Investment decisions are not made in a vacuum, they have a context. The main question is – What is that context which you should set, as an investor or a VC, before making an investment decision?

For a long time, investors have followed the practice to include a company’s stock, brand reputation, and its market as their major deciding factors. But as these are dynamic trends, things get tough while making regular investment decisions. Thus, keeping an eye on market trends becomes vital.

Novice investors make their investment decisions hugely influenced by market news. But, does the same hold true for smart investors making huge profits? No. They don’t rely on market news solely and take other important trends into account. One important trend that they rely on before investing is the innovation quotient of a company.

In today’s era, technology has a huge impact on everything and investment hasn’t been left untouched. When we are talking about technology and innovation, it is imperative to focus on the role of patents in investment decisions. Patents, for quite some time, are not only helping investors make investment decisions but also securing huge profits for them.

What role do patents play in investment decisions, you ask?

Allow me to explain. I will give you not one, but five ways where the strategic use of patents helps investors – people like you – make smart investment decisions.

1. Patents Help Make Smart Investment by Forecasting the Next Big Thing

More often than not, a prominent company researches on the next big thing which, in the future, opens the doors to huge returns. To spot these doors, one needs to evaluate patent filings of a company as it reveals a lot about their futuristic plans. On top of everything, you don’t need to read between the lines to find what they are going to do next.

Let me share an example to drive the point home – Google has been known for its search engine till 2007 until they announced Android. It was only then people realized Google’s interest in the mobile space. However, Google’s patents, for example, EP1584026 and US6982945, gave hints about their interest way before the announcement.

2. Patents Aid Your Investment Decisions by Suggesting the Market Expansion

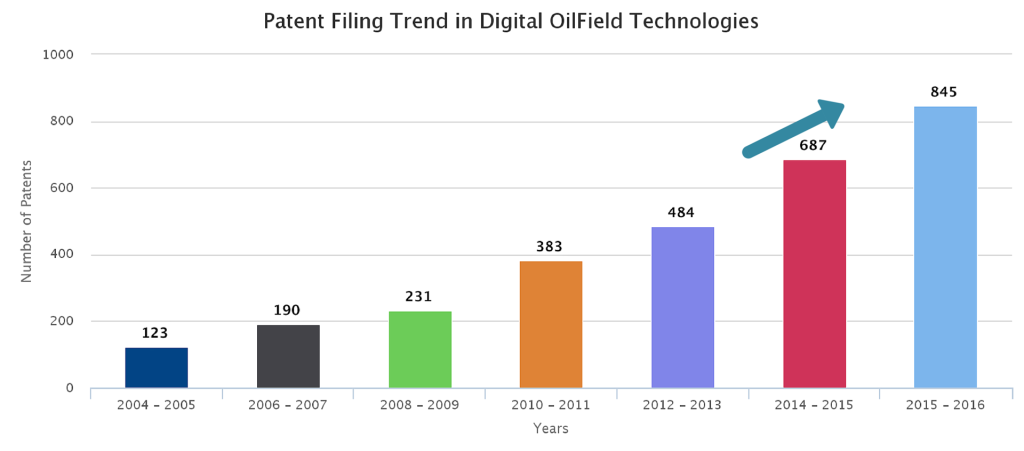

Patents give an idea of how a particular market is and will be moving. It helps figure the futuristic prospects of that field and the factors supporting them.

For example, the chart below gives a year-wise patent filing trend in digital oil field technologies. The last bar represents the expected patent filing for the year 2015-16. This, overall, indicates an increase in research activity in the domain. And if you are interested to invest in the digital oilfield domain, this is a clear go-or-no-go sort of information.

3. Patents indicate the Competitive advantage

Not only market expansion, but patents also give an idea about the technology that a particular company will be targeting in the future.

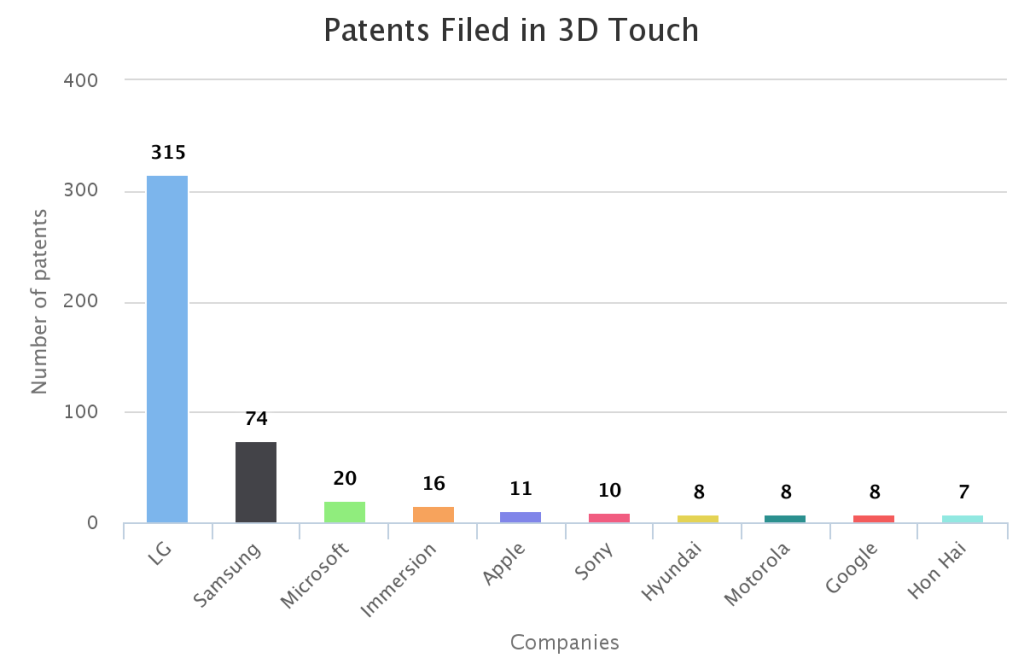

With the launch of the iPhone 6S, Apple became the only company to introduce the force touch in smartphones. But does that make Apple a pioneer in the force touch technology? Of course not. We studied the patents filed in the 3D touch sensing from 2008 onwards, and the insights surfaced tell a totally different story. Have a look at the chart below.

Did you have any idea that LG dominates the force touch technology with almost double the number of patents than other top nine companies combined? They may also dominate the market in term of revenue by earning royalty from its patents. This is the beauty of patent analytics. So, tell me one thing – If you have to invest in 3D touch, which company will you choose now?

4. Patents Help You Gauge Potential of a Startup you are going to Invest In

If you are going to pour your money in that startup which, as per you, will disrupt something in the future, looking at their patent portfolio will be a wise decision. It doesn’t only help you with investment valuation, but also give you an idea about the level of innovation that exists in that startup.

Moreover, in the later stage of the startup, having a strategic patent portfolio may attract a bigger player that wants to strengthen its patent portfolio against another large player. Thus, there are chances of finding licensing opportunities and an added revenue stream.

5. You can also make money from ongoing litigation

The investors having a hint on the inclination of the litigation decision can take an informed decision.

For example, in papers filed in federal court in San Jose, California on Thursday, December 3, Samsung Electronics Co., said it will make the payment of $548 million by Dec. 14, 2015. This is what happened to Samsung stock next day –

In light of the above, we can say that a company with sound patent assets and R&D is a good call for investment.

While working with investors, we observed that direct investment in patents is increasing day by day. Investors either purchase a patent or take a share in the patent value by supporting the independent inventors. This is also one of the lucrative and upcoming investment options with assured benefits.

There are many more examples, rather than making you aware of those, we would prefer you to create your own stories of successful investment by using the factor of technology in your decision making.