct the flow of the cooling medium into different circuits. Such systems seem simpler to build, are easier to control and less complex, and less expensive to manufacture. Several prominent players like Mahle (US10203044B2), Hyundai (KR102299300B1), Vitesco (DE102020207303A1), and Hella group (CN111623146A) are actively working towards the use of multi-way valve systems for BTMS’.

Advancements in Sustainable/Biofuel Technology

EVs seem to be the favored technology for sustainable transportation, as evidenced by patent data. This transition to EVs cannot realistically take place overnight, or say within 5 years for that matter. To help maintain traction in this transition to electric mobility, we need cleaner alternatives to petrol and diesel. This is where synthetic, sustainable, renewable, or bio-based fuels could come to the rescue.

According to the eFuel Alliance, there are over 1.4 billion vehicles presently in operation which rely on ICE technology. In addition, there are over 27,000 aircraft and an excess of 90,000 ships in operation for which contemporary battery technology could probably be futile.

Innovators are actively working in this direction and there have been quite a number of recent patent filings as well. So let’s take a glance at the selected few patents.

- The Porsche-Siemens collaboration for the production of synthetic methanol gasoline will utilize green hydrogen. Porsche says that the synthesized eFuel could cut CO2 emissions by more than 85%. The process is planned to use wind energy to generate hydrogen via electrolysis, which will be subsequently used to synthesize methanol. The initial production capacity is predicted to be 130,000 liters in 2022, followed by a rise to 550 million by 2026.

Siemens also appears to have filed patents related to renewable fuels. US7989507B2 – by Siemens, is seemingly related to the eFuel process. The patent claims using waste CO2 (from industrial processes) and renewable hydrogen to produce fuel. Porsche also seems to have filed a patent related to fuel generation, DE102020118917A1. DE’817 differs in its disclosure regarding the fuel generation process. It talks about utilizing exhaust gas from ICEs, which can be fed into a catalytic converter filled with water. This can then be used to synthesize ethanol. Though the Porsche patent is not directly related to renewable fuels, it showcases an interest in pushing the efficiency limits for ICEs, which would directly contribute to a reduced carbon footprint.

- Ensyn Renewables is working on ‘Low Carbon Transportation Fuels’ by providing low carbon biocrude feedstocks for use in refinery processes like FCC. This biocrude feedstock is processed alongside traditional FCC feedstocks. US10570340B2 – talks about the use of biomass sources such as wood, corn stover, crop residue, switchgrass, etc. for the production of renewable fuel.

Some other prominent firms interested in renewable fuel include Finland’s Neste and Australia’s Southern Green Gas. Both seem to be actively filing patents related to renewable fuels.

- US10023815B2 – by Neste, talks about producing high octane gasoline components using renewable raw materials. The Neste patent seems to suggest the use of Tall Oil Pitch as the biological origin feedstock (Tall oil is obtained as a byproduct from the cellulosic pulp cooking process).

- WO2021102503A1 – by Southern Green Gas, describes a renewable methanol production system. The system claims to capture water directly from the atmosphere, electrolyzing the water to obtain hydrogen and finally reacting it with CO2 (also directly captured from the atmosphere) to obtain methanol. The patent further suggests the use of a solar-powered electrolyzer as a renewable source of energy.

Though patent filings in the sustainable/renewable fuels sector seem to be heating up, there seem to be some concerns with its commercial applicability. The Porsche-Siemens endeavor, which is targeting over 500 million liters of production by 2026, would still be a microscopic quantity compared to commercial requirements. The USA is reported to have consumed over 450 billion liters of gasoline in 2020. The eFuel Alliance’s expectation of a 100% renewable fuel target by 2050 seems to be a day late in solving the climate crisis. Since synthetic fuel processes also involve the use of hydrogen gas, there are concerns surrounding overall process efficiency, too.

Nevertheless, eFuels don’t necessarily seem to be doomed as they come with their own set of advantages, such as being climate neutral, compatible with current ICE tech, and being easily deployable via existing infrastructure.

Hydrogen Technology

Lastly, we arrive at the much-debated hydrogen technology. Hydrogen fuel cell technology has been studied for decades with the hydrogen-oxygen fuel cell. NASA has been using these fuel cells since the 1960s as well.

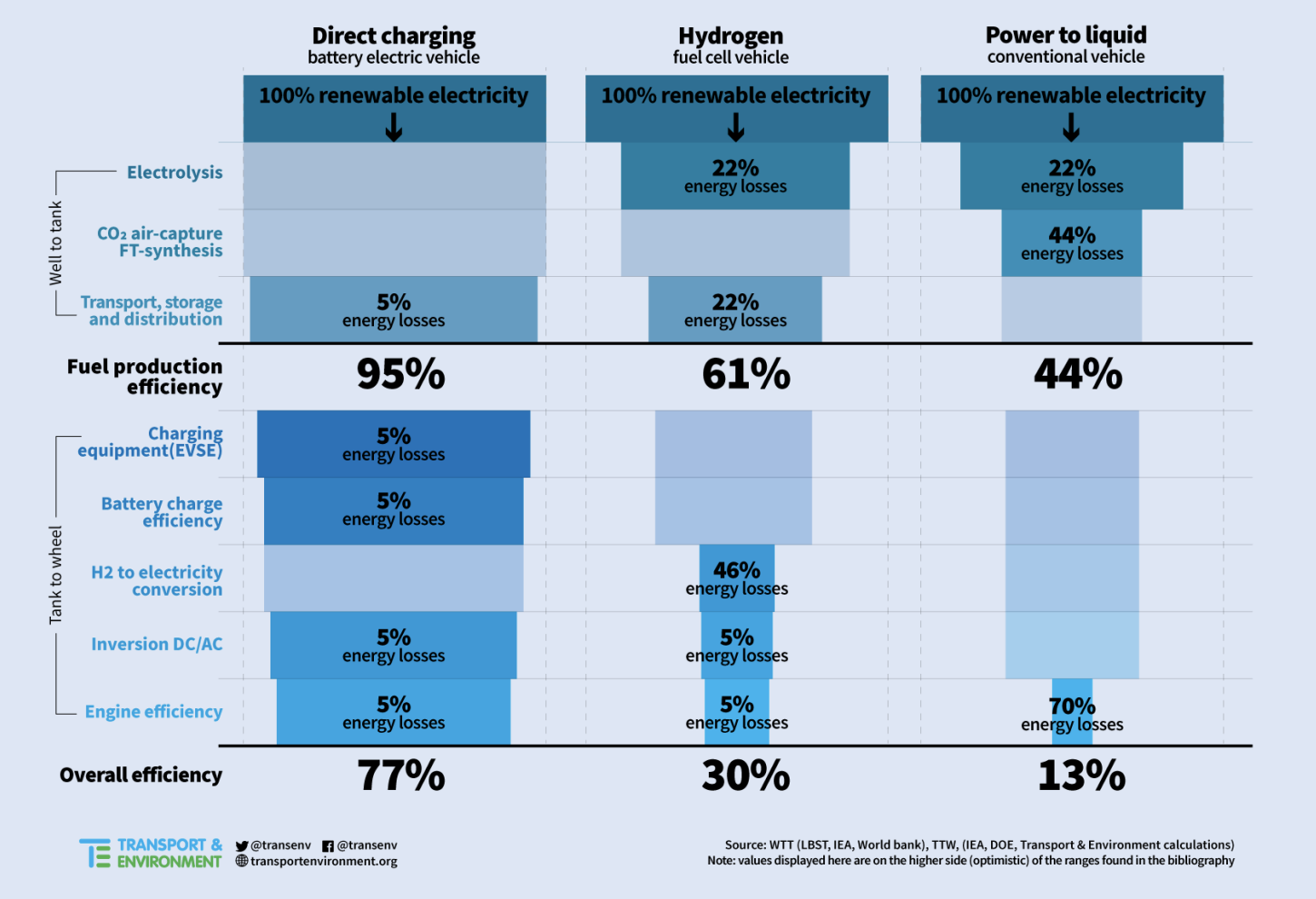

When it comes to road vehicles, hydrogen fuel cell vehicles exhibit some deficiencies like inadequate durability, flammability, elevated costs, and hefty system weight. Another major concern surrounding hydrogen technology is the inefficiency of the process of generating hydrogen via electrolysis, resulting in a 30% loss in energy. Due to better alternatives available for passenger cars (like EVs and sustainable fuels), hydrogen tech seems to be more suited for applications in the aviation and marine sectors.

Source: Transport & Environment

Although hydrogen technology appears to be more efficient than ICE technology, it is still eclipsed by EVs. The chief operating officer of Seoul-based automaker Hyundai has even suggested that hydrogen technology is a decade behind EVs. Nevertheless, Hyundai does not seem to be giving up entirely on hydrogen mobility.

In light of Hyundai’s interest in hydrogen technology, let’s take a closer look at some of the recent patent filings in the domain, starting with Hyundai.

- Hyundai has filed several patents related to hydrogen propulsion. Some recent examples include: US11201340B2 – which focuses on a hydrogen supply system (incorporating a hydrogen recirculation line) for fuel cells; US10511039B2 – which talks about a solid-state, metal hydride-based storage system for vehicles; US10072799B2 – describes a hydrogen filling method for fuel cell vehicles, for maximizing the amount of fuel.

- The aerospace behemoth Boeing also possesses some IP related to hydrogen technology. Some of the recent filings include US11101479B2 – which describes a fuel cell + canister-based system wherein the canister includes a hydride bed. This hydride bed is configured to release hydrogen gas when heated for supply to the fuel cell; US20210215298A1 – focuses on a pressure vessel for storing hydrogen. This pressure vessel comprises a mycelium structure having a surface area of at least 800 m2/m3, with some hydrogen atoms attached to this structure. According to the patent: a ‘pressure vessel comprising a mycelium structure has the potential to store up to eighty times more hydrogen than the same sized pressure vessel without the mycelium structure’.

- Some other prominent players like GM and Rolls Royce have also filed patents revolving around hydrogen technology. US20210218043A1 – by GM, focuses on hydrogen fuel-cell-based power generators. US20220099020A1 – from Rolls Royce talks about fuel vaporizers for hydrogen-fueled aero-gas turbine engines.

Where is the industry headed?

Comparing the pros and cons of the different propulsion technologies listed in this article or evaluating them from a technical outlook to anticipate the propulsion technology’s future is beyond this article’s scope.

Nevertheless, this is where patent data might provide some hints to this complex problem. Patent data can provide a glimpse into the research direction of a given industry (in this case, sustainable transportation). This data serves as a harbinger of what our future might look like and is integral to defining the mobility technology of tomorrow.

If the numbers are anything to go by, EV certainly seems to be at the top of the list. The EV market has proliferated over the last couple of years, with commercial models already available from many prominent manufacturers. Interest in the sustainable fuels sector also seems far-reaching, but it certainly faces an uphill battle in practicality. Hydrogen technology seems to be more suited for applications in the aviation and marine industry but with Korea’s Hyundai and China’s Grove Auto still sticking with the development of hydrogen technology, it might perhaps become mainstream as well.

Interested in finding out how innovators are addressing specific problems related to EV technology or perhaps want to figure out about companies involved in the renewable fuels sector, feel free to reach out to us.

In fact, if you need information on any of the below topics, you can fill out the form below

- How do innovators address specific problems related to EV technology, like powertrains or thermal management?

- Which members of the eFuel Alliance possess pertinent IP?

- The IP filing trend for the hydrogen mobility network is based on segments like transportation, storage, fuel cells, etc.

- Start-ups and companies working towards a circular economy for EV batteries.

Authored By: Prateek Gandotra