Patents, when used strategically, can take your business on the path of unshakable success. They can secure your business from corporate and legal hurdles, and help ensure a dependable revenue stream.

While acquiring patents can help big companies to compete in a market, selling those patents can also help a startup or an SME make a good amount of money. In some cases, the valuable patent portfolios become the sole reason behind a company’s acquisition.

Consider, for instance, InVisage — a California based startup, which specialized in making quantum dot-based image sensors. The company’s products enable images from handheld devices such as camera phones and PDAs. However, they are best known for their key product QuantumFilm, which is better at taking high-quality pictures in a variety of non-optimal lighting conditions.

In 2017, InVisage was acquired by Apple, along with its patent portfolio, which contained over 100 patents on Quantum Dot Technology for Advanced Cameras along with other technologies.

This is just one example among a plenitude of cases where a startup or SME survived or was acquired by a large corporation only because they had strong patents securing promising inventions.

However, this is just one side of the story. In business, everyone has different needs and therefore different strategies are needed and thus, crafted for solving them. In this article, we have shared 21 such strategies companies use to buy and sell patents irrespective of their size.

Chances are, you might be aware of a few and some might be completely new to you. One thing that can be guaranteed is that there is a lot to learn and refresh from this brief piece covering various strategies to buy and sell patents. Whether you’re a person handling an IP team at a large corporation or an individual inventor looking to monetize your patents, there is something in this article for everyone.

We hope you find a suitable strategy/strategies that help you achieve your objective. Let us begin.

Patent Buying Strategies

Defense from Patent Litigation

Sometimes the sole purpose of litigation is to enforce patents for licensing or selling. But a contrasting strategy from the Defendant side can be to acquire patents from the market that can cause trouble to the Plaintiff OR buy the patents from the plaintiff itself.

Companies – irrespective of their size – can purchase patents to secure themselves from the risk of unwanted lawsuits and have a stronger defensive portfolio surrounding its products.

For example, in 2014, flash array vendor Pure Storage bought 100 patents from IBM related to storage technology to prevent litigation. In a different scenario, the same year, Nintendo bought the very patents from the IA Labs, which the latter had previously used to sue Nintendo over the Wii Fit exercise peripheral in 2010.

IP Speculation

Speculation is a financial transaction that carries a great risk of losing all the value with only a slight chance of a significant gain. It is risky, but if played strategically, one can use this strategy for a substantial gain.

One big example of speculation is Google’s acquisition of Motorola Mobility and its 20,000+ patents for a tremendous amount of $12.5 billion. According to sources, this move by Google was for two main reasons: Establish itself in the smartphone industry and smackdown Samsung when it tried to take too much credit (source), and get a hold over a high-quality portfolio to avert litigation in the years when smartphone wars were highly prevalent.

Google did try its hand at smartphone business with Moto phones briefly before selling Motorola Mobility to Lenovo for $2.91 Billion in January 2014, along with all but 2000 of its acquired patents from the deal. These very patents, perhaps were crucial to Google, as a couple of years later in 2016, Google launched the Pixel line of smartphones, designed, developed and marketed by Google itself.

Some might quip – Buying Motorola at 12.5 Billion and then selling it for 2.9 Billion. Was that a smart move on Google’s end?

Perhaps, yes. According to Gordon Kelley, it was a well-played move, and below is the reason why:

And what of Google’s supposed $10bn loss? It’s a misreported myth calculated by subtracting Motorola’s $2.91bn sale price from its $12.5bn purchase. What it misses are the $3.2bn Motorola had in cash, $2.4bn saved in deferred tax assets and two separate Motorola unit sales totalling $2.5bn in 2013. Factor in Lenovo’s purchase against roughly $2bn of Motorola losses during Google’s ownership and Google has still only paid $3bn for what it retained: $5.5bn worth of Motorola patents and the company’s cutting edge research lab.

Well played Google. Well played.

Catch and Release

Normally used by patent aggregators, catch and release is a strategy in which a company purchases patents, offers a license to its members, and then sells the patents after a certain period.

However, this practice is not limited to patent aggregators solely. This strategy is also used by companies when they need patents to protect a product before launching it (to avoid infringement) or for further licensing purposes. When these patents have served their purpose, companies either sell these patents or donate them.

For example, RPX is a company devoted solely to buying patents for defensive purposes (at least when it started). It buys patents with the expressed intention of not suing others (at least on papers). It asks for an annual membership fee ranging from $30,000 to $5 million, depending on a company’s size. In return, the members get rights to every patent RPX has bought. An intriguing feature of RPX is its public commitment to never litigate (BTW, we are not sure how true it is at the moment).

Diversification

Most of you might be aware of the concept of diversification — a strategy to distribute your assets to minimize the risk and volatility. The same strategy is also applicable for patent portfolios, but not to minimize risks but to expand research.

Many companies pursue diversification of patents just to ensure that they can expand their research whenever they can. For example, Sony has a diversified patent portfolio, which includes patents from video games to pillow napping. Sony is a conglomerate and owns every type of business, so it comes as no surprise that they have a diverse patent portfolio.

However, not only conglomerates but companies specializing in a particular niche also invest in a diversified portfolio. The Japanese camera-maker Canon, for instance, has a diverse patent portfolio, which includes patents on robotics to touchscreens and even medical innovations.

While some companies make themselves internally diversified (Diverse R&D), other companies choose to buy patents to achieve the same result. One example is the acquisition of Sucampo for $840 million by British pharmaceutical company Mallinckrodt in 2017 for further diversification of its portfolio.

Licensing Pool (SEPs)

Patent pools or cross-licensing is a licensing strategy in which two or more companies agree to use each other’s patents related to a particular technology.

Sometimes, a company holding SEPs or patents valuable to technology can open a licensing pool for other companies to participate in and utilize the patents of use but not to litigate. This is a cool strategy one could peruse since such pools mostly are built around patents which are highly valuable(including SEPs).

Google, for instance, in 2017, opened a patent pool for Android of which major companies like Samsung, Foxconn, and LG became a part.

Patent pools surrounding a particular technology are fairly common. For instance, In 2012, Via Licensing opened a patent pool of LTE technology with 10 members comprising of AT&T, Clearwire Corporation, DTVG Licensing (DIRECTV), HP, KDDI Corporation, NTT DOCOMO, SK Telecom, Telecom Italia, Telefónica, and ZTE Corporation.

Fire Sales

You might be aware of this term, which is used to refer to the event when a company sells its products(patents) at a heavy discount. The reason could be anything such as the company trying to avoid bankruptcy or maybe the product is no longer valuable to the company.

One example is Kodak, the famous camera-maker, who had to sell their patents to avoid bankruptcy. They hired a firm to calculate its patent portfolio worth which the firm valued at about $2 billion to $3 billion between 2012 to 2020.

However, in the real deal, Kodak was offered a low amount and because Kodak had no choice left due to the impending bankruptcy, they signed the deal for $527 million. Their 2300 patents of digital imaging sold for $94 million and additional money was for a licensing deal on remaining patents. Companies like Apple, Samsung, Google, Amazon, HTC, Facebook, Huawei hugely benefited from the deal. Later in 2013, Kodak emerged from bankruptcy.

Bankruptcy

Sometimes bankruptcy is confirmed, but a company has some assets left, which they also sell for a heavy discount, especially patents. Similar to Fire Sale, one can use this strategy to get some patents at a very low amount.

For example, Nortel Networks sold its portfolio in $4.5 billion to a consortium of Apple, Sony, Microsoft, and Blackberry. The sale included more than 6,000 patents and patent applications spanning various technologies, including wireless, wireless 4G, data networking, optical, voice, internet, semiconductors, among others. The most prized ones were related to mobile broadband technology used in emerging 4G standards such as long-term evolution (LTE).

Stick Licensing

It is a practice of licensing where you threaten the company, infringing on your patent, to take a license to avert litigation. This is an offensive approach to licensing.

There are many examples when a company filed a lawsuit against another company and even though the licensor may not be interested, he agrees to take a license from the former.

For example, in 2017, Apple agreed to settle the patent dispute with Nokia by getting into a licensing agreement.

In another example, Caltech University sued Nokia and RIM in 2010 over image sensor patents. A couple of years later, both the companies agreed to buy Caltech patents to settle the dispute.

Carrot Licensing

The opposite of stick licensing, carrot licensing refers to the approach when a patent holder approaches a licensee in a friendly manner with a target enough to lure the potential licensee to take a license.

The universities’ approach to licensing their patents can be referred to as carrot licensing as universities spend money on their research and want to be benefited by the results of their research.

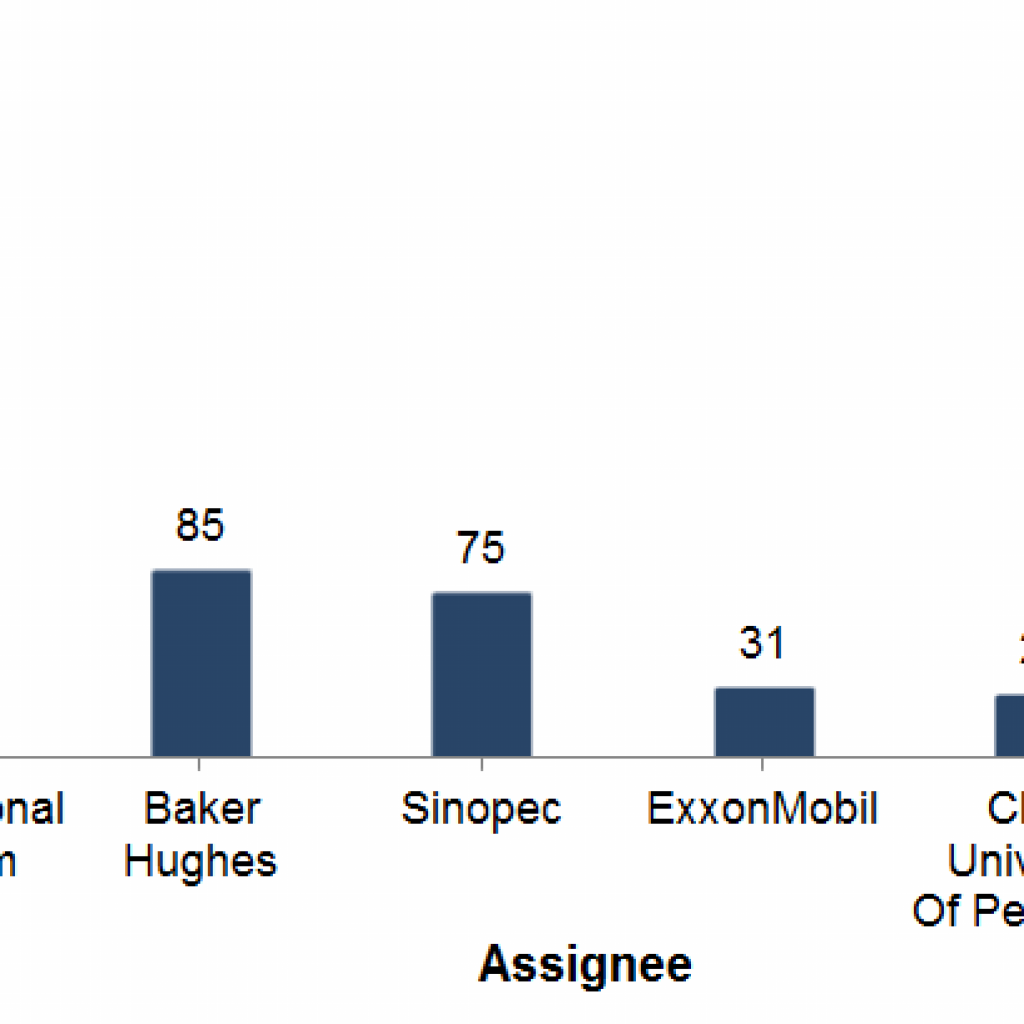

This strategy is quite significant, as universities despite being hubs for innovation, are not often viewed as the go-to spots for patent acquisition or licensing. However, with the surge in patent filing rate by universities, an increase has been noticed in the licensing activity by universities too. If you are looking for patents to acquire for a particular technology, it is a good idea to check up on patent portfolios of universities researching in a particular niche.

Hot Technology

Without a doubt, when buying patents, one should opt for patents related to the latest or hot technologies — which are emerging — in the tech industry. Owning patents related to hot technologies could be very beneficial as you can either use them for your future products or license it to other companies.

This strategy is beneficial for startups especially as they need patents for growth and owning some hot technologies can help them grow significantly.

One example is Elemental Technologies, which was acquired by Amazon for $500 million in cash, in part for its rich patent portfolio covering video streaming which is a hot technology for current times.

Another good example is the acquisition of Adaptix by Acacia Research for $160 million, in the pursuit to own 230 core patents related to 4g technology in 2012 when 4G was hot.

Hot Inventors

The other strategy is to buy patents of hot inventors who file patents related to your industry and work individually rather than for a company. This might help you to get some valuable patents at a lower price as individuals generally ask for lower rates when compared to companies.

Besides, the concentration of package sales is increasing, with a higher percentage of sales coming from a smaller number of sellers. Individual inventors know that they have a limited time to get revenue from their patents. Hence, they are often on the lookout for someone to purchase or license their patents, which can be a great opportunity for buyers to get patents at a comparatively lower rate.

Freedom of Operation

One of the benefits of buying patents is the freedom to operate. In today’s era, when the chances of litigation have grown significantly, and proving willful litigation is not easy either, the need for FTO search also grows significantly. And when you opt for an FTO search, you might find patents which overlap your invention.

If that is the case, the best strategy is to acquire the patents which could risk the launch of your product or cause infringement lawsuits in the future. Take Uber and Xiaomi for example, both companies bought patents in the initial years of their business which helped them grow substantially without fear of unnecessary litigation.

Looking back, Xiaomi had quite an interesting history of patent acquisitions, bought from multiple sources. Xiaomi had amassed a huge portfolio within a few years, most acquired and some filed within and the insights from its filing strategy are quite profound. Curious to know more? Read this — Xiaomi Patent Acquisition strategy

“With patents taking on average four years to grant, we hadn’t had enough time to build up our own portfolio, and we knew we needed some way to protect our business.”

— Kurt Brasch, Uber’s patent transactions lead.

Maintenance Fee Abandonment

Sometimes, a small entity like a startup or small business owns a patent or a set of patents that could be valuable. But they sometimes fail to pay the maintenance fee for various reasons – mostly financial. Given that maintenance fees cost around thousands, it can get difficult for small entities to retain this IP if they are not of any particular use to them at the moment.

The same applies to big entities as well. Companies with huge patent portfolios like IBM and Microsoft adopt pruning to get rid of “useless” patents. However, sometimes during the pruning, some valuable patents get abandoned by these companies without a proper review, which could be highly useful.

When searching for patents to acquire, if you find any patents valuable to you which are lapsed due to non-payment of maintenance fee, try to approach the patent owner to sell them to you for a reasonable amount.

If you were wondering what good is a lapsed patent, the good news is US patents can be revived within 2 years of lapse after paying the fee. Further, patents filed after December 18, 2013, has no time limit and can be revived anytime after payment of maintenance fee.

Revenue Stream (patents with existing royalty streams, such as a licensed or standard pool)

Other than acting as defense for their product lines, a major reason behind the acquisition of patents is to act as a revenue stream. Buying patents strategically can help open a revenue stream — be it in the form of licensing, creating patent pools, further selling it or opening a new product line.

You can further benefit by acquiring patents with existing royalty streams by either licensing or standard pooling.

For instance, Interactive acquired Technicolor’s patent portfolio in which some patents were already making money from licensing. The deal closed at $475 million, including an upfront payment of $150 million.

Lipstick on a Pig (Funding, IPO)

Lipstick on a pig” is a popular Americanism for making superficial or cosmetic changes that disguise the true nature of a product. In the current scenario, lipstick can be referred to as patents and pig can be denoted by a company that buys patents to show the innovative perspective of the company.

It is often seen that some companies even buy patents to increase their valuation before major events like Funding or IPO. Snap, for instance, before its IPO purchased 245 patents from IBM for $9M.

In 2014, Alibaba also bought patents before its IPO to avoid any pitfalls.

As there is a significant impact of a patent portfolio’s worth on valuation, acquiring a quality patent portfolio can be a good idea.

Money Conversion

In addition to all the above things, buying patents have another advantage – Asset conversion.

Mostly adopted by big companies, who have a great deal of money, this strategy can help them in the pursuit of converting their money into any other form.

As patents are intangible assets with great ROI, if bought and used strategically, they also come with the added benefit of tax saving. You can buy patents, make money from it, and also save significant tax which you had would have paid if you had those assets in the form of green bills.

That gets us to the end of our list of buying strategies. Now let’s have a look at some of the selling strategies.

Patent Selling Strategies

Maintenance Fee Avoidance

Maintenace fees can cost a company millions every year, especially if they have a huge patent portfolio. For any mid-sized companies with a decent-sized portfolio, maintenance fees can cause a significant dent in their pockets. This cost can be quite justified if the patents are essential to protect the product lines of the company. But what about patents that are not related to the product lines, are not actively used or do not fetch any licensing revenues?

It’s pretty simple. These patents can be sold to recoup some of the costs incurred earlier in prosecution and maintenance until the moment and save further payment of maintenance fees.

Companies like IBM often do this as paying maintenance for non-core patents doesn’t make sense especially when they have copious patents in their portfolio. To avoid the maintenance fee, IBM offers its non-core patents to startups for a reasonable price in which they can afford the patents. Just like IBM, anyone can use this selling strategy for saving a considerable amount of money.

Pruning the Portfolio

Patent portfolio pruning is a strategy to increase the value of a patent portfolio. In this strategy, companies do an intense analysis of their patent portfolio and churn out the low-quality patents from their portfolio.

After the distribution of the patents into different categories such as weak or strong patents, a company can decide which patent they want to sell and to whom and how. Let’s have a look at each of these individual selling strategies.

Weak Patents (a large bundle of patents)

Selling a large bundle of weak patents is a selling strategy multiple companies vouch by. As you know, weak patents are of no use and maintenance fee payment for the same rather makes them a liability than an asset.

Companies with large patent portfolios include a considerable amount of weak patents or patents related to the old technologies which are valueless. These patents can be sold to startups who are working in the domain at a huge discount to make some money out of the worthless.

Strong Patents (a few patents)

Similarly, some companies also sell their few core patents in exchange for either money or other desirable objective.

Universities and Research Institutes are a prime example as they have a lot of core patents in their portfolio and often accrue a good amount in exchange for the sale.

For example, Stanford University sold its patent rights to Google in exchange for 1.8 million shares which they sold for $336 million. That’s quite an insane amount for a patent.

Hype cycle (selling patents when it is in vogue)

It makes sense to sell a patent when the related technology is in the hype. During that time, any big buyer can offer you a great amount of money if the patents discuss the core technology.

For example, OTT (Over The Top) technology is considered hot as applications, products, and services related to this technology are making significant sales. An agreement also took place between Walt Disney and Kudelski Group related to 3000 patents of OTT technology for an undisclosed amount.

Existing licensing stream (standard pool or direct licensing) converting cash flow to a single payment

Since patent licensing is a great practice for getting cash flow, selling your patents which are generating that cash flow might give you a single payment with solid numbers. And as your patents are valuable and generating money, selling such kind of patents will not be a tough nut to crack for you.

For example, in 2017, AT&T along with other major players agreed to the sale of the pool of more than 60,000 patents to startups in exchange for equity when the up-and-coming companies raise venture capital funds.

Conclusion

Owning patents doesn’t mean you will not face litigation, but they could help you escape litigation unscathed. These patent strategies if applied tactically can work as a panacea for your business difficulties.

But, it is your efficacy that will help you figure out which buying or selling strategy will be best suited for you.

Struggling to choose the best strategy to fulfill your objective and need our suggestion?

Authored by: Vipin Singh, Research Analyst, Market Research and Vincy Khandpur, Team Lead, Infringement.