FrieslandCampina has positioned itself as a key player in the ever-evolving dairy landscape by embracing new technologies and sustainable practices. Central to its success is its unique “grass-to-glass” approach, strongly emphasizing customer satisfaction and prioritizing sustainability.

In today’s market, FrieslandCampina aims to reinforce its position as a leading producer of essential dairy products. The company has also made notable efforts to streamline its operations by reducing milk processing in unprofitable product segments.

Our comprehensive study will explore the company’s plans, strategies, partnerships for the future, and past efforts to achieve its goals. Not just that, our in-depth examination will provide invaluable insights for industry leaders and decision-makers seeking to understand and navigate the complex dairy market.

Therefore, without any further do, let’s get into it.

Key Highlights

- FrieslandCampina launched “Our Purpose Our Plan 2.0,” which used various research projects such as SEANUTS (Southeast Asia Nutrition Surveys) and SEANUTS II to track its goal to provide value to people’s lives through natural nutrition.

- They also work closely with their member dairy farmers to promote six key focus areas: enhancing nutrition, promoting biodiversity, reducing carbon footprint, and developing sustainable packaging options.

- FrieslandCampina has brought to the market many innovative products, such as Landliebe Cheese Dip, Valess Italian Herbs, Fristi MilkyPap, Friso Comfort Multio, Friso Gold Homecoming, Dutch Lady MaxGro, and Frisian Flag PRIMAGRO.

- The company also launched Infant Nutrition Innovations such as Vivinal Milk Fat Globule Membrane, Friso Prestige Organic, Plantaris Pea Isolate, etc.

- FrieslandCampina has undertaken several collaborations, acquisitions, and investments in recent years as part of its growth strategy.

Interested in what innovation trends will impact the Dairy Industry in 2024? Fill out the form below to get our exclusive Dairy Trends 2024 report:

FrieslandCampina’s Strategy – Our Purpose, Our Plan 2.0

The company aims to provide better nourishment for the world while providing a good livelihood for its member farmers today and in the future. Hence, they have implemented their sustainability strategy that is based on the ISO 26000 guideline. It connects seven United Nations’ 2017 Sustainable Development Goals (SDGs), which are:

- Better nutrition affordable for everyone

- Better living for farmers

- Better climate, carbon-neutral future

- Better nature, improving biodiversity

- Better packaging, 100% circular

- Better sourcing, 100% responsible

FrieslandCampina’s sustainability plan is woven across the organization, with a governance framework that regularly reports on success internally and externally. (Source)(Source)

The intention of being more sustainable is great, but what’s even better is the company’s strategic goals such as.

- Exemplary performance price for member dairy farmers

- To realize our sustainability targets

- Organic growth in value-added products

- Higher gross profit margin

- Increased return on invested capital (Source)

These benchmarks set by the company will ensure that they are continuously striving their way towards their sustainability goals by following up on their strategic goals.

Now, let’s take a look at the projects undertaken by FrieslandCampina in the last few years.

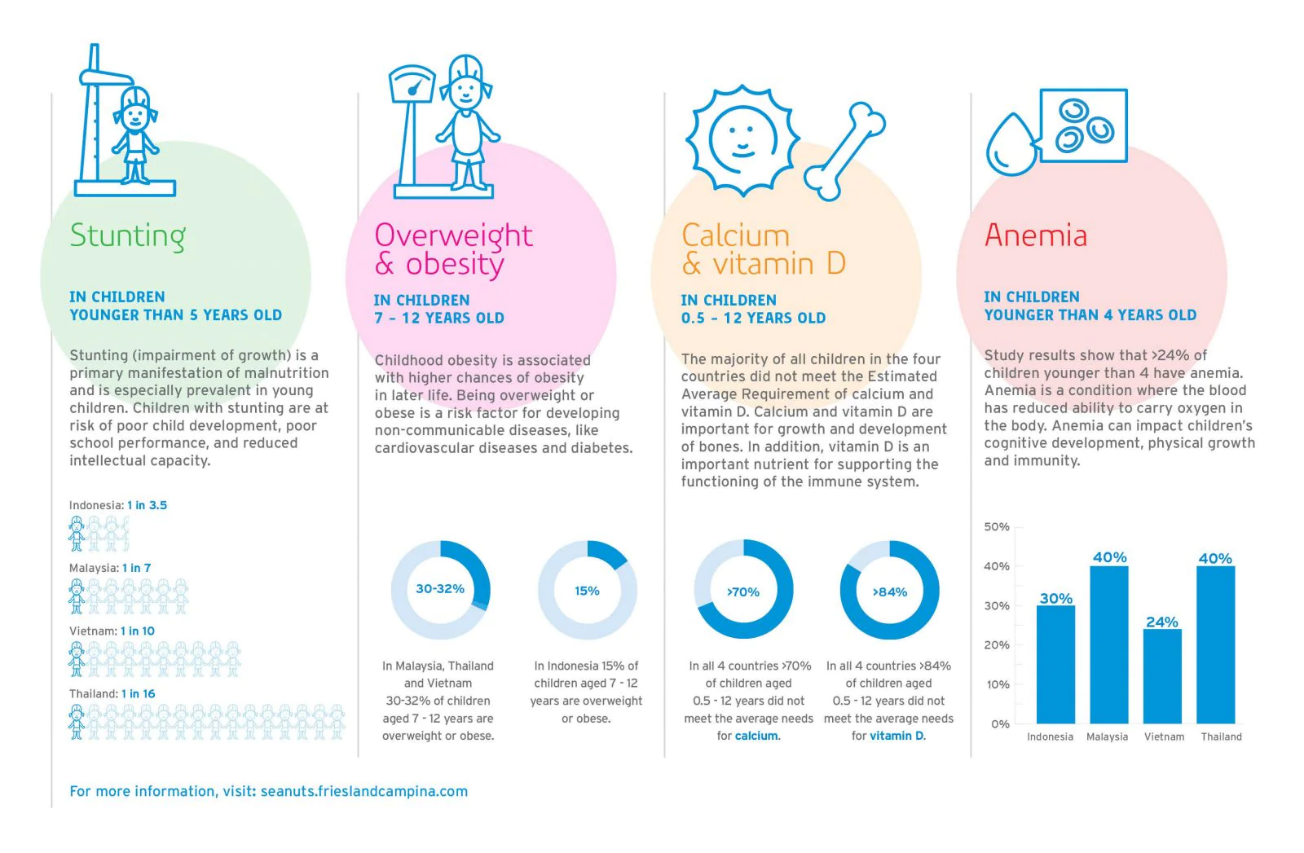

SEANUTS and SEANUTS II

In 2012, FrieslandCampina launched SEANUTS (Southeast Asia Nutrition Surveys), one of Southeast Asia’s most significant nutrition research projects. The company completed data gathering for SEANUTS II, its second version, in 2021. For this survey, scientists evaluated the nutritional health, dietary intake, and lifestyle behaviors of over 14,000 children ages 6 months to 12 years in Indonesia, Malaysia, Thailand, and Vietnam.

Dr. Poh Bee Koon, Principal Investigator for SEANUTS II in Malaysia and Professor of Nutrition at UKM’s Faculty of Health Sciences, Centre for Community Health Studies, states, “Healthy nutrition is about balance, moderation, and variety. Children won’t grow and develop properly if they don’t get the nutrition they need. Our new study revealed that more than 70 percent of the children in all four countries did not meet the average need for calcium, and more than 84 percent did not meet the average vitamin D requirements.”

These numbers emphasized an urgent need to improve food security and the availability of food products that meet children’s needs, thus increasing access to healthy nutrition.

According to Margrethe Jonkman, Global Director, Research & Development, FrieslandCampina said, “Research is key to getting a better understanding of local nutritional needs. The results from this study will help FrieslandCampina in developing better and affordable products that meet the nutritional needs of children and in setting up programs to promote a well-balanced diet and active lifestyle in collaboration with local authorities, health workers, and schools.” (Source)(Source)

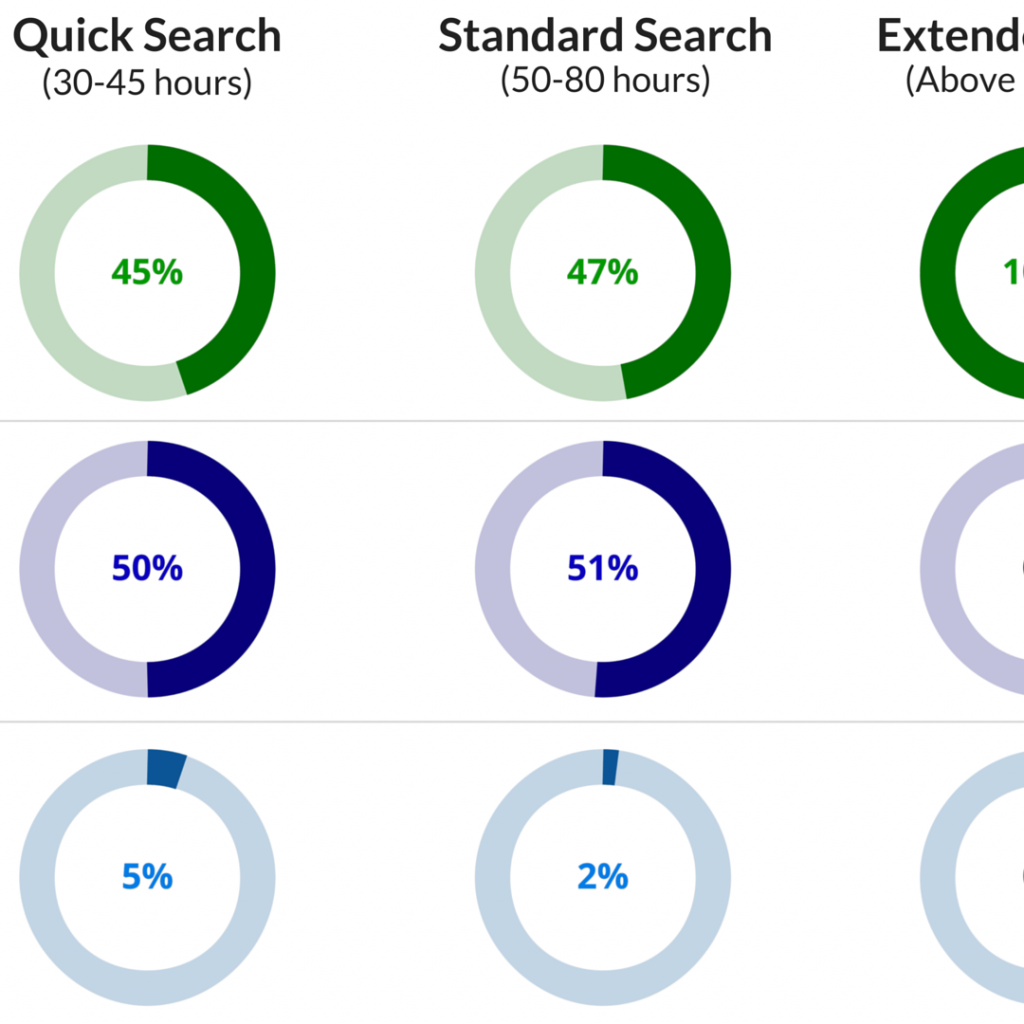

Survey Results of SEANUTS

The company’s strategy to look into potential market venues was a good move in elevating its business. Their research focus is equally, if not more, important. Let’s see what it is.

Research Focus

Through R&D, the company is always looking for ways to improve and develop new ideas that mainly focus on three growth areas: drinks made with dairy, nutritional food for kids, and branded cheese. The company collaborates with innovation partners such as the Wageningen University & Research Center to continuously improve the innovation process and develop new technologies. Some of these have been discussed thoroughly in the following paragraphs. (Source)

New Technologies

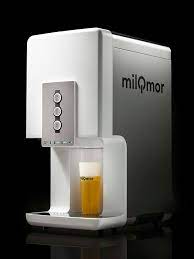

Milqmor

In 2017, FrieslandCampina introduced Milkubator to uncover disruptive products or business model innovations. It is built on lean startup principles that focus on alleviating consumer pain points. Milkubator teams are completely autonomous and are typically formed by their personnel.

Its product, Milqmor, is a unique B2B solution in Asia exclusively created to produce milk caps. It is the first artificially designed tech to revolutionize the traditionally time-consuming process of preparing and serving milk caps. This patented innovation is a fast, convenient, and hygienic solution to the milk caps problem

According to Ilya Sharafan, Manager of Business Development Milqmor, “The Milkubator methodology learnt us to design solutions that our customers need, and not the ones we believe are best.” (Source)

Recyclable Cheese Pack

FrieslandCampina introduced the world’s first recyclable cheese pack with 40% less plastic than its previous packaging. The recyclable cheese pack is made from Polypropylene, a type of plastic known for being recycled multiple times.

The company now looks forward to making the pack completely recyclable and from recycled materials in the future. (Source)

Lactose-Encapsulated DHA and ARA Formula Ingredients

FrieslandCampina Ingredients has expanded its Vana-Sana product line with three new additions. It includes two docosahexaenoic acids (DHA) products based on algal oil and an arachidonic acid (ARA) ingredient developed from fungus oil. The product names are Vana-Sana DHA algae 20L, Vana-Sana ARA 20L, and Vana-Sana DHA algae 11N. The new products check off several boxes, including high oil content (7% to 20%) and ARA and DHA from various sources, including protein-free variations for plant-based applications. The removal of dipotassium phosphate, a buffering agent, and silicon dioxide, a flow agent, has also been addressed in this clean-label trend. (Source)

Recycled PET Bottles

In February 2021, FrieslandCampina claimed to produce PET bottles made entirely of recycled PET (rPET). To ensure these bottles can be effectively recycled, FrieslandCampina’s Research & Development department has developed a new “zipper” to easily separate the label from the bottle. This innovation marks FrieslandCampina as the first dairy company to achieve near-complete bottle circularity across multiple countries, including the Netherlands, Belgium, the United Kingdom, and Hungary.

“With the 100% recycled PET bottle, FrieslandCampina is taking a new step in making its packaging circular. Our ambition is to become fully circular. That is why we are increasing the recycled content of our PET bottles from 20% to 100%. ” Patrick van Baal, Global Director Packaging Development at FrieslandCampina. (Source)

The step was crucial to achieving the sustainability goals as all packaging must become recyclable and/or reusable.

Sustainable Development Goals

By 2050, FrieslandCampina hopes to generate completely climate-neutral dairy. Its climate plan nourishes a better world sustainability initiative, including nutritious and affordable food, a good living for farmers, biodiversity, sustainable packaging, and sustainable raw material sourcing. The climate plan includes specific targets and activities, with a significant decrease in greenhouse gas emissions by 2030 as a checkpoint. FrieslandCampina aims to guide 75,000 local farmers through the Dairy Development Program by 2025. (Source)(Source)(Source)

With respect to its past targets, a table is given below on FrieslandCampina’s Sustainability Targets 2022 vs the Achieved Numbers

| Sl. No. | KPI | 2022 Objective | 2022 Actual |

| 1. | Product Composition(As a percentage of the total volume of consumer products that comply with the FrieslandCampina Global Nutritional Standards Next Level) | 71 | 72 |

| 2. | Greenhouse Gas Emissions on Member Dairy Farms(kt CO2 equivalent) | 10,866 | 10,823 |

| 3. | Greenhouse Gas Emissions From Production and Transport(kt CO2 equivalent) | 663 | 649 |

| 4. | Water Consumption(m3/tonne end-product) | 4.74 | 4.72 |

| 5. | Biodiversity(Number of member dairy farmers remunerated for improvements) | 1,350 | 1,995 |

| 6. | Recyclable Packaging(Percentage suitable for sorting and recycling systems) | 90 | 91 |

| 7. | Dairy Development(Number of local dairy farmers participating in a training program) | 64,200 | 70,101 |

| 8. | Traceability to Source(Palm oil, pulp and paper, and cocoa purchased by the company) | 94 | 94 |

Packaging

FrieslandCampina’s packaging, as of the moment, keeps dairy products safe and fresh while also being environmentally friendly. It guarantees that items have a longer shelf life, thereby reducing food waste. The company’s goal, however, is to have 100% of its packaging recyclable and reused by 2025, and it must be circular and climate-neutral by 2050. The company works with each region separately to develop optimally recyclable and inexpensive packaging that ensures the quality of its dairy products. Furthermore, it has also designed the RESPACKT tool to test packaging for sustainability.

Following the recycled PET bottles, in July 2021, FrieslandCampina adopted sustainable labeling for yogurt and soft curd cups. Over 400,000 kg of cups are recyclable due to a method devised by its R&D department. (Source)(Source)

Supply Chain

FrieslandCampina aims to make the entire manufacturing and distribution process circular and CO2-neutral. It ensures good nutrition, high quality, and long-term production for consumers. The company’s milk output has climbed by 18% during the last 30 years, while its greenhouse gas emissions have fallen by 20%. In addition, the firm has decreased its water use and recycles all residual streams at its production plants. (Source)

Nutrition

FrieslandCampina is constantly working to improve the nutritional content of its products. While manufacturing the products, it adheres to its Global Nutritional Standards while giving consumers transparent and consistent nutritional information to assist them in making healthy food choices. Furthermore, its Nutrition Policy was made with the help of government officials and nutrition and health experts, using the FrieslandCampina Compass as a guide. (Source)(Source)(Source)

FrieslandCampina’s hold on various markets

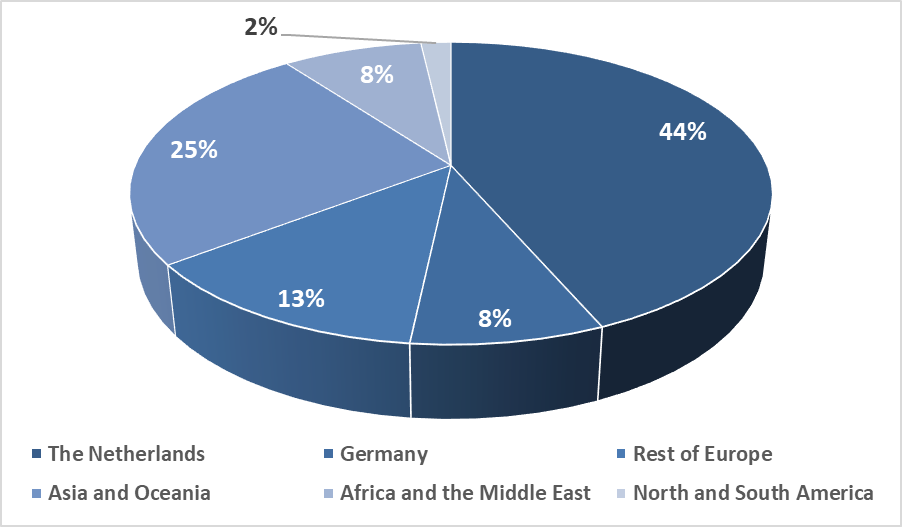

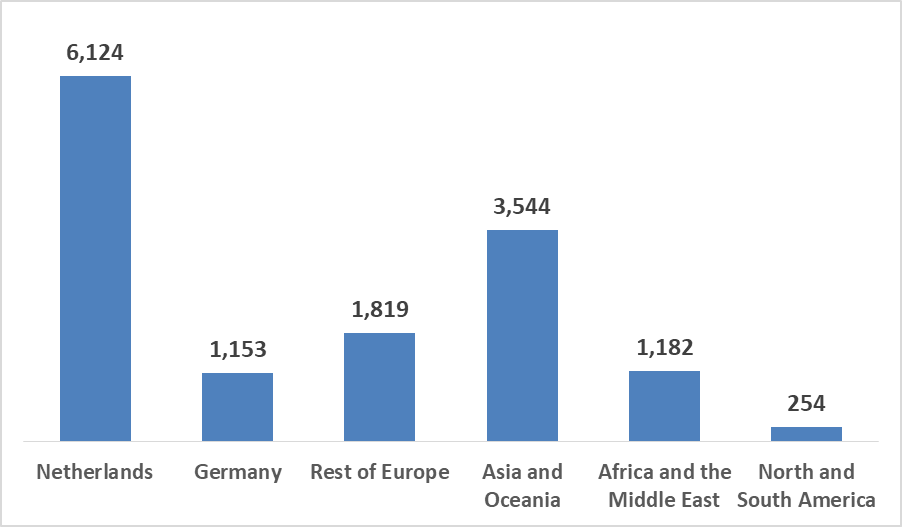

The top markets/countries of FrieslandCampina in terms of highest revenue generated include the Netherlands, Germany, Asia, and Oceania, the Rest of Europe, Africa, and the Middle East.

Market Share of FrieslandCampina (by location) in 2022

Market Expansion of FrieslandCampina

In Australia and New Zealand, with its trademarked ingredient “Aequival”

FrieslandCampina announced in 2022 that Australian and New Zealand authorities had approved its 2′-fucosyllactose trademarked Aequival. It is used in infant milk formula and is en route to expanding its portfolio of human milk oligosaccharides (HMO). FSANZ granted the company a 15-month exclusivity period for its non-GMO 2′-FL fermented using lactose as a substrate. The approval, according to FrieslandCampina, is only the beginning of its HMO business in Australia and New Zealand.

“2’-FL is a great start, but we believe including various HMOs in infant milk may offer a wider range of health benefits. As a result, our focus is on expanding our HMO portfolio, launching LNT, 3’-SL, 6’-SL, and 3-FL. In fact, samples of Aequival LNT are already available for customers to trial.” Sophie Nicolas, Marketing Manager, Early Life Nutrition at FrieslandCampina Ingredients. (Source)

In the Asia-Pacific Region, with its Prebiotic Supplements

FrieslandCampina introduced Biotis GOS-OP High Purity in the Asia-Pacific region in 2022. Its high-level Galacto-oligosaccharides (GOS) ingredient is intended to fill the market void and fuel innovation in prebiotic supplements. According to the company, Biotis GOS-OP High Purity is designed to help supplement manufacturers innovate without facing technical obstacles.

Job van Rozendaal, Managing Director for Asia-Pacific, FrieslandCampina Ingredients, states, “There’s a clear need for gut health solutions in the APAC market, and by launching Biotis GOS-OP High Purity, we aim to empower our customers to answer those calls. As many as 61% of the region’s consumers experience digestive issues on at least a weekly basis. That’s a significant number.”

Per Industry experts, enabling innovation in convenient supplement solutions could transform how consumers in the APAC region take care of their gut health. Further, convenience is expected to become the key priority in developing new products as more consumers in the APAC region prioritize their gut health. (Source)

In China, with its Innovation Experience Centre

In 2021, FrieslandCampina launched a one-of-a-kind Innovation Experience Centre (IEC) in China. An approximately 13,347-square-foot center spanning two stories. The IEC exhibits the FrieslandCampina portfolio, corporate values, enduring heritage, and next-generation features such as AI, test and trial, live streaming, etc. It enables its clients to decipher the trend of Chinese desires and preferences.

“We have seen exceptional revenue growth over the past 12 years’ journey in China. The key growth engine for us to win the market would be that we are always tuned in to changes and our commitment to innovation. ” Grace Chen, China Managing Director, FrieslandCampina Ingredients.

FrieslandCampina is optimistic about the Chinese dairy market and aims to achieve a business target of 10 billion. (Source)

FrieslandCampina’s Operations or Research Facilities

In 2022, FrieslandCampina invested around €93 million in research and development compared to €85 million in 2021. It conducts extensive research in animal nutrition, food safety, and product development for its Consumer Dairy & Specialized Nutrition.

FrieslandCampina also collaborates with its innovation partners (Wageningen University & Research Center) to continuously improve the innovation process. The FrieslandCampina Institute benefits from an international staff of approximately 600 research and development experts worldwide. They develop new insights concerning the relationship between milk or dairy products and nutrition and health. (Source)(Source)

In 2022, FrieslandCampina launched a pilot project with Lely and Rabobank to implement 90 Lely Sphere stabling systems at member dairy farms. The goal is to decrease nitrogen emissions from these dairy farmers’ stables by up to 70%. (Source)(Source)

Acquisitions or Investments Made By FrieslandCampina

FrieslandCampina has made several investments and acquisitions over the last five years to expand its operations and product offerings. Below are some of the important investments and acquisitions made by the company over the years.

Major Investments

Investment in the Napolact Factory in Romania

In 2022, FrieslandCampina invested €3 million ($3.2 million) in the Napolact factory in Cluj, Romania, for their new cheese production. The aim was to improve their cheese production at the plant, and now they can make 3 types of cheese there alongside milk and butter. The plant’s production capacity is 8,000 tonnes of cheese and butter per year and up to 35,000 tonnes of milk. (Source)

Investment in the Sustainable PET line in Aalter

FrieslandCampina invested in a third PET line for its production facility in Aalter, Belgium, in 2020. The new third PET line marked the next step in FrieslandCampina’s sustainability strategy. The investment presented opportunities for commercial growth, with changing consumer needs and increased demand for sustainable packaging for FrieslandCampina.

In 2022, the company again invested in a new PET line for the production facility in Belgium with a new sustainable strategy. Through this investment, they focused on increased demand for sustainable packaging of dairy products. The company also introduced more sustainable beverage cartons. For example – For Dutch Lady cartons in Vietnam, the company used unbleached cardboard and plant-based plastic.

“Sustainability is a priority for our business. Introducing new technologies will once again provide a huge boost to the Aalter site’s capacity for innovation and knowledge development. Jeroen Van de Broek, Managing Director at FrieslandCampina in Belgium and France.

Furthermore, the investment and consequent shift from HDPE to PET represents a significant but critical investment for the company. This move will enable them to meet the evolving demands of consumers and customers concerning user convenience and the environment. Implementing the new line in Aalter aligns with the company’s long-term sustainability policy across the entire value chain, from farm to production facilities to packaging. Additionally, this investment aligns with the company’s goal of making 100% of its packaging recyclable or reusable by 2025. (Source)

Investment in the Holland Dairy PLC in Ethiopia

In 2018, Veris Investments and FrieslandCampina joined forces by investing in Holland Dairy PLC in Ethiopia. By investing in the supply chain, production, and market development, Veris and FrieslandCampina aimed to enhance and extend their market presence. FrieslandCampina had already been exporting UHT under the Dutch Lady brand and milk powder under the Coast brand to Ethiopia. The company already had a presence in the Ethiopian dairy market, particularly in yogurt products. However, with this minority investment, FrieslandCampina strengthened its export position. (Source)(Source)

Major Acquisitions

Acquisition of Jana Foods

In 2018, FrieslandCampina acquired cheese importer Jana Foods in the United States. The acquisition further strengthened FrieslandCampina’s position in supplying Dutch specialty cheese to US consumers. Jana Foods imported and marketed FrieslandCampina’s Dutch cheese in the United States and other fine cheese from the UK, Denmark, Australia, Ireland, and other countries. Jana Foods had been an important strategic partner of FrieslandCampina in the United States for many years. With this acquisition, they helped FrieslandCampina establish a strong position for their international cheese by distributing Kroon, A Dutch Masterpiece, and Gayo Azul cheese brands.

“This investment aligns with our strategy to grow our cheese business and strengthens our position in the Americas. This deal will allow us to offer consumers a wider portfolio of innovative products for the U.S. market.” Roel van Neerbos, President FrieslandCampina Consumer Dairy. (Source)(Source)

Acquisition of Millán Vicente

In 2018, FrieslandCampina acquired Millán Vicente. With this deal, FrieslandCampina aimed to strengthen its position as a cheese supplier to Spanish and Portuguese consumers. Later, the company renovated its cheese processing department and installed biogas at the facility to reduce carbon emissions and gas consumption.

“For decades, cheese products of FrieslandCampina have found their way to consumers and customers in the Iberian peninsula. With this acquisition, combining the local commercial expertise and flexibility of Millán Vicente, we can further grow, innovate and strengthen our product offering for consumers and customers in Spain and Portugal.” Roel van Neerbos, President FrieslandCampina Consumer Dairy. (Source)

Acquisition of Best Cheese Corporation USA

In 2019, FrieslandCampina acquired Best Cheese Corporation USA to strengthen its position in the American consumer market. With this acquisition, Best Cheese had been fully integrated with the FrieslandCampina Consumer Dairy USA business. FrieslandCampina announced that the former shareholders of Best Cheese, including the Dutch Investment Company Antea, will no longer be associated with the business.

“As a part of our transformative strategy, we continue to focus on delivering the best product to serve consumer’s needs. The Americas is a strategic growth market for us.” Roel van Neerbos, President FrieslandCampina Consumer Dairy. (Source)(Source)

Financial Condition – FrieslandCampina

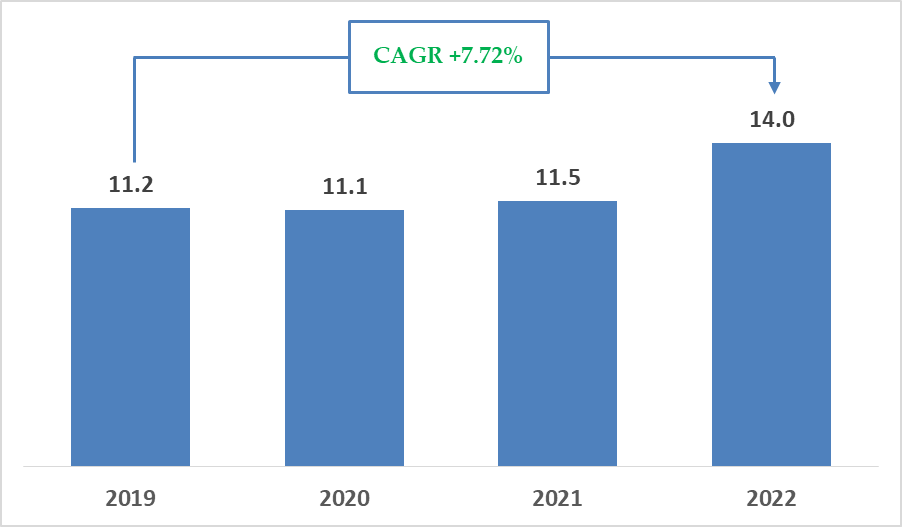

In 2019, FrieslandCampina’s revenue was €11.2 billion ($12.19 billion). In 2020 its revenue didn’t increase, mainly due to the coronavirus pandemic. While in 2020, there was strong growth in the sale of consumer brands through the retail channel. At the same time, the lack of out-of-home activities and negative currency translation affected and put the revenue under pressure.

FrieslandCampina’s Revenue During 2019-2022 (€ Billion)

Both 2021 and 2022 have been years of progress for FrieslandCampina, despite the coronavirus pandemic’s impact on their revenue and profit. In 2021, FrieslandCampina’s revenue was valued at €11.50 billion ($12.51 billion), while in 2022, the revenue was valued at €14.07 billion ($15.26 billion). The revenue increased by 22.3% from 2021 to 2022. This was primarily driven by higher commodity dairy prices and the cautious recovery of European out-of-home business. The currency translation also negatively impacted (-1.1%) revenue due to the devaluation of the Nigerian naira and dollar-related currencies in Asia. (Source)(Source)(Source)

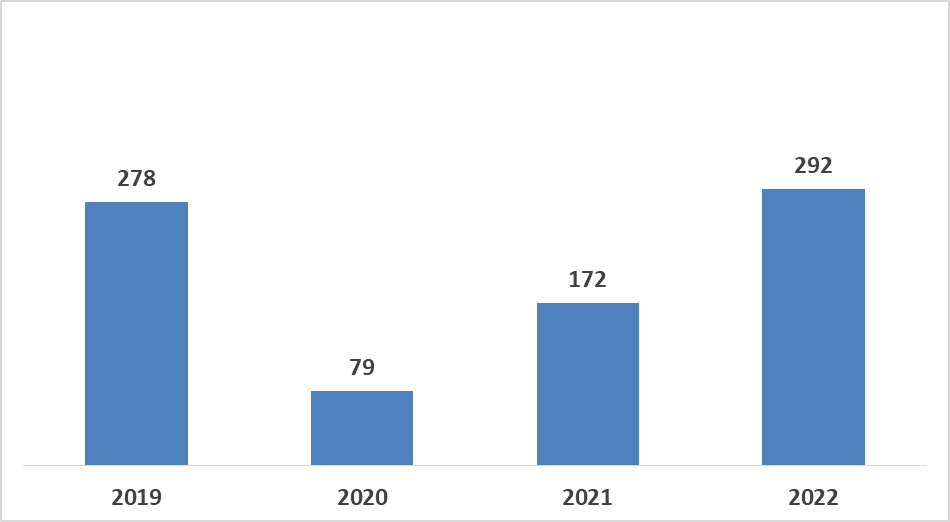

FrieslandCampina’s Net Income During the Period 2019-2022 (€ Million)

The net income of FrieslandCampina in 2019 was €278 million ($302.46 million), and in 2020 it decreased to €79 million ($85.95 million). This was due to the significantly lower operating profit, restructuring charges, and a higher effective tax burden. Furthermore, the operating profit dropped by 38% in 2020. The decrease in operating profit was due to the increased restructuring charges of €106 million ($127.6 million) in 2020. However, excluding the restructuring costs and currency translation effects, the operating profit fell by 10.9%. (Source)(Source)

In 2022, FrieslandCampina faced an increase in net income valued at €292 million ($318.23 million), i.e., by 69.77%. The lower restructuring costs after the pandemic and the improved results of both the Professional and Trading business groups increased the overall net income in 2022. (Source)(Source)(Source)

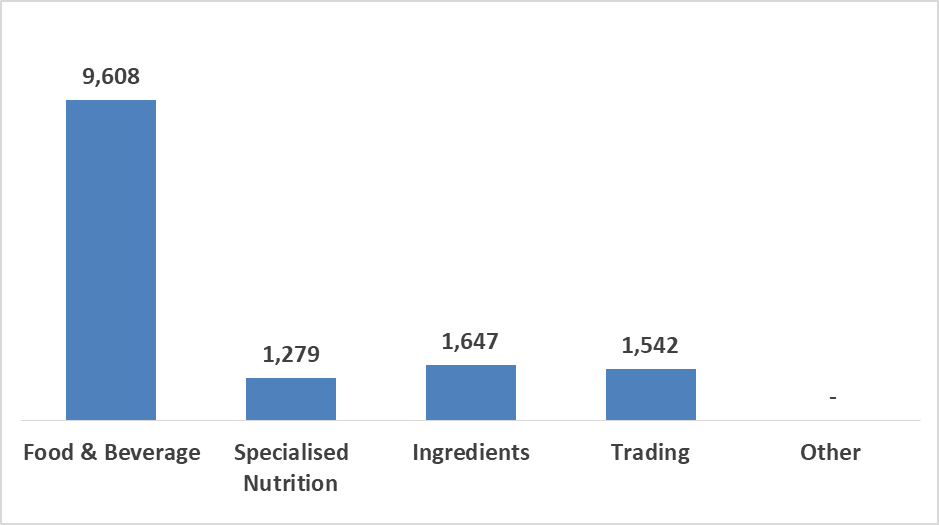

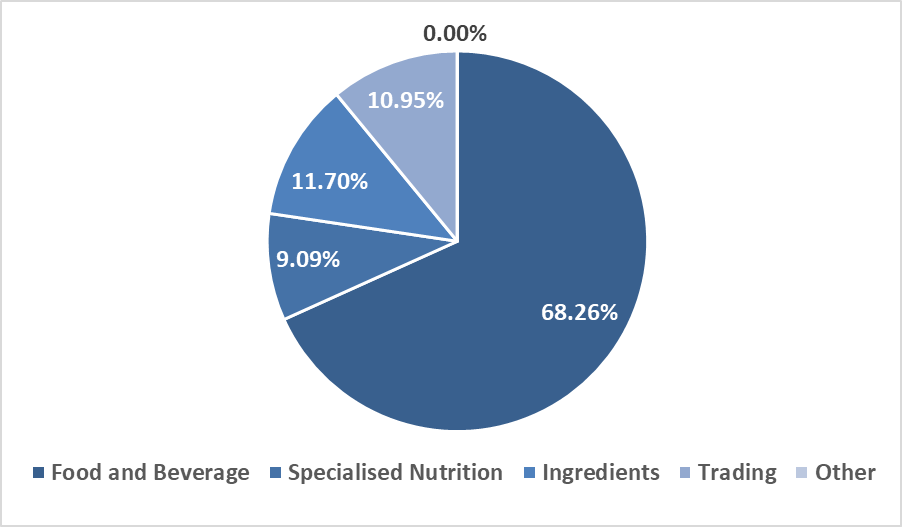

Revenue Breakdown As Per Segment

In 2022, the Food & Beverage business group of FrieslandCampina performed well while accounting for €9.6 billion in revenue or 68.3%, higher than the rest of the segments. This was driven by commodity price increases and the growth of out-of-home activities, primarily in Europe. Following the Food and Beverage Business Group is the Ingredients one, with its revenue valued at €1.6 billion ($1.79 billion).

Revenue Split By Business Group In 2022 (€ Million)

Additionally, the Specialized Nutrition corporate group that operates in Asia, Europe, Africa, and South America increased its revenue from €1.08 billion in 2021 to €1.28 billion in 2022. Its growth was driven mainly by volume expansion, favorable currency translation effects, and a better mix due to increased sales of premium infant nutrition products in China and Mexico. (Source)

Revenue Split By Business Group In 2022 (%)

In 2022, the country-wise revenue in the Netherlands, Asia, and Oceania had been the greatest with a value of €6.12 billion ($6.67 billion) and €3.54 billion ($3.86 billion), respectively. Asia and Oceania mainly include the countries of establishment Indonesia, China, Philippines, Thailand, and Pakistan, which saw an increase in their revenues in 2022. On the other hand, the Netherlands occupied a vast share of 43.5% of the total revenue, and Asia and Oceania 25.2% of the total revenue in 2022.

Revenue Split By Geography In 2022 (€ Million)

The Rest of Europe primarily includes the countries of establishment France, Belgium, and Greece occupying a share of 12.9% or €1.81 billion ($1.98 billion). On the other hand, Germany, Africa, and the Middle East occupied a share of 8%, respectively. However, Germany’s revenue was slightly higher at €1,153 million ($1.25 billion) than Africa and the Middle East €1.18 billion ($1.28 billion) in 2022.

Additionally, pasture grazing was practiced by 83.8% of member dairy farmers in the Netherlands in 2022. This exceeded the 81% sector target and remained nearly stable compared to 2021. (Source)

Furthermore, in 2021, FrieslandCampina Trading successfully accelerated the volume growth of mozzarella cheese. The customer portfolio in different segments and regions grew drastically, and a volume of approximately 60 kt of mozzarella cheese was sold. The mozzarella was produced externally in two ultramodern production facilities, the Netherlands and Germany, and was sold throughout Europe and Asia to business-to-consumer and business-to-business customers. This reflected an increase in their revenue in 2021, matching their marketing costs and consumer needs. (Source)

Top Partnerships Made By FrieslandCampina

Partnership with Triplebar Bio to Scale Up Cell-based Protein Manufacturing

In 2023, FrieslandCampina agreed to a strategic relationship with specialized biotechnology business Triplebar Bio Inc. to develop and scale up cell-based protein manufacturing utilizing precision fermentation. FrieslandCampina Ingredients and Triplebar will use precision fermentation to create microbial cells that can produce bioactive proteins that promote human health and nutrition in childhood and adulthood. Both firms want to produce high-quality proteins at scale while leaving a small land, water, and energy footprint.

“Precision fermentation is a fast-developing technology that will shape the future of the food and nutrition industry.”, Anne Peter Lindeboom, Managing Director of Innovation at FrieslandCampina Ingredients. (Source)

Partnership with Agrifirm to Experiment with Oat and Soy Farming

In 2023, FrieslandCampina and Agrifirm collaborated to experiment with oat and soy farming on 200 and 50 hectares. The venture involves 30 FrieslandCampina member dairy farms, which will use the crops as raw materials to develop plant-based food manufacturing.

“We have already launched several plant-based products for our consumers in the Netherlands. Some recent examples are Friesche Vlag Barista Haver, Chocomel, and Campina plant-based. The next step is to explore whether member dairy farmers can start locally producing the raw materials for plant-based products. That’s why we are launching this trial.” Thomas Gribnau, Marketing Director at FrieslandCampina (Source)(Source)

Partnership with ASEAN Coffee Federation to Elevate the Status of the Barista Community

In 2022, FrieslandCampina Professional (FCP) signed a 10-year sponsorship with the ASEAN Coffee Federation (ACF) as its Founding Partner and exclusive dairy milk brand. The partnership aimed to elevate the professional status of the barista community in ASEAN and improve knowledge of milk used in cafes. Consumers have increased demand for cafes, so their coffee experiences have also increased. However, the art of coffee making is often overlooked. By co-developing the Milk Science module with ACF, FCP aimed to improve coffee mastery in ASEAN markets. The partnership also helped achieve ACF’s goals of establishing quality standards of coffee and providing affordable coffee education across ASEAN.

“Our dairy brands have been providing ASEAN consumers, food service professionals, and industrial customers with high-quality products for over a hundred years. We believe in constantly innovating and adding value to our industry partners so that our consumers continue to enjoy the most up-to-trend beverages. Ms. Tracy Fortu, Marketing Lead for Coffee and Tea APAC, FrieslandCampina Professional. (Source)

Partnership with De Nieuwe Melkboer to Develop a Local Chain for Plant-based Dairy Alternatives

In 2022, FrieslandCampina and De Nieuwe Melkboer joined forces to develop a local chain for plant-based dairy alternatives. The partnership enabled De Nieuwe Melkboer to utilize FrieslandCampina’s knowledge and expertise. While FrieslandCampina aimed to gain insights into this new local chain and explore new growth opportunities for its member farmers using this partnership. In addition, De Nieuwe Melkboer supplied the first soy-based alternatives for milk and yogurt from Dutch soil. The partnership aimed to develop an earnings model for farmers.

Dustin Woodward, Managing Director FrieslandCampina Netherlands, states, “As a leading food company with a strong core in dairy, FrieslandCampina always looks at how it can support its members’ initiatives, especially if these can create value for its members. The market always comes first: what is the consumer’s need? De Nieuwe Melkboer responds creatively to two important trends: local and plant-based. We are delighted that De Nieuwe Melkboer has its origins at the dairy farm of one of our members, and we are happy to support Bart and Tom in realizing their dream. We look forward to working with De Nieuwe Melkboer and learning from each other.” (Source)(Source)

Partnership with Rabobank and Lely to Reduce Nitrogen Emissions

In 2022, FrieslandCampina, Rabobank, and Lely joined forces for a pilot project to decrease nitrogen emissions from dairy farms. Lely Sphere, a round barn system, separated solid manure and turned nitrogen emissions into fertilizer. The farmers reused these fertilizers for precision fertilization on the land. Moreover, the system helped create a ‘closed mineral cycle’ and reduced using artificial fertilizers. It reduced ammonia emissions by up to 70%. Therefore, 96 “Lely Spheres” were installed in dairy farms throughout the Netherlands as part of the initiative. This collaboration helped FrieslandCampina in the reduction of nitrogen more sustainably.

Hein Schumacher, CEO FrieslandCampina, said, “We always look at how we can contribute to making the sector more sustainable through technology. With the Lely Sphere, we achieve an immediate and proven nitrogen reduction. We believe this is a more sustainable and future-proof solution for the Netherlands than an expensive buy-out scheme. With this, we want to encourage the government to take on this approach and invest in farmers who want to make their farm management more sustainable.”

Partnership with Arabian Food Industries to Export Cheese from Egypt to Africa

In 2021, FrieslandCampina and Arabian Food Industries (Domty) established a joint venture to export cheese from Egypt to Africa and the Middle East. In the proposed JV, FrieslandCampina held a 51% stake, while Domty held the remaining 49% stake. Arabian Food Industries focused on expanding its market reach within Egypt and export operations in the Middle East and the Gulf region. Despite already distributing their cheese to North African countries and the Middle East, with the cooperation with Domty, FrieslandCampina was granted a faster and easier route into the growing market. The cooperation was also attributed to affordable cheese products in the region with an improved customer base.

FrieslandCampina Consumer Dairy Africa managing director Dustin Woodward states, “We are very excited about the joint venture with Domty. Combining our joint expertise, capabilities, and footprint will allow us to nourish more African families. Over the next few years, we will bring exciting innovations to create new cheese propositions that are more healthy, affordable, and accessible to consumers across Africa and the Middle East.” (Source)(Source)(Source)

Future Outlook

FrieslandCampina has placed a strong emphasis on innovation and sustainability. For the company, “sustainability” refers to having a favorable impact on farmers, societies, and the environment. According to Hein Schumacher, CEO of Royal FrieslandCampina N.V., “FrieslandCampina is keen to give people daily access to good and affordable food, produced in balance with the planet. Unsurprisingly, then, reducing our greenhouse gas emissions is one of the priorities enshrined in our Nourishing a better planet sustainability program.”

Additionally, the company has outlined other future goals to position itself as a leader in the industry, such as(Source)

- FrieslandCampina’s objective is to provide the highest possible performance price to its member dairy producers while also training 75,000 local farmers through its Dairy Development operations by 2025.

- By 2030, the corporation aims to cut more than a third of its greenhouse gas emissions compared to 2015 and be carbon neutral by 2050 at the latest.

- The company aims to have a net positive biodiversity impact inside the cooperative by 2050.

- The company aims to have 100% sustainably obtained agricultural raw materials and 95% traceable (chosen) raw resources by 2025. (Source)

But, it may not be feasible to keep a check on every next move of your competitor. And that is where greyB’s professional competitor analysis dashboard comes in handy.

If your goal is to keep pace with the latest breakthroughs and growth strategies in your industry, simply fill out the form below. Our team will then design a tailored dashboard to meet your specific needs so that you never miss out on the next big move in your domain.