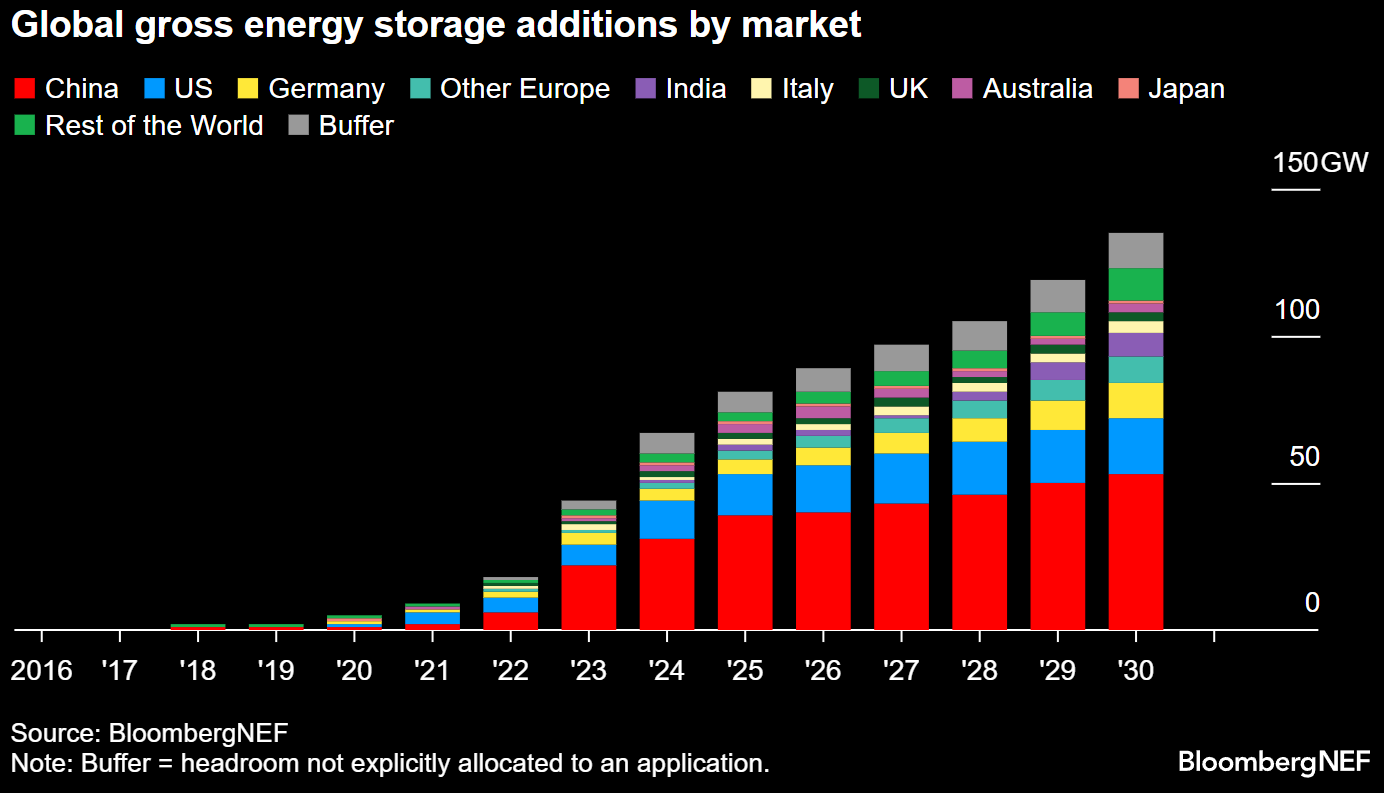

In 2023, the global energy storage market experienced its most significant expansion on record, nearly tripling. This surge occurred amidst unprecedentedly low prices, particularly noticeable in China where, as of February, the costs for turnkey two-hour energy storage systems had plummeted by 43% compared to the previous year, reaching a historic low of $115 per kilowatt-hour.

Following last year’s addition of 45 gigawatts (97 gigawatt-hours), the energy storage sector is poised for sustained strong growth. In 2024, it is expected to surpass 100 gigawatt-hours of capacity for the first time, with China continuing to lead as the world’s largest energy storage market.

The United States ranks as the second-largest market, driven by state-specific targets, utility procurements, and favorable economic conditions in regions like Texas. In the combined regions of Europe, the Middle East, and Africa, residential batteries will remain the primary demand driver for storage, with Germany and Italy leading the charge. Other significant contributors include Austria, Switzerland, Belgium, Sweden, Spain, and the UK.

This high value in the global market is due to the new technological solutions that are improving and innovating the energy storage sector.

The article covers the top 5 trends from our study on 10 Energy Storage innovation trends. The study includes their market growth, advantages, disadvantages, and companies & startups researching them. Fill out the form below to get a complete understanding of all the 10 trends delivered right to your inbox:

Here are the top 5 innovation trends in energy storage –

Trend 1: Solid-State Batteries

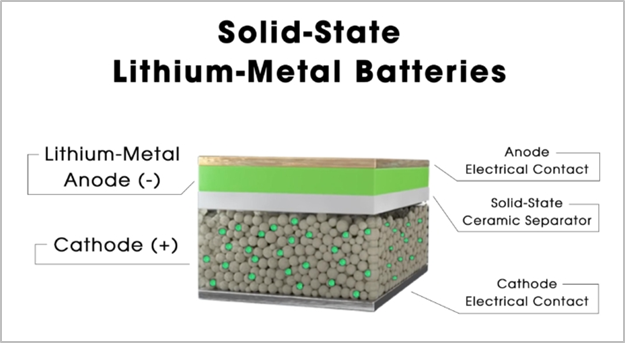

A Solid-State Battery is a rechargeable power storage technology structurally and operationally comparable to the more popular lithium-ion battery.

The solid-state battery employs a solid electrolyte rather than a liquid electrolyte solution, and the solid electrolyte also serves as a separator. Due to its solid construction, the solid-state battery has a solid electrolyte, better stability, and improved safety because it keeps its form even when the electrolyte is broken.

Structure Of A Solid-State Battery

In 2022, Nissan, Renault, and Mitsubishi declared a collective investment of €23 billion in electric vehicles. By mid-2028, this collaboration hopes to have broad commercial production of all-solid-state batteries (SSB). QuantumScape is widely regarded as one of the pioneers in solid-state batteries. It has already built a solid-state battery that can charge from 0% to 80% in under 15 minutes, while a Lithium-ion battery requires 60 minutes to charge from 10% to 80%. (Source)(Source)(Source)

In 2021, the global solid-state battery market was valued at $805 million ($0.80 billion) and is expected to increase and reach $13.15 billion by 2030. The market is anticipated to grow at an approximate CAGR of 36% during the forecast period. The use of solid-state batteries in electric cars is one of the main growth prospects for the solid-state battery market. Demand for solid-state batteries is predicted to increase as the automobile sector in India, China, Japan, and South Korea expands rapidly. (Source)(Source)

Global Solid-State Battery Market Size during 2021-2030 ($Billion)

Advantages of Using Solid-State Batteries

Greater safety—Solid-state batteries lack a liquid electrolyte, one of the most troublesome components regarding safety in lithium-ion batteries due to their volatile and, thus, more combustible nature. This is altered by a thicker separator layer of a structurally more resistant material to high temperatures. At the same time, it improves the separation between the anode and cathode, preventing short circuits even on occasion of misuse or degradation, thus increasing the intrinsic safety of the cells.

Keep track of energy density – According to recent findings, solid-state batteries possess an energy density of 2-2.5 times that of existing lithium-ion technology, resulting in a lighter and more compact battery. The increased inherent safety contributes to another significant improvement: using a pure metal anode promotes a significant boost in energy density. The ions stay during the transfer in a solid-state battery, and a bulky, heavy chemical portion that does not actively help create energy is removed.

Ultra-fast charging times – According to recent studies, solid-state batteries can charge up to six times more quickly than existing technology on the market. Existing solid-state battery models charge very fast but at the expense of other critical performance parameters. (Source)(Source)(Source)

Challenges of Solid-State Batteries

Presence of substitutes – Graphene batteries, fluoride batteries, sand batteries, ammonia-powered batteries, and lithium-sulfur batteries are replacements or substitutes for solid-state batteries. Fluoride batteries have the potential to run up to eight times longer than solid-state batteries. The new lithium-ion battery uses silicon instead of graphite to achieve three times the performance of the existing graphite Li-ion batteries. During the forecasted period, all of these batteries limit the expansion of the solid-state battery market.

Manufacturing process complicated – Solid-state battery production procedures and methods are complicated. During the creation of these batteries, suitable production tools are required for highly precise material deposition. Solid-state batteries are made by systematically arranging electrodes separated by solid electrolytes. These non-porous solid electrolytes must be able to prevent dendrite growth between electrodes. As a result, solid-state battery producers must constantly focus on research and development efforts linked to these batteries to analyze the difficulty of the production process of solid-state batteries. (Source)(Source)

Trend 2: Hybrid Energy Storage System

A Hybrid Energy Storage System (HESS) consists of two or more types of energy storage systems. These systems outperform any single-component energy storage device, such as batteries, flywheels, supercapacitors, and fuel cells. A hybrid energy storage system is poised to be the long-term solution for microgrids and a sustainable alternative for energy production in standalone applications.

The following are three forms of hybrid storage that have emerged beyond the pilot stage:

- Power-to-heat/battery

- Battery/Battery

- Ultracapacitor/battery

Hybrid storage provides additional cost-cutting opportunities; two or more units can utilize much of the same power electronics and grid connection gear, lowering both initial and ongoing expenses. (Source)(Source)(Source)(Source)

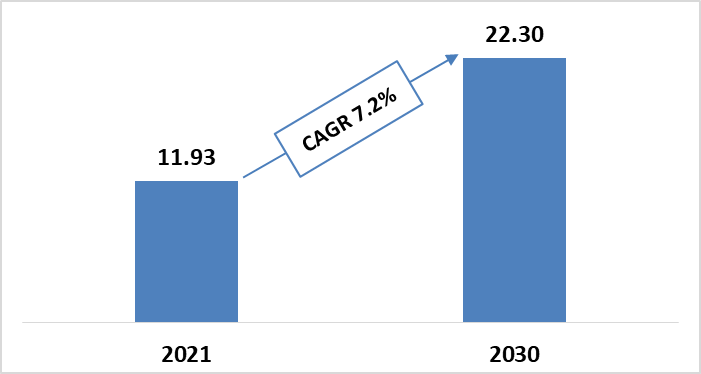

In 2021, the global hybrid energy storage system market was valued at $11.93 billion and is expected to increase and reach $22.30 billion by 2030. The market is anticipated to grow at an approximate CAGR of 7.2% during the forecast period. A boost in demand for high-energy storage systems for load shifting and an expansion in small and medium-sized businesses are driving market expansion. (Source)

Global Hybrid Energy Storage System Market Size during 2021-2030 ($Billion)

Advantages of Using Hybrid Energy Storage System

Improved utilization of existing energy resources – Hybrid energy storage systems improve the efficiency of existing energy systems by reducing looping and changing output, reducing emissions, and a smaller carbon footprint. A high-power-operations-capable technology increases system efficiency for applications that demand storage to address short-term power fluctuations, such as renewables ramping/smoothing. Utilizing the same hybrid system for low-power, long-duration applications such as backup power, on the other hand, will not jeopardize its overall health. (Source)

Challenges of Hybrid Energy Storage System

Limited Energy Production – The Hybrid Energy Storage System may encounter obstacles since the storage system’s limited energy production will be restricted to the quantity of energy stored. The absence of power flow control and energy management options results in inefficient storage utilization. (Source)

Trend 3: Long-Duration Energy Storage Systems

A long-duration energy storage system (LDES) can store energy for more than ten hours. This cornerstone technology will allow the economy to function upon intermittent renewable energy sources and backup power after grid interruptions.

In 2021, as part of its Energy Earthshot Initiative, the United States Department of Energy began an endeavor to bring the costs of long-term energy storage down to a more affordable level by 2030. It aspires to provide inexpensive grid storage for clean energy by decreasing the cost of grid-scale energy storage by a factor of 90% for systems that can store energy for 10 hours or more.

LDES systems, such as the pumped storage hydropower projects, have been used for several years. To reach the goal of a net-zero power sector on a global scale by 2040, LDES needs to be scaled up by about 400 times from where it is now to 85–140TWh. This expansion could be worth between $1.5 and $3 trillion. The government, including the U.S., is becoming more interested in LDES systems. (Source)(Source)(Source)

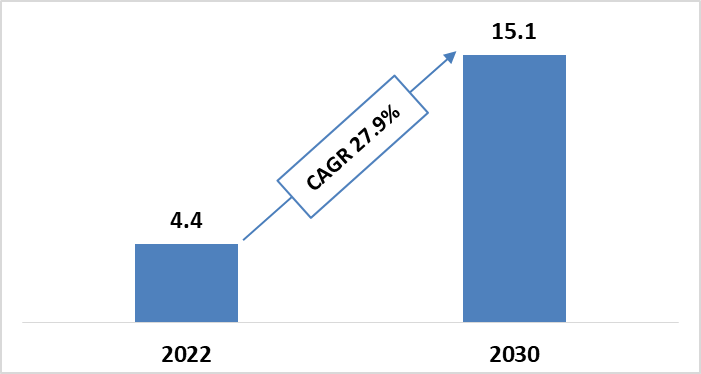

In 2022, the global long-duration energy storage systems market was valued at $4.4 billion and is expected to increase and reach $15.1 billion by 2030. The market is expected to increase at an approximate CAGR of 27.9% during the forecasted period. (Source)

Global Long Duration Energy Storage Systems Market Size during 2022-2030 ($Billion)

Advantages of Using Long-Duration Energy Storage Systems

Energy Arbitrage—Energy storage has the potential to engage in energy arbitrage by charging when the price of energy is low (surplus output) and producing when the price is high (high demand). LDES can transfer energy over longer durations. The shift can be from low-demanding weekends to high-demanding weekdays or even seasonally from spring and winter, when renewable curtailment is high, to high-demanding summers.

Resiliency Support – When energy is available for longer periods, there is an opportunity for LDES to support resilience and reduce the effects of unforeseen extreme events that span over many days. LDES can help with resilience in a big way because the loss of load value is very high, and it keeps on increasing. (Source)

Challenges of Long-Duration Energy Storage Systems

Storage – The problem of storage, specifically long-term energy storage, is one of the most challenging problems in clean technology. The other obstacles for LDES include cost, the readiness of the technology, the pushback from society, suitable market values for storage of over 4 hours, and the fact that there is not yet enough renewable grid penetration. (Source)

Trend 4: Smart Grid

The phrase “Smart Grids” refers to various technologies that may need to be implemented to allow electrical networks to operate more efficiently. A smart grid is an electricity network that allows devices to connect, control demand, safeguard the distribution network, save energy, and reduce costs.

Real-Time Dynamic Network of a Smart Grid

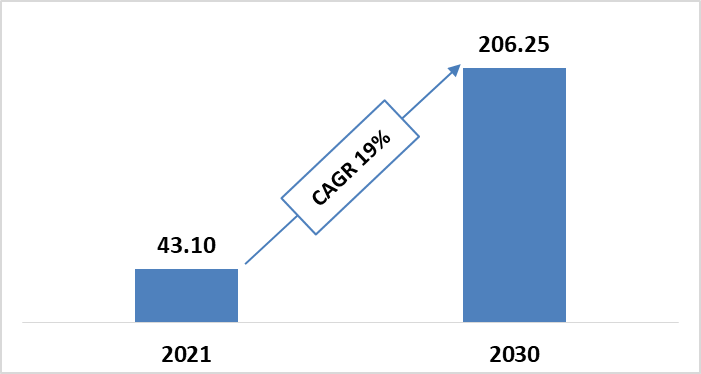

In 2021, the global smart grid market was valued at $43.10 billion and is expected to increase to $206.25 billion by 2030. The market is expected to grow at an approximate CAGR of 19% during the forecasted period. In 2021, the North American region held the largest share, 35%. The growing need for smart infrastructure and the growing number of smart city projects were some of the important factors driving the growth of the smart grid market in North America.

Global Smart Grid Market Size during 2021-2030 ($Billion)

Canada’s Ministry of Natural Resources introduced the Renewable and Electrical Pathways Program in 2020, a four-year scheme that aided in the roll-out of smart grids. This scheme received $4,795 million in funding. It aimed to improve the dependability and capacity of its smart grids. North America was an early user of smart grid technology, and the potential benefits of smart grids encouraged investments in the region’s smart grid infrastructure implementation. In June 2021, Poland’s power grid operator PSE announced plans to invest $1.23 billion by 2030 across its network in the country’s north to distribute electricity from planned Baltic offshore wind turbines to clients. (Source)(Source)(Source)

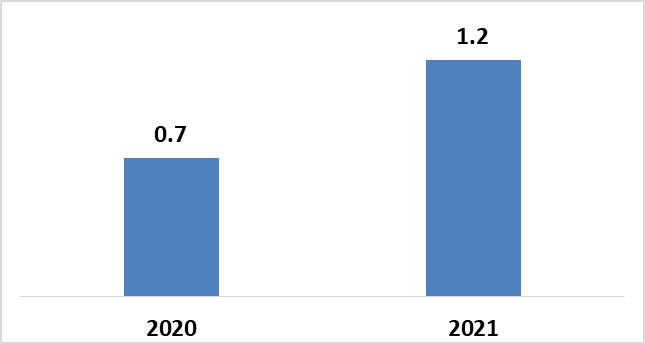

VC Investments

In 2021, smart grid firms raised $1.2 billion in venture capital funding in 35 agreements, a 55% increase from the $748 million raised in 38 deals in 2020. With $789 million in 18 deals, smart charging firms received the most venture capital funding in 2021. In the smart grid sector, 19 M&A deals were documented in 2021, compared to 21 transactions in 2020. (Source)

Smart Grid VC Funding during 2020-2021 ($Billion)

Advantages of Using Smart Grid

Load Balancing on Automatic Mode – A primary advantage of a smart electrical grid is automatic load balancing, which minimizes the likelihood of equipment failure. Companies must make manual modifications since electricity load varies depending on external variables. A smart grid employs technology that analyzes consumption trends to manage loads. This decreases strain on electrical equipment, particularly at peak periods.

Increased Efficiency of Electrical Transmission – Smart grids can regulate electrical transmissions by using intelligent technologies to reduce electrical wastage during distribution. This boosts the efficiency of electrical transmission, which benefits all stakeholders.

Enhanced Utilization of Renewable Energy – Smart grids may offer better choices for integrating renewable energy into the grid. Renewable energy sources, such as residential solar and battery storage, will play a greater role in future smart grids, supplying regular base-load electricity and responding to demand surges. (Source)(Source)

Challenges of Smart Grid

High Initial Costs for Deployment of Smart Grid Technology—The early stage of smart grid adoption requires a significant investment. Local and national governments’ involvement in modernizing energy infrastructure is critical. Smart grid technology necessitates large initial investments to establish the transmission networks that allow two-way communication between the utility and the customers.

Storing and Managing Complicated Smart Grid Infrastructure Data – The adoption of smart grid technologies has created huge amounts of complicated data. The data is largely unstructured and needs to be analyzed to acquire critical insights. Smart grid solution suppliers struggle to store and manage data generated by network nodes. (Source)(Source)

Trend 5: Virtual Power Plant

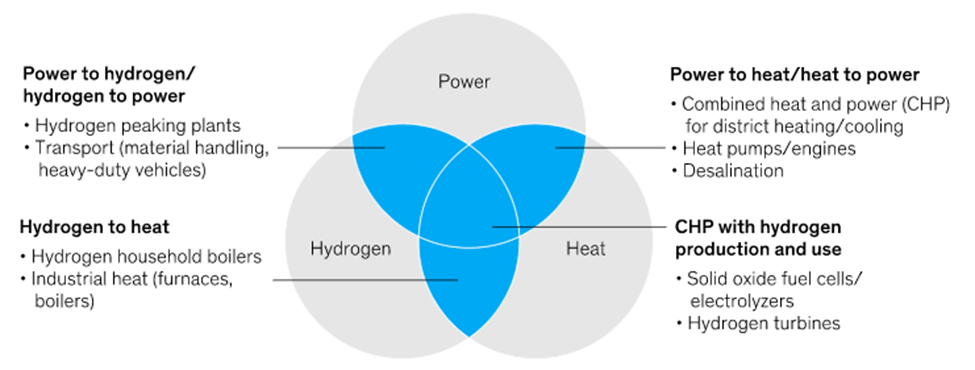

A Virtual Power Plant (VPP) is a network of decentralized, moderate-size power generation units, adaptable energy consumers, and storage devices. VPPs can perform a wide range of activities depending on the market context. The goal is to connect dispersed energy resources such as wind farms, solar parks, and Combined Heat and Power (CHP) units so that they may be observed, forecasted, optimized, and exchanged. The capability of various distributed energy resources (DERs) dispersed throughout the network is aggregated by a virtual power plant (VPP).

Virtual Power Plant (VPP)

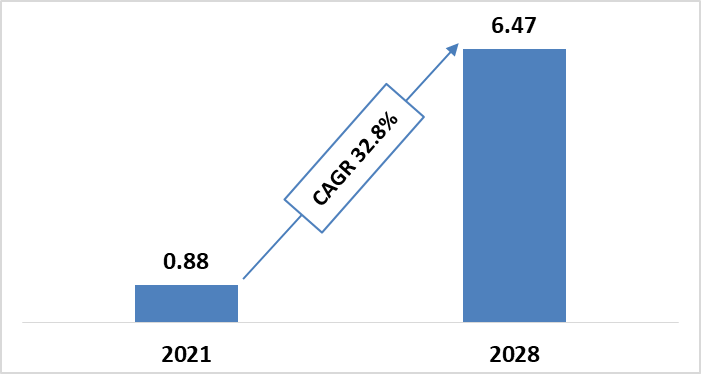

In 2021, the global virtual power plant market was valued at $0.88 billion and is expected to increase and reach $6.47 billion by 2028. The market is anticipated to grow at an approximate CAGR of 32.8% during the forecast period 2022-2028. Factors such as the widespread adoption of novel technologies such as cloud platforms and IoT applications in the power sector will significantly affect market growth. (Source)(Source)

Global Virtual Power Plant Market Size during 2021-2028 ($Billion)

Portland General Electric Company, in Oregon, announced a trial program in July 2020 to stimulate the installation and connection of 525 home energy storage batteries. This project produced up to four megawatts of power. The distributed assets created a virtual power plant comprising tiny units that could work alone or collaboratively to serve the grid. (Source)

SunPower Corp. confirmed the launch of its Virtual Power Plant (VPP) solution in November 2021, allowing SunVaultTM energy storage clients to be reimbursed for enabling the flexibility to use stored energy throughout peak demand. As a result, their community’s power grid will become more stable. (Source)

Advantages of Using Virtual Power Plant

Contributing to the Creation of a More Stable Grid—All power networks require energy production and electricity demand to be balanced to operate efficiently and safely. Plants in this market are sometimes paid to stand by and be ready to turn on immediately. VPPs can function in this sector since they can quickly discharge or charge power from the grid.

Reducing Emissions and Load Shifting – VPPs enable real-time movement of residential, commercial, and industrial loads based on price signals to provide demand-side management services to grid operators. When done correctly, this will minimize the demand for high-emitting power plants while lowering carbon emissions. (Source)(Source)

Challenges of Virtual Power Plant

Inadequate Infrastructure and Huge Costs – Advanced communication technologies, such as an energy management system (EMS), which enables the observation, management, and control of different energy devices, must be included in the high-quality infrastructure required to build VPP. Integrating current technologies and processes into a VPP requires significant investment and a highly qualified workforce. As a result, inadequate infrastructure and the increased costs associated with new technologies are projected to limit market growth over the forecasted period.

Stabilizing Virtual Power Plants – Some countries have already detected a negative impact on grid stability and electrical quality. The grid is gradually becoming an active distribution network as various alternative energy sources, particularly renewable ones, are developed. In this situation, procuring the stability provided by ancillary services becomes highly significant. The providers of virtual power plants (VPPs) encounter a challenging situation because they want to gain from the shift to renewable energy while retaining their capacity to provide the service accurately and cost-effectively. (Source)(Source)

Our complete study discusses the 10 trends in energy storage. These include solid-state batteries, hybrid energy storage systems, smart grids, etc. Fill out the form below to access the complete report:

Authored By: Vipin Singh, Market Research

Edited By: Nidhi, Marketing