In early 2012, Google acquired Motorola Mobility for $12.5 billion, along with access to its vast collection of patents. Motorola was also a founding member of the Open Handset Alliance, consisting of 84 companies working together to develop Android. With this acquisition, Google became the driving force behind Android (the world’s largest mobile operating system platform today).

IP acquisition has remained a critical strategy for companies’ growth and expansion. Industry leaders recognize that strengthening their patent portfolio through strategic acquisitions increases valuation, company growth, and additional cash flow.

This report details the top 5 reasons IP assets are critical in mergers and acquisitions.

1. Gain Legal Rights to Technologies by Acquiring IP

There are many examples of companies acquiring selective patents from others. For instance, in 2021, Instacart, the North American e-commerce platform, acquired 250 patents from IBM through a collaborative partnership. Instacart officials stated this acquisition allows them to innovate on their platform and grow their business.

Big Blue holds more US patents than any other company in America- over 150,000– so the most suitable move for Instacart was selective licensing and acquisition.

In cases where the target company is smaller, it’s better to acquire them entirely to boost project development activities. Apple does this all the time. The multi-trillion-dollar Cupertino giant acquires a new company every three to four weeks!

A notable acquisition was Beddit, a sleep-tracking startup. After the acquisition, Apple did not directly use Beddit’s original product design. However, its tracking technology and several accompanying patents immensely benefited them in creating WatchOS features.

Use this 3-stage framework for IP analysis during mergers and acquisitions.

2. Create New Income Sources Through IP Licensing

Many companies with vast IP portfolios, like Ericsson, strategically monetize their patents to generate substantial and passive revenue through licensing fees. Additionally, a licensing option lets other players in the industry borrow legal rights to a particular art and innovate on their terms. IP licensing is one of the best ways to create income without blocking anyone’s growth.

There are three primary forms of IP licensing:

1. Exclusive License

The licensee gets exclusive access to the IP. The owner may not grant the same IP to any other party or use it themselves. Furthermore, this licensing method can be employed for highly niche patents, driving new business between the license owner and licensee. Massive companies like Disney and ARM semiconductors use this licensing method.

Advantage: These create a guaranteed source of passive income for the licensor through royalties.

Drawback: Exclusive licenses may cause the owner to lose access to the IP permanently due to a lack of due diligence on the licensee.

2. Non-exclusive License

The licensee gets rights to the IP without restricting the owner from using or granting licenses to other parties. This type is ideal for widely used arts. Nokia Technologies often uses non-exclusive licenses for its IP.

Advantage: These allow the licensor to develop their IP further while monetizing it through other innovators using that art.

Drawback: These licenses may create more competition since they can simultaneously grant legal, operational rights to multiple licensees.

3. Sole License

These are similar to exclusive licenses except that the owners can still use the IP alongside the sole licensee, but no other party may do so. Companies usually prefer the non-exclusive model, but there are exceptions. ARM company’s sub-brands, such as Cortex, Mali, and PowerVR, are known to follow this license model for single-use applications.

Advantage: Compared to an exclusive license deal, this type allows the licensor to retain more control over their IP.

Drawback: If the licensee disagrees with the licensor on how the IP is used in the future, there can be expensive legal battles to deal with. Furthermore, the licensee’s actions may tarnish a brand or its product’s reputation by association. But that holds true for nearly all licensing agreements.

GreyB’s proprietary patent insight tool, BOS, helps companies optimize the monetization of their patent portfolio.

3. Raise Money with IP as Collateral

By building a strong IP portfolio through mergers and acquisitions, businesses can raise funds through loans by pledging IP as debt collateral should the need ever arise.

IP finance usually only operates with formal IP such as trademarks, patents, copyrights, and design rights. Note that informal IPs, such as the company’s branding, supplier relationships, and business process, don’t demonstrate bankability unless they have substantial authority or are well articulated to demonstrate their value.

Read more: Top 10 Banks that Take Patents as Collateral for Loans.

Here are the main types of loans obtainable against IP:

IP-Backed Loans

These loans can significantly benefit companies lacking other tangible assets or facing insufficient cash flow at that moment, which makes obtaining a traditional credit solution difficult. Holding IP assets obtained through mergers and acquisitions can be a lifeline should the need to raise capital emerge.

Note that IP-backed loan amounts are usually determined by the IP portfolio’s liquidation value percentage and overall risk as determined by the lender. The lenders get a security interest in a company’s IP assets as collateral for the loan in exchange for interest payments.

IP Sale-Leaseback

This financing structure provides IP holders with immediate liquidity. In most cases, these IP sale-leaseback transactions include a repurchase option, allowing the seller to buy back the ownership within a predetermined time period.

IP Legal Finance

IP legal finance has quickly become a preferred IP financing vehicle for large investors. It allows IP owners to advance funds against the future value of their outstanding IP infringement disputes. In addition to covering operating expenses, the capital is often used to mount a successful case against the infringing parties.

IP Royalty Securitization

IP royalty securitizations generally require the owner to sell an IP-related income stream for a fixed duration in exchange for a predetermined amount of cash upfront. The primary difference between securitization and an IP-backed loan is that the IP owner is not borrowing money but is instead selling a stream of future cash flows.

In addition to these loans, many investors consider having a portfolio of patents extremely valuable. They might invest in a company simply for the rights to use a particular set of patents.

4. Increase Competitive Advantage

Apple has one of the most powerful patent portfolios in the world. But that’s not what made them the multi-trillion-dollar company they are today. Registering or acquiring patents must be based on innovation. Acquiring IP is how companies like Apple ensure their vision gets a competitive edge and thrives in their targeted market.

Contrary to the impression that patents block innovation, the fact that patents expire provides enough reason for companies to push through and invent new systems and technologies. Acquiring the legal rights to a design or technology can give a company’s projects a competitive advantage and protection from infringement.

5. Attract New Consumer Bases

It’s common to see phrases such as “patented technology” or “patent pending” in a company’s advertisements and marketing campaigns. A consumer perception survey conducted by Inventree indicates that patented products feel safer or more credible to consumers. Patents convey that a company has strived and has sunken costs to protect its invention, which can lead to patented products being perceived as ‘superior.’

In addition, declaring patent ownership can serve as a warning to competitors who may attempt to replicate a product design. This happens all the time on crowdfunding projects, which are often not patent-protected- a third-party manufacturer copies their design and goes to market faster at a cheaper price. Acquiring the necessary patents in advance can significantly reduce a company’s encounters with such situations while attracting customers.

Conclusion

Gaining access to a company’s IP through mergers and acquisitions can help create additional sources of revenue and help raise capital. IP can legally secure a company’s products against infringement and bolster its USPs in a competitive landscape.

However, finding a valuable IP in a portfolio is not easy. Most patents, while securing the invention from infringement, do not provide good growth and monetization opportunities. Analysts often refer to such hard-to-find patents as “gem patents.” These present immense potential for revenue generation.

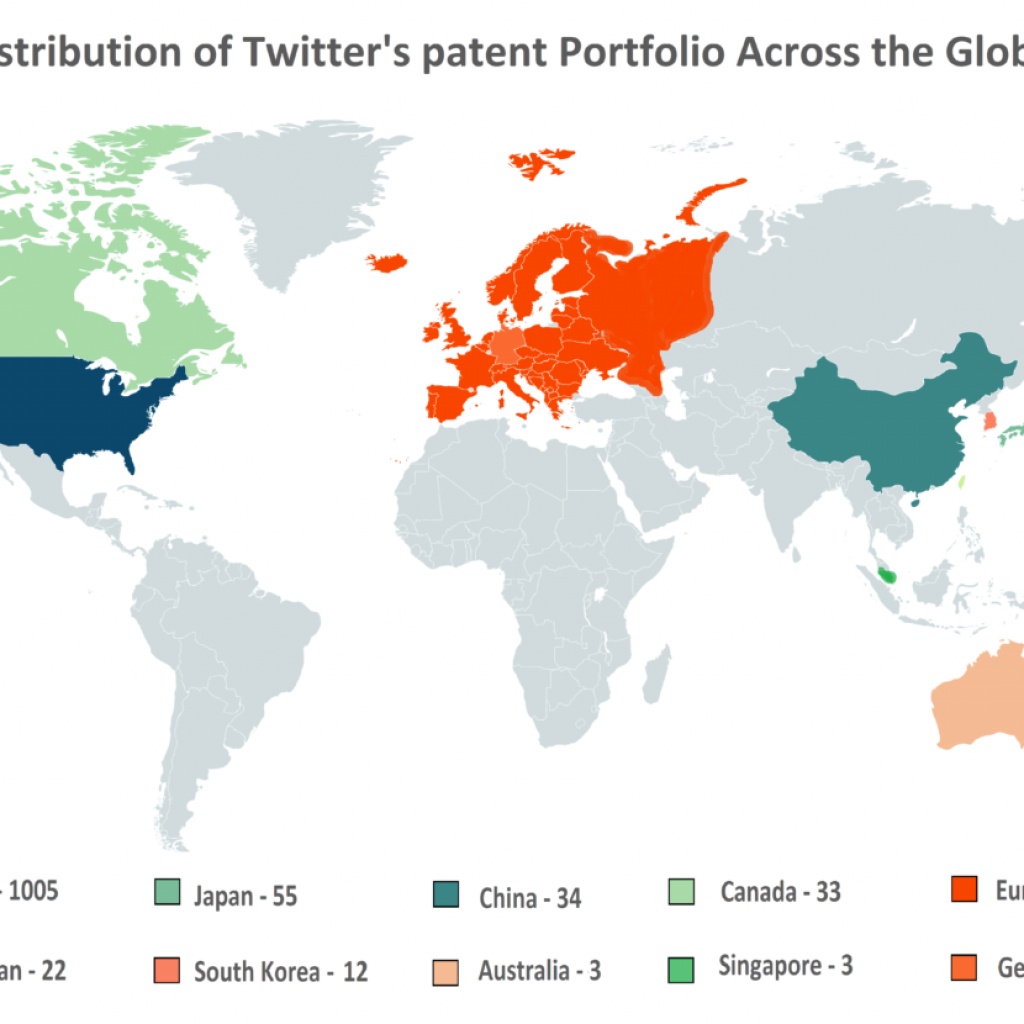

A social networking giant recently discovered one such gem hidden in its patent portfolio, leading to a breakthrough in its monetization strategy.

Read all about it here.

Authored By – Hemanth Shenoy, Marketing