The biotech industry, valued at approximately $1292.5 billion in 2023, is driven largely by a global focus on personalized medicine. This rapid expansion is forecasted to continue, with a projected compound annual growth rate (CAGR) of 19% from 2024 to 2032, indicating a future market value of about USD 6189.9 billion by 2032.

Advancements like treatments for Alzheimer’s disease, such as the FDA-approved LEQEMBI and the promising Alzheimer’s vaccine UB-311 developed by Vaxxinity. Another historic milestone was reached with the UK’s approval of Casgevy, the world’s first CRISPR-based therapy, signaling a new era in gene-editing technology for inherited blood disorders like sickle cell disease and beta-thalassemia.

These breakthroughs shed light on the changing landscape of the biotech industry. In this report, you will read about similar biotech advances made by top biotech and biopharma companies.

This comprehensive report includes information on biotech companies, including research and development, progressive drugs, and products filed or approved in the US and EU markets in recent years. It details popular solutions manufactured by these companies, the significant revenue contributions from their drug portfolios, and drugs that have lost and will lose exclusivity in a few years. The report also highlights recent mergers, acquisitions, and collaborations reshaping the industry.

1. Regeneron Pharmaceuticals

Regeneron Pharmaceuticals is an American pharmaceutical and biotech company headquartered in Westchester County, New York. The company reported revenue of $3.16 billion in the second quarter of 2023, marking a 10.5% increase from the previous year. This growth was driven primarily by higher revenue from its collaboration with Sanofi, especially due to the strong demand for Dupixent, a monoclonal antibody treatment.

The development of odronextamab, a bispecific CD20xCD3 antibody, is among Regeneron’s recent breakthroughs.

This innovative therapy has shown clinically meaningful efficacy and safety in patients with relapsed or refractory follicular lymphoma (FL) and diffuse large B cell lymphoma (DLBCL).

The biotech giant also announced new data on multiple combination therapies at the European Society for Medical Oncology Immuno-Oncology (ESMO IO) Congress 2023. This included encouraging the initial activity of the investigational costimulatory bispecific antibody REGN5668 (MUC16xCD28) in combination with PD-1 inhibitor Libtayo® (cemiplimab) for patients with recurrent ovarian cancer.

These developments highlight Regeneron Pharmaceuticals’ commitment to advancing medical research and treatment, positioning it as a leader in the biotech industry.

Regeneron Pharmaceuticals’ R&D Priorities and Strategies

Investment in Research and Development

Regeneron Pharmaceuticals spent about $4.305 billion on research and development from September 2022 to September 2023, 30.97% more on a year-over-year basis. The quarterly expenses for R&D were $1.101 billion in March, $1.085 billion in June, and $1.075 billion in September. This consistent investment in R&D showcases the company’s commitment to advancing its research initiatives and maintaining a strong position in the biotechnology industry.

Pipeline

Pre-clinical research programs within the business include oncology/immuno-oncology, angiogenesis, ophthalmology, metabolic and related diseases, muscular diseases and disorders, inflammation and immunological diseases, and other aging-related diseases. The scientists invented two distinct technologies to create protein therapies that block, activate, or regulate the action of certain cell surfaces or secreted molecules. Regeneron has approximately 35 product candidates in clinical development.

Ongoing Dupixent (dupilumab) Developments

In September 2023, the Ministry of Health, Labour, and Welfare (MHLW) in Japan approved Dupixent to treat pediatric and adolescent patients with atopic dermatitis. The FDA accepted the supplemental Biologics License Application (sBLA) for treating children aged 1 to 11 years with EoE for priority review, with a target action date of January 31, 2024. In October 2023, the FDA issued a Complete Response Letter (CRL) for the sBLA for Dupixent in chronic spontaneous urticaria (CSU).

The CRL states that additional efficacy data are required to support an approval; it did not identify any issues with safety or manufacturing. An ongoing Phase 3 clinical trial (in biologic-naïve patients) continues to enroll patients, with results expected in late 2024.

NHL Expansion

Odronextamab, a bispecific CD20xCD3 antibody, has shown effectiveness and safety in treating relapsed or refractory follicular lymphoma (FL) and diffuse large B cell lymphoma (DLBCL).

The positive results from the Phase I ELM-1 and Phase II ELM-2 clinical trials have led to odronextamab being placed under priority review by the FDA for treating these conditions, with a target action date set for March 31, 2024. This expansion into the Phase III clinical development program positions Regeneron as a significant competitor in the non-Hodgkin lymphoma (NHL) label expansion race, with odronextamab forecasted to reach $468 million in global sales by 2029.

Research Partnerships

In 2022, Regeneron Pharmaceuticals, Inc. and CytomX Therapeutics, Inc. formed a strategic research partnership to produce conditionally-activated investigational bispecific cancer therapies using CytomX’s Probody® therapeutic platform and Regeneron’s Veloci-Bi® bispecific antibody development platform.

“This collaboration will enable Regeneron and CytomX to combine our collective oncology expertise with two premier platforms – Probody and Veloci-Bi – to develop novel immunotherapies and research their potential to transform patient lives.”

– John Lin, M.D., Ph.D., Senior Vice President, Immuno-oncology and Head of Bispecifics at Regeneron

Trap Technology

The company developed “Trap” technology to address the limitations in specificity and binding affinity of human antibodies available at the time. The Trap technology involves fusing two distinct fully human receptor components and a fully human immunoglobulin-G constant region. This approach creates high-affinity product candidates that act as “decoy receptors,” effectively neutralizing the harmful effects of various signaling proteins. This novel and patented technology has been used to develop several drugs, including EYLEA, ZALTRAP, and ARCALYST, for various diseases and conditions.

VelociSuite®

VelociSuite® is another Regeneron platform that has revolutionized its approach to biological drug development. It encompasses a series of Regeneron-invented technologies designed to accelerate, improve, and disrupt traditional drug discovery and development processes. These technologies enable rapid and effective identification and validation of antibody targets. VelociSuite® includes VelociGene®, VelocImmune®, VelociMab®, VelociMouse®, VelociT®, VelociHum®, Veloci-Bi®, and Velocinator™.

These technologies facilitate everything from the rapid manipulation of mouse DNA to create disease models (VelociGene®) to the generation of fully human monoclonal antibodies (VelocImmune®) and bispecific antibodies (Veloci-Bi®). VelociSuite® enhances target specificity, reduces doses for improved safety and efficacy, and accelerates the validation and development of therapeutic targets.

The Regeneron Genetics Center (RGC)

The Regeneron Genetics Center (RGC), a subsidiary of Regeneron Pharmaceuticals, houses one of the world’s largest and most diverse genomic databases, enabling significant discoveries in human health and disease. RGC’s innovative approach, combining extensive global genomic data and “team science,” has led to breakthroughs in understanding various diseases and conditions.

Its work extends into gene therapy, genome editing, and gene silencing. With technologies like CRISPR and RNA interference (RNAi), RGC and Regeneron are developing innovative treatments for various diseases.

The center expands scientific understanding and accelerates drug development by partnering with over 120 global entities. These collaborations include the University of Colorado, Geisinger Health System, Mayo Clinic, and the University of Pennsylvania. These agreements give genetic researchers access to biological samples and related phenotypic data from fully consented patient participants. RGC genetically sequences these samples to produce a one-of-a-kind library of de-identified genetic data and associated phenotype data for research.

Popular Drugs

Regeneron Pharmaceuticals owns a diverse portfolio of impactful medicines. Some of their popular drugs include:

Dupixent (dupilumab)

Dupixent (dupilumab) was manufactured in 2022 and approved for treating adult patients with moderate-to-severe prurigo nodularis. The drug is also used to treat moderate-to-severe eczema (atopic dermatitis) in adults and children at least six months old. It is an add-on treatment for moderate-to-severe asthma in patients six years and older. Dupixent can treat chronic rhinosinusitis with nasal polyps in adults. It is also approved for treating eosinophilic esophagitis (EoE) in patients 12 years and older, weighing at least 40 kg.

Inmazeb

Inmazeb is a fixed-dose combination of three monoclonal antibodies: atoltivimab, maftivimab, and odesivimab-ebgn. FDA approved it in October 2020 for treating infections caused by the Zaire ebolavirus in adult and pediatric patients, including newborns of mothers who tested positive for the infection.

In the PALM trial conducted during an Ebola virus outbreak in the Democratic Republic of the Congo in 2018/2019, Inmazeb mortality rates were less than other treatments. Scientists at the La Jolla Institute for Immunology have uncovered the detailed structure and function of Inmazeb.

A new study published in Cell Host & Microbe presents a high-resolution, 3D structure of the three antibodies as they bind to the Ebola virus glycoprotein. This discovery sheds light on the drug’s mechanism and indicates the potential for Inmazeb to treat additional species of Ebolavirus. The findings suggest that Inmazeb could provide lasting immunity against Ebola virus variants and guide the development of novel antibody drugs targeting the glycoprotein more broadly or effectively.

Evkeeza

Evinacumab, brand name Evkeeza, is a monoclonal antibody medication for treating homozygous familial hypercholesterolemia (HoFH). It is commercialized in the United States under the name evinacumab-dgnb. Ultragenyx is responsible for its commercialization outside the U.S.

The European Commission has approved Evkeeza as an addition to diet and other low-density lipoprotein cholesterol (LDL-C) lowering therapies for treating pediatric patients aged five years and older with HoFH. In clinical trials, Evkeeza demonstrated the ability to significantly reduce LDL cholesterol levels when combined with other lipid-lowering therapies, potentially having a transformative impact on younger patients at risk for severe cardiac events.

REGEN-COV

REGEN-COV® is a combination of monoclonal antibodies, casirivimab and imdevimab, developed by Regeneron Pharmaceuticals Inc. and co-developed by F. Hoffman-La Roche Ltd (Roche) for treating and preventing COVID-19. It is known as Ronapreve™ in countries other than the US. The U.S. FDA initially authorized its emergency use in November 2020 for treating mild to moderate COVID-19 in people at high risk for severe disease progression. In June 2021, the EUA was revised to include post-exposure prophylaxis for COVID-19.

REGEN-COV showed a reduction in COVID-19-related hospitalization or emergency room visits compared to placebo in high-risk patients. A Phase III clinical trial (REGN-COV 2069) met its primary and secondary endpoints, significantly reducing the risk of infection and symptom resolution time.

During the second pandemic wave, the Emergency Use Authorization was granted in May 2021 in India. In partnership with Cipla, Roche India is responsible for marketing the drug in the country.

Other Popular drugs that the company manufactures are:

- Libtayo (REGN-2810, REGN2810, cemiplimab-rwlc)

- Kevzara (Sarilumab)

- Pozelimab (VEOPOZ™)

- Aflibercept (Sold as Zaltrap And EYLEA, EYLEA HD)

- Arcalyst (Rilonacept)

Products Filed for Approval in the US/EU

| Serial No. | Year | Description |

| 1 | 2023 | Regeneron Pharmaceuticals announced on 18 Aug 2023 that it had received FDA approval for Veopoz™ (pozelimab-bbfg), the treatment for CHAPLE disease in patients 1 year and older in the US. |

| 2 | 2023 | Regeneron Pharmaceuticals has secured FDA approval for EYLEA HD (aflibercept) Injection 8 mg for usability to treat wet age-related macular degeneration (wAMD), diabetic macular edema (DME), and diabetic retinopathy (DR) in the US in August. EYLEA injection was approved in February by the FDA for the treatment of preterm infants with retinopathy of prematurity (ROP). |

| 3 | 2022 | Regeneron Pharmaceuticals and Sanofi recently received FDA approval for Dupixent® (dupilumab) for treating adult patients with prurigo nodularis, marking the first-ever medicine specifically indicated for this condition in the US. |

Drugs Losing Exclusivity in the Coming 2 or 3 Years

EYLEA – Regulatory exclusivity in the US extended until May 17, 2024, offering continued protection for Regeneron. Previously, exclusivity was expected to lapse in November 2023.

Note: Know more about the other Regeneron drug patents expiring soon, here.

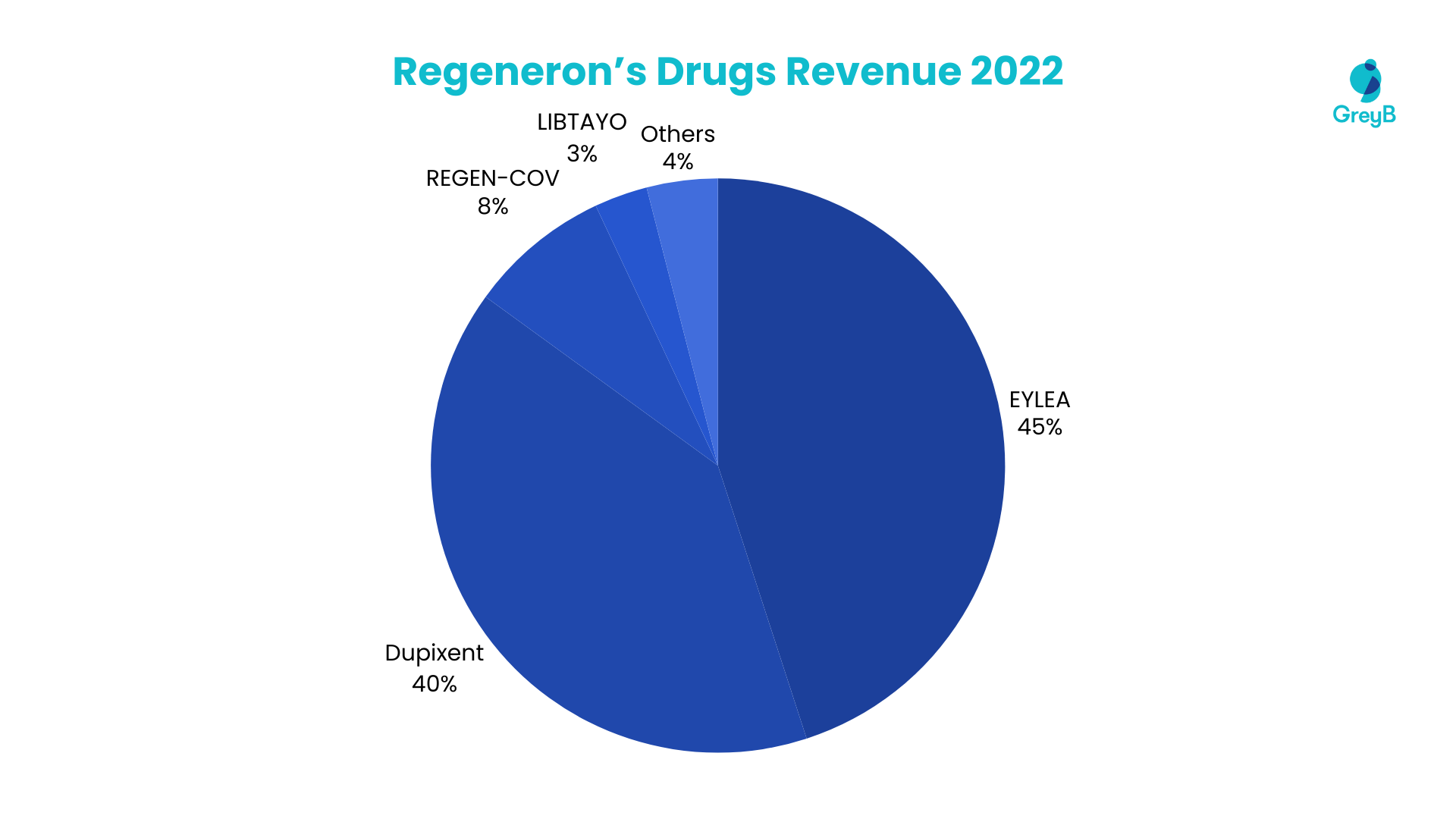

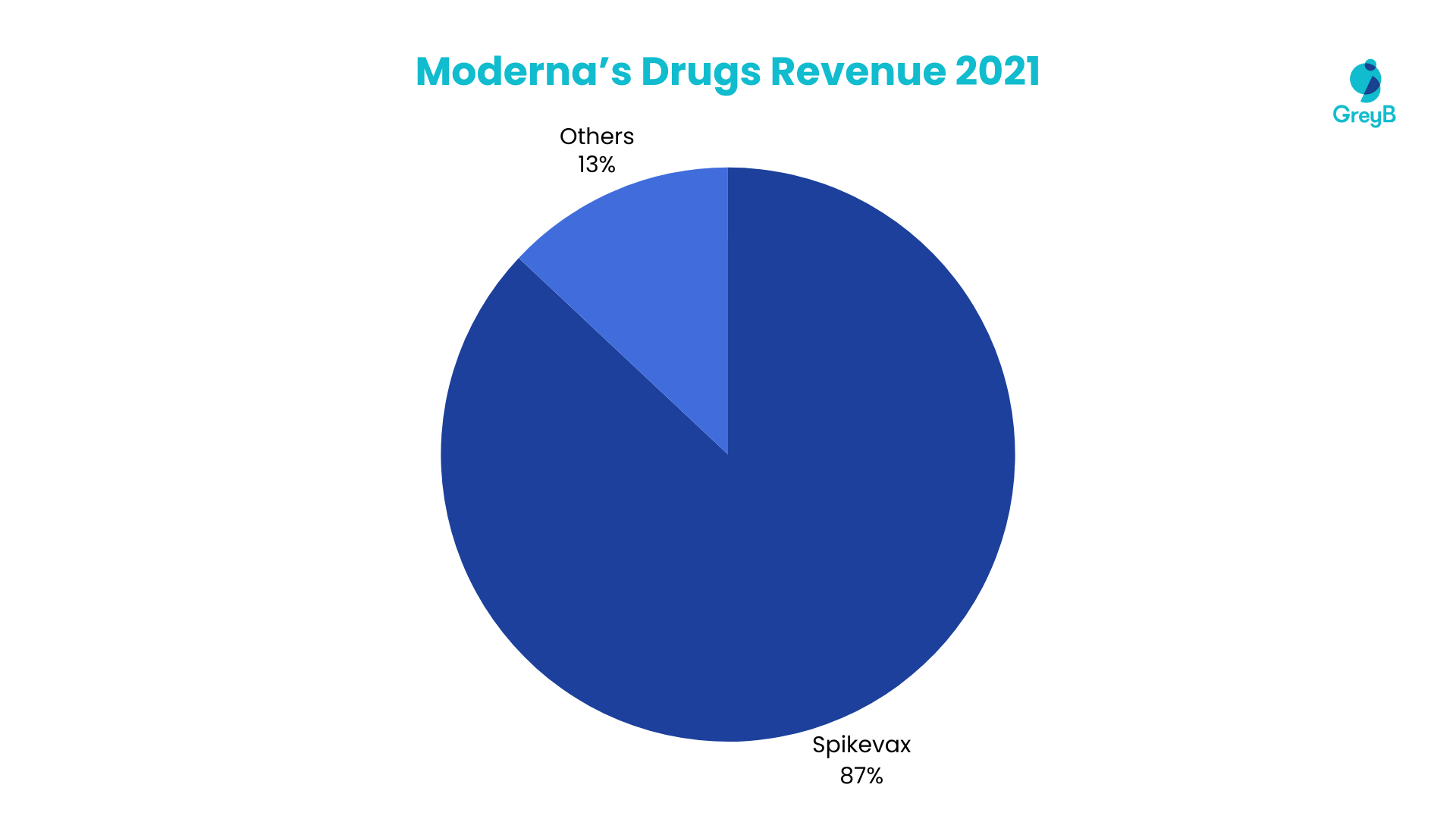

Revenue Contribution from Drugs

Regeneron Pharmaceuticals derived a significant portion of its revenue from vital therapeutic agents in 2022. EYLEA stands out as the primary contributor, accounting for 45% of the company’s total revenue. Dupixent follows closely, constituting a substantial 40%, while REGEN-COV contributes 8%. Libtayo, Praluent, and Kevzara collectively represent 6% of the revenue, with Libtayo contributing 3%, Praluent 2%, and Kevzara 1%. The remaining 1% is attributed to other products within Regeneron’s diverse portfolio. This distribution underscores these drugs’ pivotal role in shaping the company’s financial landscape.

Top 6 Medicines and Vaccines Account for 99% of the Total Revenue in 2022

Mergers and Acquisitions

Checkmate Pharmaceuticals

Regeneron Pharmaceuticals, Inc. successfully purchased Checkmate Pharmaceuticals, Inc. in 2022, extending its commitment to immuno-oncology and adding a new modality to its portfolio of possible combination-ready therapies for difficult-to-treat cancers.

The agreement was worth roughly $250 million for the lead immuno-oncology product vidutolimod

“As we continue to deepen and expand our efforts in immuno-oncology, the acquisition of Checkmate adds a potentially best-in-class clinical asset, as well as a promising underlying technology platform in the VLP delivery system.”

– Leonard S. Schleifer, M.D., Ph.D., President and Chief Executive Officer of Regeneron

Sanofi’s Share in Libtayo® Acquired

The biotech giant finalized the acquisition of Sanofi’s share in Libtayo® in July 2022, granting Regeneron exclusive worldwide development, commercialization, and manufacturing rights to the drug in Regeneron’s laboratory.

Acquisition of Decibel Therapeutics

Regeneron Pharmaceuticals, Inc. finalized the purchase of Decibel Therapeutics, Inc., in September 2023, boosting the company’s gene therapy and auditory initiatives. The acquisition of Decibel expands on the firms’ previous relationship and includes three ongoing gene therapy initiatives addressing various forms of congenital, monogenic hearing loss, including DB-OTO.

Collaborations

Regeneron Pharmaceuticals and CytomX Therapeutics, Inc.

Regeneron announced a strategic collaboration and licensing agreement with CytomX Therapeutics, Inc. on November 17, 2022, to develop conditionally-activated bispecific cancer therapies. This partnership combines CytomX’s Probody® therapeutic platform with Regeneron’s Veloci-Bi® bispecific antibody development platform. The collaboration aims to create investigational bispecific immunotherapies activated by proteases in the tumor microenvironment, potentially enhancing the therapeutic window and reducing off-target effects. These therapies target T-cells and could be effective against tumor types traditionally unresponsive to immunotherapy.

Under the agreement, Regeneron and CytomX jointly undertake discovery activities to identify and validate conditionally active bispecific antibodies, with Regeneron funding the preclinical and clinical development and commercialization.

Regeneron Pharmaceuticals and Ultragenyx Pharmaceutical, Inc.

Regeneron announced a license and collaboration agreement with Pharmaceuticals and Ultragenyx Pharmaceutical Inc. on January 7, 2022, to develop and commercialize Evkeeza® (evinacumab) globally outside the United States. Evkeeza, a first-in-class medicine approved by the FDA and EC, treats homozygous familial hypercholesterolemia (HoFH), an ultra-rare form of high cholesterol. Ultragenyx leads its clinical development, commercialization, and distribution in the European Economic Area and other international markets.

Under the agreement, Regeneron received a $30 million upfront payment, with the potential for up to $63 million in additional regulatory and sales milestones. Ultragenyx obtained rights for the development and commercialization outside the U.S. and shared costs for global trials led by Regeneron. The company has also been granted an exclusive option to collaborate on developing and commercializing Regeneron’s investigational antibody for fibrodysplasia ossificans progressiva (FOP) outside of the U.S.

Regeneron Pharmaceuticals and Sonoma Biotherapeutics, Inc.

In March 2023, Regeneron and Sonoma Biotherapeutics, Inc. partnered to share their scientific and clinical experience, as well as their respective technological platforms, to the discovery, development, and commercialization of novel regulatory T cell (Treg) medicines for autoimmune disorders.

The partnership will combine VelociSuite® technologies to discover and identify fully human antibodies and T cell receptors (TCRs) with Sonoma Biotherapeutics’ approach to creating and producing gene-modified Treg cell therapies. Both companies will investigate and develop Treg cell therapeutics together for ulcerative colitis, Crohn’s disease, and two other unspecified indications, with a fifth indication available to Regeneron. Research and development of all potential products will be co-funded by partners, and commercial expenses and profits will be shared equally.

Read here about 7 Stem Cell Therapy Startups Innovating in the Biotechnology Industry.

Regeneron Pharmaceuticals and Intellia Therapeutics, Inc.

Regeneron announced an expanded research collaboration with Intellia Therapeutics, Inc. on October 3, 2023, to develop innovative in vivo CRISPR-based gene editing therapies for neurological and muscular diseases. This partnership builds upon the success of their existing collaboration, combining Regeneron’s expertise in proprietary antibody-targeted adeno-associated virus (AAV) vectors and delivery systems with Intellia’s cutting-edge Nme2 CRISPR/Cas9 (Nme2Cas9) technology. The collaboration focuses on surpassing current genetic medicine limitations, which predominantly target the liver, by exploring new avenues for delivering genetic treatments to specific cells in the body.

Notable Mention: Regeneron Pharmaceuticals, Inc. and Roche partnered in 2020 to battle COVID-19 while developing, manufacturing, and distributing REGN-COV2, Regeneron’s experimental anti-viral antibody combination, to individuals worldwide. This collaboration expanded REGN-COV2 supply to at least three and a half times the present capacity, with the possibility of even further expansion.

Looking for more detailed information on the Biotech and Biopharma companies? Contact our experts by clicking the button below.

2. Vertex Pharmaceuticals

Vertex Pharmaceuticals, a leader in biotech innovation, demonstrated significant progress in 2023, particularly in cystic fibrosis (CF) treatment and gene editing therapies. The company’s CF medicines continued to impact more patients globally. At the same time, the launch of CASGEVY™ in the US, UK, and Bahrain marked a pivotal step in gene editing therapy for sickle cell disease and transfusion-dependent beta-thalassemia (TDT).

The company also completed pivotal studies for its next-in-class triple combination CFTR modulator therapy vanzacaftor/tezacaftor/deutivacaftor, showing potential advancements over existing treatments like TRIKAFTA®.

Research and Development Priorities and Strategies

Investment in Research and Development

Vertex Pharmaceuticals’ annual R&D spending in 2022 was $2.54 billion, a 31.09% rise from $1.94 billion in 2021. For the twelve months from September 2022 to September 2023, it invested $3.032 billion in R&D. The amount is 25.71% more on a YOY basis. The company’s research aim is to combine transformational advancements in human illness understanding and therapeutic science to increase human health.

Strategy And Pipeline

The company’s research and early development strategy entails moving many compounds or medicines from each program into early clinical trials to collect patient data. The data can help choose the most promising compounds in the pipeline for later-stage research and guide ongoing discovery and development efforts.

This strategy has proven to be effective as it succeeds in getting novel product candidates into clinical trials and achieving commercial clearances for TRIKAFTA/KAFTRIO, KALYDECO, ORKAMBI, and SYMDEKO/SYMKEVI for the treatment of CF and INCIVEK for the treatment of hepatitis C infection.

Clinical Trials Planned for 2024

- Vertex made developments in acute and neuropathic pain management. The completion of three Phase 3 studies for VX-548 for moderate to severe acute pain, including abdominoplasty and bunionectomy surgeries, create new pain management solutions. Also, positive Phase 2 results for VX-548 in diabetic peripheral neuropathy and the initiation of a Phase 2 study in lumbosacral radiculopathy highlight the company’s developments in peripheral neuropathic pain solutions.

- This biopharma giant has made headway in treating alpha-1 antitrypsin deficiency and AMKD, with the completion of the Phase 2B dose-ranging study for inaxaplin and the anticipation of beginning Phase 3 trials in early 2024.

- The company’s advancements in type 1 diabetes (T1D) treatment are noteworthy, with VX-880 showing promising results in producing endogenous insulin and aiding glycemic control in patients.

Forming Strategic Alliances

In recent years, the company has formed strategic research alliances with several firms, including Obsidian Therapeutics, CRISPR Therapeutics, Entrada Therapeutics, Moderna, Inc., etc. These strategic research collaborations resulted in the discovery of novel medicines that regulate gene editing to treat critical genetic illnesses and advance research activities.

Popular Drugs

Vertex Pharmaceuticals is actively engaged in research and development, concentrating on areas such as cystic fibrosis, sickle cell diseases, beta thalassemia, type-1 diabetes, and pain. Its drugs and solutions include-

CASGEVY™

CASGEVY™, or exagamglogene autotemcel, is a gene therapy developed for treating sickle cell disease (SCD) in patients aged 12 years and older who experience recurrent vaso-occlusive crises (VOCs).

It uses CRISPR/Cas9, a genome editing technology, to modify the patient’s hematopoietic (blood) stem cells. The therapy is administered as a one-time intravenous infusion and is the first FDA-approved treatment utilizing this type of genome editing technology. It is also the first cell-based gene therapy approved for SCD, marking a milestone in treating this debilitating disease.

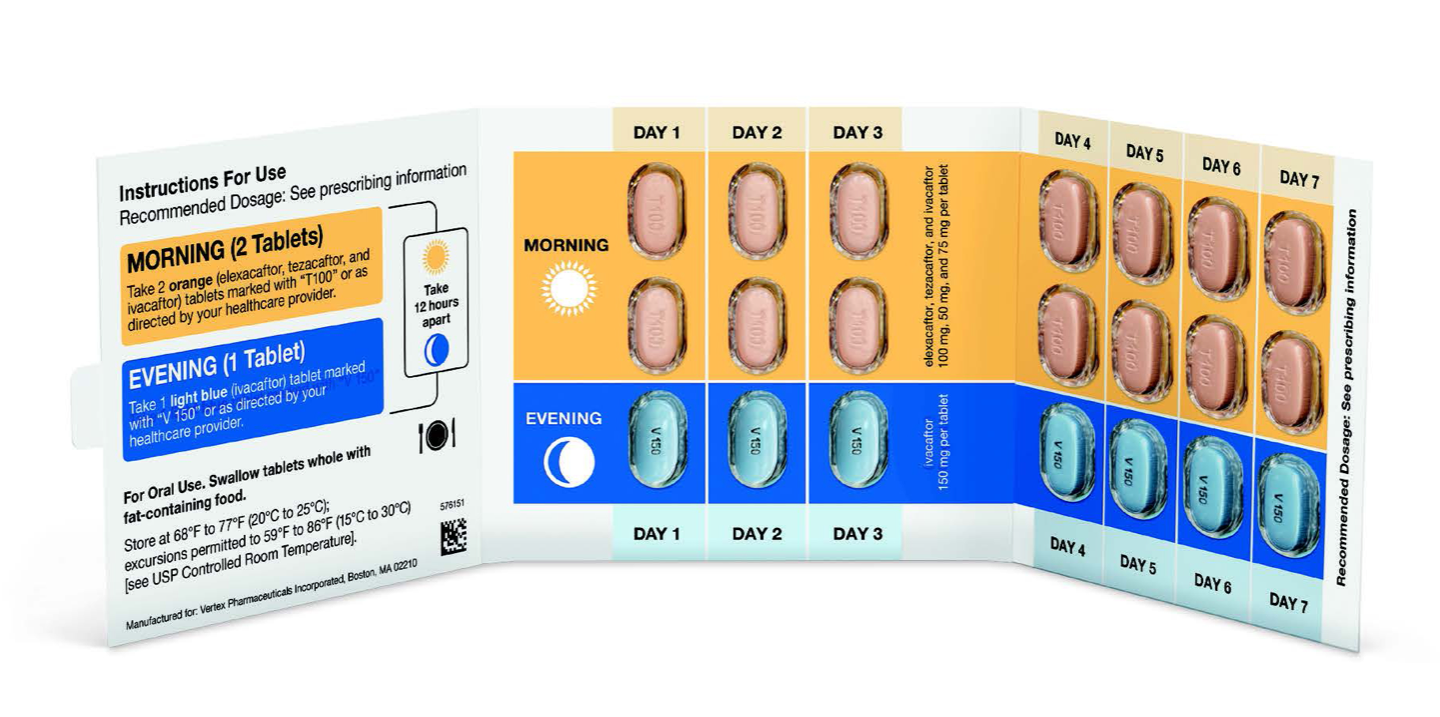

TRIKAFTA

TRIKAFTA® is a combination drug used to treat cystic fibrosis (CF) that includes three active substances: lumacaftor, lumacaftor, and ivacaftor. These are CFTR modulators, which work by targeting the cystic fibrosis transmembrane conductance regulator (CFTR) protein.

It is prescribed for treating cystic fibrosis in patients two years and older. TRIKAFTA improves the function of the defective CFTR protein found in CF patients. This action helps hydrate and clear mucus from the airways, reducing the number and severity of infections and improving lung function. It is an oral medication, making it convenient for patients to take.

Other drugs manufactured by the company used for treatment of Cystic Fibrosis (CF) are:

- KALYDECO® (ivacaftor)

- SYMDEKO® (tezacaftor/ivacaftor and ivacaftor)

- SYMKEVI® (tezacaftor/ivacaftor in combination with ivacaftor)

- ORKAMBI® (ivacaftor/lumacaftor)

- KALYDECO® (ivacaftor)

- KAFTRIO® (ivacaftor/tezacaftor/elexacaftor in combination with ivacaftor)

VX-522

VX-522 is an investigational messenger ribonucleic acid (mRNA) therapy to address the underlying cause of cystic fibrosis (CF). Vertex is working on this treatment for lung disease for people living with CF who cannot benefit from CFTR modulator treatments. It is designed to deliver full-length CFTR mRNA encapsulated in a lipid nanoparticle directly to the lungs via inhalation.

VX-548 is another novel investigational drug created by the company to inhibit NaV1.8 selectively, a voltage-gated sodium channel for pain signaling in the peripheral nervous system.

Products Filed for Approval in the US/EU

| Serial No. | Year | Description |

| 1 | 2023 | FDA-approved CRISPR/Cas9 genome-edited cell therapy for the treatment of sickle cell disease (SCD) in patients aged 12 and older, offering a potential functional cure by addressing recurrent vaso-occlusive crises (VOCs) in the US. |

| 2 | 2023 | Vertex Pharmaceuticals has gained FDA approval for extended use of TRIKAFTA® for children aged 2 to 5 years with cystic fibrosis possessing specific gene mutations. This expansion follows prior approval for individuals aged 6 years and older. |

Drugs Losing Exclusivity

Two of the company’s drug patents expire in December 2026 and May 2027.

Read more about the Vertex Pharmaceuticals patents on our exclusive drug patent monitoring platform — Pharsight.

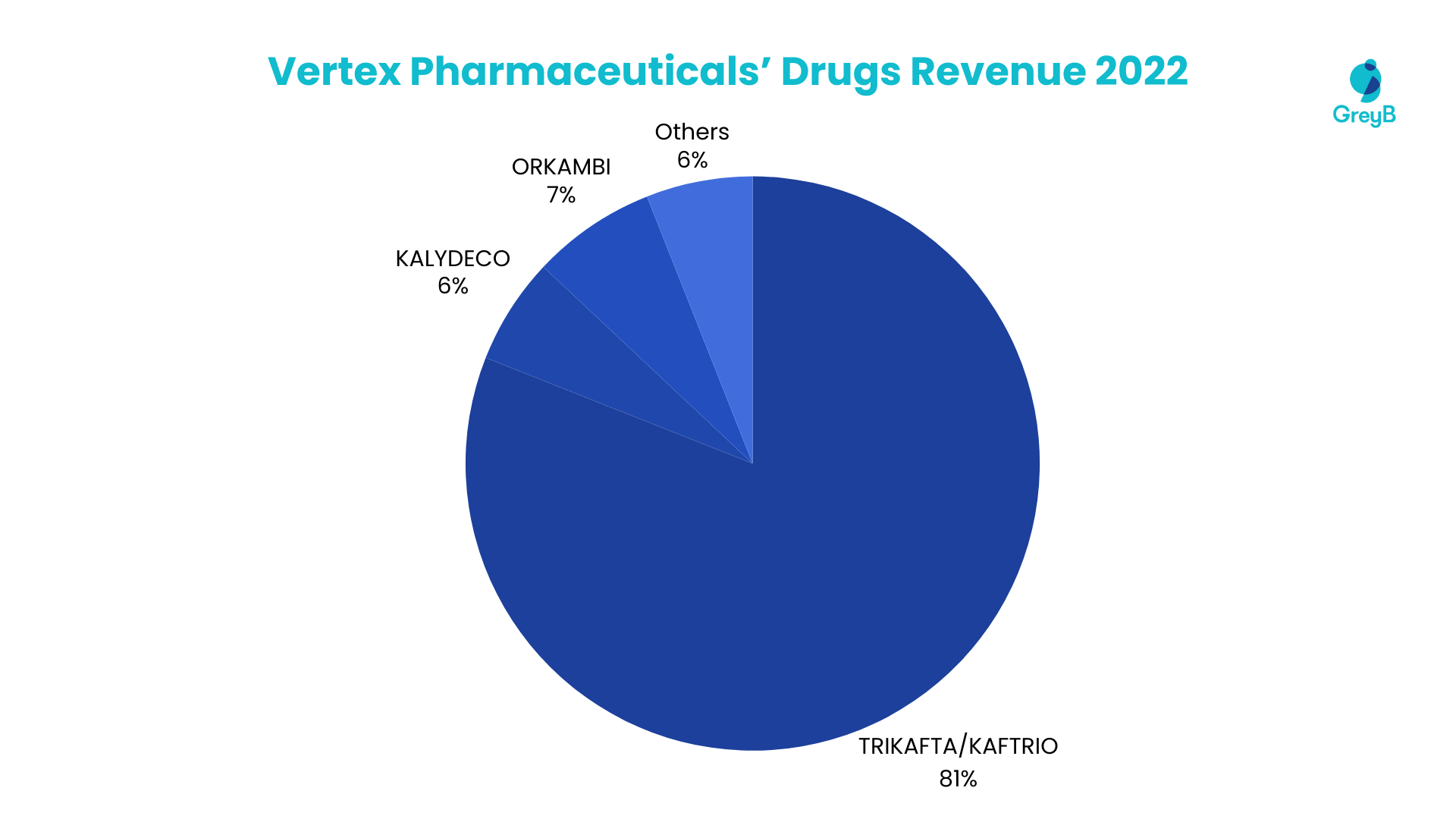

Revenue Contribution from Drugs

The 2022 revenue landscape of Vertex Pharmaceuticals was prominently shaped by critical therapeutic solutions. An overwhelming 81% of the company’s total revenue was attributed to TRIKAFTA/KAFTRIO, underscoring its pivotal role in Vertex’s financial success. Following closely, KALYDECO contributes a significant 6%, while ORKAMBI and SYMDEKO/SYMKEVI collectively account for 7% of the revenue. The remaining 6% was derived from various other products within Vertex’s portfolio. This distribution underscores the critical importance of TRIKAFTA/KAFTRIO in driving the majority of Vertex Pharmaceuticals’ overall revenue.

The top 4 Medicines and Vaccines accounted for 95% of the Total Revenue in 2022

Mergers and Acquisitions

Acquisition of ViaCyte

Vertex Pharmaceuticals inked a deal to acquire ViaCyte in 2022 for approximately $320 million. The acquisition offered Vertex complementary assets, capabilities, and technologies, including additional human stem cell lines, intellectual property related to stem cell differentiation, and GMP manufacturing facilities for cell-based therapies, accelerating Vertex’s ongoing T1D programs. Through the ViaCyte relationship with CRISPR Therapeutics, the acquisition also provides access to novel hypo-immune stem cell assets.

So far, this biotechnology giant made three acquisitions across sectors. The other two are Exonics and Semma Therapeutics.

Collaborations

Vertex Pharmaceuticals and Verve Therapeutics, Inc.

Vertex Pharmaceuticals initiated an exclusive four-year global research collaboration with Verve Therapeutics on July 20, 2022, to discover and develop an in vivo gene editing program for a specific, yet undisclosed, liver disease. Verve manages the discovery, research, and preclinical development stages, funded entirely by Vertex, which is responsible for further development, manufacturing, and commercialization.

Vertex Pharmaceuticals and Entrada Therapeutics, Inc.

The company announced a global collaboration with Entrada Therapeutics on December 8, 2022, to develop Endosomal Escape Vehicle (EEV™) therapeutics for Myotonic Dystrophy Type 1 (DM1). This partnership includes Entrada’s ENTR-701, an investigational EEV candidate for DM1 in late-stage preclinical development.

Entrada received a $224 million upfront payment and a $26 million equity investment from Vertex. The four-year collaboration allows Entrada to continue DM1-related research, funded by Vertex, which will handle the global development, manufacturing, and commercialization of ENTR-701 and any additional DM1 therapies.

Vertex Pharmaceuticals and CRISPR Therapeutics

CRISPR Therapeutics entered a licensing agreement with Vertex Pharmaceutical, where Vertex received non-exclusive rights to CRISPR Therapeutics’ CRISPR/Cas9 technology. This agreement aims to expedite the development of Vertex’s hypoimmune cell therapies for Type 1 Diabetes (T1D). CRISPR Therapeutics gets a $100 million upfront payment along with potential milestone and royalty payments for future gene-edited hyperimmune T1D products.

Vertex’s T1D portfolio includes clinical programs like VX-880 and VX-264 and preclinical hypoimmune programs. The collaboration is part of Vertex’s strategy to develop fully differentiated, insulin-producing hypo-immune islet cells for T1D treatment.

3. Jazz Pharmaceuticals

Jazz Pharmaceuticals is renowned for its innovative approach to drug development, particularly in oncology and sleep disorders. Distinguished for its dynamic research and development strategies, Jazz has made significant breakthroughs in treatments for various cancers, with a special focus on HER2-expressing cancers. Its groundbreaking work with zanidatamab, a bispecific antibody, exemplifies its commitment to addressing unmet medical needs.

At the San Antonio Breast Cancer Symposium (SABCS), Jazz Pharmaceuticals presented a spotlight poster on the positive results from an investigator-sponsored Phase 1 trial evaluating neoadjuvant single-agent zanidatamab in stage 1 node-negative HER2+ breast cancer. This research demonstrates the company’s commitment to advancing targeted treatment options for patients with solid tumors expressing HER2.

Research and Development Priorities and Strategies

Growth Strategy

Jazz Pharmaceuticals’ growth strategy is based on completing commercial launches and ongoing commercialization strategies, pursuing significant research and development initiatives, and producing impactful clinical findings.

The business prioritized research and development activities in its brain and oncology therapeutic areas in 2022. Its research and development activities primarily include clinical testing of novel product candidates and actions linked to clinical improvements of its existing marketed medications at various phases of development.

Zepzelca research

The company primarily focuses on Zepzelca research and development in its oncology therapeutic area, both now and in the future. This includes using Zepzelca with other therapeutic agents such as Rylaze, Zanidatamab, Vyxeos, and JZP815 and developing new product candidates through external collaborations.

Products and Trials

Along with supporting more investigator-sponsored trials, or ISTs, that are expected to produce more product data, the business has partnered with external parties to conduct research and develop novel early-stage product candidates. In 2022, Jazz Pharmaceuticals initiated a Phase 2 basket trial for Zepzelca in solid tumors, a Phase 3 trial for Epidiolex in EMAS, a Phase 2 trial of suvecaltamide in patients with Parkinson’s disease tremor, etc.

Investment

The company’s R&D expense was around $590 million in 2022, which increased by 17% from the year prior. This amount consisted primarily of costs related to clinical studies and outside services, personnel expenses, milestone expenses, and other research and development costs.

Zanidatamab Collaborations

Jazz Pharmaceuticals collaborated with several other companies and universities for research and development on therapeutic candidates/ medicines while investigating zanidatamab, Jazz’s experimental HER2-targeted bispecific antibody, in various HER2-expressing malignancies. More details are shared below in the section highlighting the company’s collaborations.

Popular Drugs

Jazz Pharmaceuticals is recognized for its diverse portfolio of medications addressing various medical needs in the fields of Neuroscience and Oncology.

Xyrem

Xyrem (sodium oxybate) is a medication used for the treatment of narcolepsy, a condition characterized by excessive daytime sleepiness and cataplexy. It was approved by the FDA in 2018 for the treatment of cataplexy or excessive daytime sleepiness in patients aged 7 to 17 years with narcolepsy, expanding its therapeutic reach. Authorities strictly regulate the drug due to its high potential for abuse and severe side effects, and it is only available through a restricted distribution program.

Epidiolex

Epidiolex, also known as cannabidiol (CBD), is used for treating seizures associated with two rare and severe forms of epilepsy, Lennox-Gastaut syndrome and Dravet syndrome, in patients of two years and older. On June 25, 2018, it became the first FDA-approved drug that contains a purified substance derived from marijuana. Epidiolex has also been approved to treat seizures associated with tuberous sclerosis complex (TSC) in patients one year of age and older.

Rylaze

Rylaze, asparaginase erwinia chrysanthemi (recombinant)-rywn, is used in the treatment of acute lymphoblastic leukemia (ALL) and lymphoblastic lymphoma (LBL). It received initial FDA approval on June 30, 2021, under the Real-Time Oncology Review (RTOR) program. Rylaze is particularly crucial for adult and pediatric patients (one month and older) who have developed hypersensitivity to E. coli-derived asparaginase.

Jazz Pharmaceuticals has submitted an sBLA for an intravenous route of administration for Rylaze and a Marketing Authorisation Application to the European Medicines Agency to expand the drug’s accessibility and application. Rylaze’s ongoing clinical trials and research efforts focus on further exploring its broader patient populations and optimizing its administration methods for those with ALL and LBL.

Erwinaze (asparaginase Erwinia chrysanthemi) is another medication that Jazz Pharma manufactured to treat ALL and LBL. It is derived directly from the bacterium Erwinia chrysanthemi and does not involve recombinant DNA technology like Rylaze. Erwinaze is administered intramuscularly or intravenously and without a specific FDA-approved dosing schedule.

Zepzelca

Zepzelca, or lurbinectedin, is an anti-cancer medication primarily used for the treatment of metastatic small-cell lung cancer (SCLC). The U.S. FDA granted accelerated approval to Zepzelca on June 15, 2020, for patients with metastatic SCLC who have progressed on or after platinum-based chemotherapy. Zepzelca is continuously being evaluated in various clinical settings as a newer therapeutic agent. Following its initial approval, PharmaMar, the company behind Zepzelca, has been actively pursuing additional clinical trials to expand its applications and explore its effectiveness in other types of cancer. Jazz Pharmaceutical uses this trademark of PharmaMar under license.

Zanidatamab

Zanidatamab, also known as ZW25, is a bispecific antibody currently under development by Zymeworks Inc. This therapeutic agent targets HER2, a protein often overexpressed in various cancers.

The FDA has granted Zanidatamab Breakthrough Therapy designation for its application in patients with previously treated HER2 gene-amplified biliary tract cancer (BTC) and two Fast Track designations. The first Fast Track designation is for Zanidatamab as a single agent in refractory BTC, while the second is for its use in combination with standard chemotherapy for first-line treatment of gastroesophageal adenocarcinoma (GEA).

Zanidatamab is involved in multiple international studies for solid tumors expressing HER2, including cancers of the breast, lung, ovaries, and colon.

It also received Orphan Drug designations for treating biliary tract, gastric, and ovarian cancers and from the European Medicines Agency for biliary tract and gastric cancer treatments. Jazz Pharmaceuticals Ltd. and BeiGene Ltd. are developing Zanidatamab under license agreements from Zymeworks.

Other drugs manufactured by the company include:

- Vyxeos

- Xywav (JZP-258)

- Defibrotide sodium

- Sunosi

- Ziconotide

- FazaClo

- FazaClo HD

- Luvox CR

- Prialt

Products Filed for Approval in the US/EU

| Serial No. | Year | Description |

| 1 | 2022 | Jazz Pharmaceuticals announced FDA approval of a supplemental Biologics License Application for Rylaze® (asparaginase erwinia chrysanthemi (recombinant)-rywn) on November 18, 2022. This approval adds a Monday/Wednesday/Friday intramuscular dosing schedule for Rylaze, used in a multi-agent chemotherapeutic regimen for acute lymphoblastic leukemia (ALL) and lymphoblastic lymphoma (LBL) in patients over one month old who are hypersensitive to E. coli-derived asparaginase. |

| 3 | 2020 | The FDA approved Xywav for the treatment of idiopathic hypersomnia in adults. |

Drugs Losing Exclusivity

Jazz Pharmaceuticals has two patents expiring in June and December 2024. To know more and keep track of the patents the company is losing soon, visit this link.

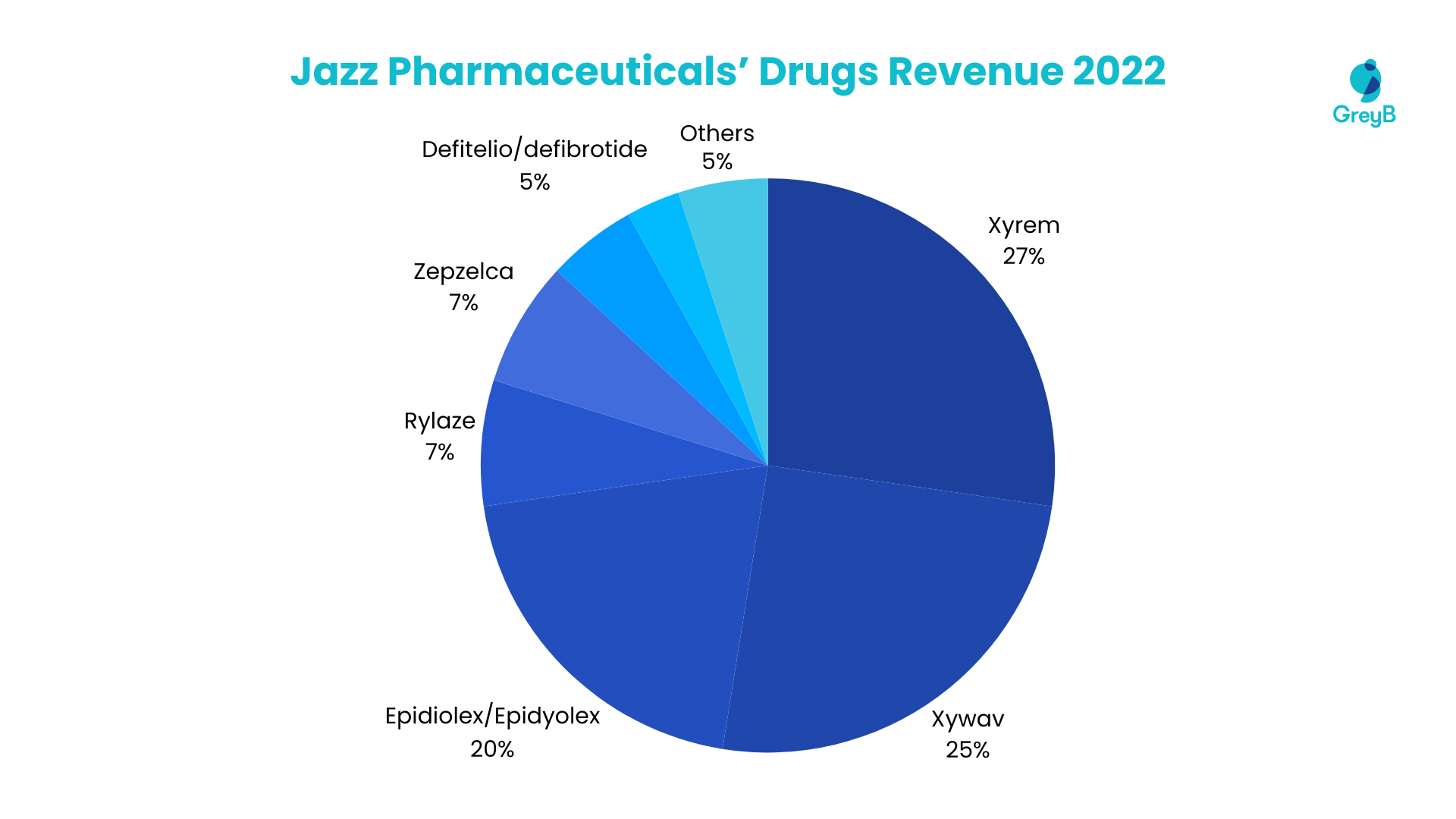

Revenue Contribution from Drugs

In 2022, Jazz Pharmaceuticals’ revenue is significantly driven by key therapeutic agents, with a notable distribution among its top-performing drugs. 27% of the revenue is attributed to Xyrem, followed closely by Xywav at 25%. Epidiolex/Epidyolex contribute 20%, while Rylaze and Zepzelca each hold a crucial 7% share. Defitelio/defibrotide and Vyxeos contribute 5% and 3%, respectively.

The remaining 5% is divided among Sativex, Sunosi, and other drugs in the portfolio. This diverse revenue distribution underscores the significant impact of these leading drugs on Jazz Pharmaceuticals’ financial performance.

Top 9 Medicines and Vaccines Account for 99% of the Total Revenue in 2022

Mergers and Acquisitions

Jazz Pharmaceuticals and SpringWorks Therapeutics, Inc.

The companies signed an asset acquisition and exclusive licensing deal in 2020, under which Jazz purchased SpringWorks’ fatty acid amide hydrolase (“FAAH”) inhibitor development, which included PF-04457845. Jazz first concentrated on developing PF-04457845 for the treatment of post-traumatic stress disorder (“PTSD”) and its accompanying symptoms. Under the terms of the deal, SpringWorks assigned and solely licensed all assets relevant to its FAAH inhibitor development, including SpringWorks’ patented FAAH inhibitor PF-04457845 and its license agreement with Pfizer, Inc.

Acquisition of GW Pharmaceuticals Plc

Jazz Pharmaceuticals announced the completion of its $7.2 billion cash-and-stock acquisition of GW Pharmaceuticals Plc in 2021 while expanding its neuroscience division by adding a cannabis-based epilepsy medication. Jazz expanded beyond sleep disorders and cancer therapies by bolstering its neuroscience unit. Jazz’s extensive portfolio now includes clinical-stage research projects addressing critical unmet patient needs in neuroscience and oncology, including sleep disorders, movement disorders, psychiatry, hematology, and solid malignancies.

Collaborations

Jazz Pharmaceuticals and Werewolf Therapeutics, Inc.

In 2022, Jazz Pharmaceuticals and Werewolf Therapeutics, Inc. signed a licensing partnership agreement under which Jazz bought exclusive global development and commercialization rights to Werewolf’s investigational WTX-613, a differentiated, conditionally-activated interferon alpha (IFNα) INDUKINE™ molecule.

The pharmaceutical giant submitted an Investigational New Drug (IND) application to the United States Food and Drug Administration (FDA) in 2023 for WTX-613. It is the company’s first immuno-oncology program and an addition to Jazz’s substantial oncology pipeline.

Jazz Pharmaceuticals and Zymeworks Inc.

The company announced in December 2022 that it has opted to continue its exclusive development and commercialization rights with Zymeworks Inc. for zanidatamab in the U.S., Europe, Japan, and other key markets. Both companies already signed an agreement for this in October 2022. Zanidatamab is a bispecific antibody and is being developed for multiple HER2-expressing solid tumors.

This decision was based on positive clinical data from the HERIZON-BTC-01 trial for HER2-amplified biliary tract cancers, where zanidatamab showed a notable objective response rate and safety profile. Jazz’s payment to Zymeworks includes a one-time $325 million fee, with potential additional regulatory and commercial milestone payments totaling up to $1.76 billion, plus tiered royalties on net sales.

Jazz Pharmaceuticals and The University of Texas

Jazz Pharmaceuticals signed a five-year strategic research collaboration agreement with The University of Texas MD Anderson Cancer Center to evaluate zanidatamab in 2023. This effort builds upon a strategic collaboration between both parties focused on hematologic malignancies.

MD Anderson’s translational medicine and clinical research expertise are combined with Jazz’s growing oncology drug development capacities to investigate the potential of zanidatamab as monotherapy and in combination with additional therapies for patients with various tumor types and stages. Jazz and MD Anderson formed a joint steering committee to monitor the relationship, which will fund several studies throughout its five-year period. Research under the collaboration is expected to begin in late 2023 or early 2024.

Jazz Pharmaceuticals and Autifony Therapeutics Limited

The company announced a global licensing agreement with Autifony Therapeutics Limited On November 14, 2023, to develop drug candidates targeting two ion channels associated with neurological disorders. Autifony will lead drug discovery and preclinical development, while Jazz will manage clinical development, manufacturing, regulation, and commercialization.

The agreement includes an upfront payment from Jazz to Autifony, with potential development, regulatory, and commercial milestone payments amounting to approximately $770.5 million. Autifony is also eligible for royalties on future net sales of these drug candidates.

Be the first one to get access to comprehensive industry reports like this one and stay informed about the market and competitors’ moves by filling out the form below.

4. Novavax

Novavax Pharmaceuticals, a leader in biotech and biopharma, has made significant strides in 2023, particularly in vaccine development. A notable achievement for the company is the FDA’s amendment of the emergency use authorization (EUA) for its COVID-19 vaccine, Adjuvanted, for individuals 12 years and older, including the 2023-2024 formula. This updated vaccine targets the omicron variant lineage XBB.1.5, offering better protection against the severe consequences of COVID-19.

Novavax reported revenue of $81 million for the first quarter of 2023, despite a drop from the previous year due to seasonal demand patterns for its COVID-19 vaccine. It has also implemented a cost reduction plan, reducing the global workforce by about 25% and lowering annual R&D and SG&A expenses.

Research and Development Priorities and Strategies

The company focuses its research and development efforts on vaccines, an area in which it believes it has specific expertise and a viable technology.

R&D Investment

In 2022, Novavax’s R&D expenses were around $1.23 billion, which decreased from the previous year’s R&D expense, which was $2.5 billion. The decline was mostly due to a drop in coronavirus vaccine development activities, including NVX-CoV2373, an Omicron BA.1 vaccine candidate, bivalent formulations, and CIC. For the third quarter of 2023, the company invested $106 million on R&D initiatives, compared to $304 million in the same period in 2022.

Ongoing Trials

Immunogenicity and safety findings from the SIIPL and India Council of Medical Research Phase 2/3 trial were published in The Lancet in January 2023 and on the medRxiv preprint server for health sciences. This Phase 2/3 trial included a pediatric group in addition to adults. The experiment was an observer-blind, randomized, controlled study with 920 children aged 2 to 17 years old, and it was shown to be well-tolerated and immunogenic.

Vaccine Pipeline

The company has been actively advancing its vaccine pipeline. It released topline results from a Phase 2 trial for three respiratory vaccine candidates:

- A COVID-Influenza Combination vaccine

- A stand-alone influenza vaccine

- A high-dose COVID vaccine

All three vaccines demonstrated favorable safety profiles and reactogenicity comparable to authorized vaccine comparators. These developments position the company as a key player in respiratory diseases through innovative vaccination solutions.

Novavax secured a three-year contract with the Bill and Melinda Gates Medical Research Institute in 2023 to supply its adjuvant for preclinical vaccine research.

Popular Drugs

Novavax is developing innovative vaccines to address global infectious disease challenges. Some of the notable candidates in their pipeline include:

Nuvaxovid (NVX-CoV2373)

It is a protein subunit vaccine against COVID-19. It received Emergency Use Authorization (EUA) in the US for adults in July 2022 and adolescents aged 12-17 in July 2023. It has earned full approval in several countries around the globe.

Novavax recently submitted an application to the FDA for a booster dose of NVX-CoV2373 targeting the Omicron variant. This comes after promising Phase 3 trial results, demonstrating the booster’s safety and efficacy against Omicron BA.1 and BA.2 sub-variants. Clinical trials are ongoing to evaluate its effectiveness against emerging variants and assess its potential use in younger populations.

Adjuvanted (NVX-CoV2601)

Adjuvanted (NVX-CoV2601), also known as Nuvaxovid™ XBB.1.5 dispersion for injection or Covovax XBB.1.5, is an updated version of Novavax’s original COVID-19 vaccine. It earned full approval in the European Union in October 2023 and received EUA in Canada in December 2023. The company is pursuing further regulatory approvals worldwide, including in the US.

NVX-CoV2601 utilizes the same recombinant nanoparticle technology of NVX-CoV2373, adding its Matrix-M™ adjuvant, enhancing the immune response against the highly transmissible XBB.1.5 variant. Recent data from adult clinical trials revealed potent neutralizing antibody responses against XBB.1.5 and other Omicron sub-variants, showcasing its potential for broader protection.

The company is investigating the efficacy and safety of NVX-CoV2601 in younger populations, with ongoing Phase 2/3 trials evaluating its effectiveness in adolescents aged 12-17 years.

Influenza (qNIV) vaccine

The influenza (qNIV) vaccine, also known as NanoFlu or Quad-NIV, is a quadrivalent influenza vaccine candidate developed by Novavax. While still in the pipeline, it has garnered significant attention for its innovative nanoparticle technology and promising clinical trial results. The qNIV has not yet received regulatory approval from any major authority like the FDA or EMA.

This investigational vaccine has completed a successful Phase 3 clinical trial in the US for four influenza strains. The preliminary data suggests qNIV may offer broader protection against circulating influenza viruses compared to traditional vaccines.

COVID-influenza combination (CIC) vaccine

The COVID-influenza combination (CIC) vaccine, also known as Nuvaxovid™/NanoFlu™ Combination or Covovax/Quad-NIV Combination, is a potential one-shot wonder aiming to tackle both COVID-19 and influenza in a single dose. Developed by Novavax, it combines its established NVX-CoV2373 (Nuvaxovid) COVID-19 vaccine with its qNIV (NanoFlu) quadrivalent influenza vaccine.

The CIC vaccine hasn’t garnered any regulatory approvals. The company has completed a Phase 2 clinical trial, demonstrating preliminary safety and robust immune responses against SARS-CoV-2 and influenza strains targeted in qNIV.

Novavax applied for regulatory approval from the European Medicines Agency (EMA) in December 2023.

Malaria (R21)

The R21 vaccine, also known as Novavax Malaria Vaccine or R21/Matrix-M, is to fight against this deadly mosquito-borne disease. While it hasn’t secured FDA approval yet, it recently reached a major milestone – WHO prequalification in December 2023.

R21 boasts impressive efficacy, demonstrating 77% protection against symptomatic malaria for 12 months in Phase IIb trials. This surpasses the WHO’s target of 75% efficacy for a malaria vaccine, marking a significant breakthrough. A Phase 3 trial, with over 4,000 participants, is ongoing in Africa.

The latest development in R21’s journey is submitting a Phase 3 clinical trial application to the FDA in December 2023.

Products Filed for Approval in the US/EU

| Serial No. | Year | Description |

| 1 | 2023 | Novavax (Nuvaxovid™ or NVX-CoV2373) protein-based COVID-19 vaccine, with Matrix-M™ adjuvant, granted full Marketing Authorization in the EU for individuals aged 12 and older as a primary series and adults aged 18 and older as a booster dose. |

| 2 | 2023 | Novavax’s COVID-19 vaccine (NVX-CoV2601) receives Emergency Use Authorization (EUA) from the FDA for the 2023–24 formula, addressing current variants. It is approved for ages 12 and above. |

Revenue Contribution from Drugs

- Since its inception in 1987, the company’s expenses have outpaced its revenue, and the accumulated deficit as of December 31, 2022, was $4.3 billion. Its earnings and expenses vary significantly from one period to the next.

- Net losses were $0.7 billion in 2022, $1.7 billion in 2021, and $0.4 billion in 2020 over the previous three fiscal years. Novavax is heavily reliant on the commercial success of NVX-CoV2373, its sole commercial product and source of revenue.

- In 2021, the company had a revenue of $1.98 billion, which increased from $1.14 billion in 2021. In 2022, the product sales of NVX-CoV2373 were $1.55 billion, which had a geographical distribution in North America of 12.50%, Europe (52.96%), and Rest of the World (34.53%).

Mergers and Acquisitions

Purchase of Praha Vaccines

Novavax, Inc. purchased Praha Vaccines in 2020 for about $167 million. The transaction included a biologics production facility in Bohumil, Czech Republic, and related assets. According to the acquisition, Novavax had an annual capacity of more than one billion doses of antigen for NVX-CoV2373 beginning in 2021. The acquisition comprised the 150,000-square-foot state-of-the-art vaccine and biologics manufacturing facility, adjacent support buildings, existing workers, and all connected and essential infrastructure.

“This acquisition provides the vital assets required to produce more than 1 billion doses per year. In parallel with ramping up production at Bohumil, we will continue efforts to expand antigen capacity in the [United States] and Asia and increase production of Matrix-M to match antigen capacity at multiple sites globally.”

– Stanley C. Erck, President and CEO of Novavax

Collaborations

Extended Partnership with the United States Government

The company announced an alteration to its agreement with the United States Department of Health and Human Services (HHS) in partnership with the Department of Defense. The agreement called for up to 1.5 million doses of the Novavax COVID-19 Vaccine, Adjuvanted (NVX-CoV2373), to be delivered. This partnership will keep Novavax’s vaccine available to the public in the United States while supporting the development of reduced dose vials, strain selection per Food and Drug Administration (FDA) recommendations, and a seamless transition to commercial sales.

Novavax, Inc. and Siegfried Extended Partnership

Novavax and Siegfried extended their partnership till the end of 2023 for the aseptic fill and finish of Novavax’s protein-based coronavirus vaccine, Nuvaxovid, at Siegfried’s production location in Hameln, Germany. The initial production and supply deal began in 2021 and was to last until the end of 2022, which has extended until the end of 2023.

Novavax, Inc. and SK Bioscience

The company has expanded its collaboration with SK Bioscience with agreements for manufacturing a Novavax COVID-19 vaccine variant targeting the Omicron BA.5 subvariant and the production of the vaccine in prefilled syringes. The technology transfer agreement enables SK Bioscience to manufacture the drug substance for the COVID-19 variants, including Omicron BA.5.

The agreement includes manufacturing and supplying the Novavax COVID-19 vaccine in prefilled syringes. SK Bioscience already manufactures the drug substance for the vaccine. The partnership also includes a collaboration and licensing agreement for the exclusive commercialization of the Novavax COVID-19 vaccine in South Korea and joint commercialization efforts in Vietnam and Thailand.

Novavax, Inc. and Serum Institute of India Pvt. Ltd.

Novavax collaborated with Serum Institute of India Pvt. Ltd. (SII) and announced that the Drugs Controller General of India (DCGI) approved emergency use permission (EUA) for Novavax’s protein-based COVID-19 vaccine in India for teenagers aged 12 to 18 years. The vaccine, also known as NVX-CoV2373, was developed and marketed in India by SII under Covovax™ and was the country’s first protein-based vaccination approved for use in this age range.

5. Vir Biotechnology

Vir Biotechnology has made advances in chronic viral infection treatment. One of its most notable achievements includes promising results from the ongoing Phase 2 SOLSTICE and MARCH trials.

These trials are evaluating the impact of VIR-3434, an investigational monoclonal antibody, and VIR-2218, an investigational small interfering ribonucleic acid (siRNA), in patients with chronic hepatitis delta (CHD) and chronic hepatitis B (CHB).

The company received a $10 million grant from the Bill & Melinda Gates Foundation to support the Phase 1 development of VIR-1388, an investigational HIV T cell vaccine. Based on the human cytomegalovirus (HCMV) vector platform, this novel T cell vaccine generates T cells that recognize different HIV epitopes to create a safe and effective HIV vaccine.

Research and Development Priorities and Strategies

Vir’s integrated, end-to-end approach maximizes data-driven insights while leveraging an embedded functional data strategy to accelerate innovation from research to product commercialization.

Partnership Agreements

The Company has entered into ASC 606-compliant license and partnership agreements. These contracts may include promised products or services such as licensing grants, research and development services, and joint research and development committee participation.

R&D Expenses

Its research and development expenses have primarily been associated with identifying product candidates and preclinical and clinical development. The company has acquired third-party rights to develop and commercialize novel product candidates. Upfront and R&D milestone payments paid with acquired license or product rights are expensed when incurred.

The R&D expenses of Vir Biotechnology were around $0.47 billion in 2022, which increased from the previous year’s R&D expense which was $0.44 billion. The increase in the R&D expenses was due to an increase in clinical cost, which was primarily attributable to activities related to VIR-2482, VIR-2218, and VIR-3434, a rise in the contract manufacturing expense, and other R&D expenses.

In the 2021 agreement with GSK, the company reported additional research and development costs of $2.3 million by December 31, 2022, and $0.5 million for the year ending December 31, 2021.

BARDA Agreement

Vir has engaged in a separate transaction for an advanced research agreement with the Biomedical Advanced Research and Development Authority in September 2022. The Company received up to $1 billion under the BARDA Agreement to accelerate the development of a broad portfolio of novel solutions to address influenza and perhaps other infectious disease concerns.

Popular Drugs

Vir Biotechnology is developing a diverse portfolio of product candidates targeting infectious diseases and other serious conditions. Some of the notable drugs in their pipeline include:

VIR-7831 (GSK4182136)

This dual-action monoclonal antibody targets SARS-CoV-2, the virus responsible for COVID-19. The drug works by blocking the virus’s entry into healthy cells and clearing infected cells.

The Phase 3 portion of the COMET-ICE trial, which assessed the safety and efficacy of a single intravenous infusion of VIR-7831 in non-hospitalized participants, showed promising results. In an interim analysis including 291 patients in the treatment arm, VIR-7831 demonstrated an 85% reduction in hospitalization or death compared to placebo, leading to a recommendation by the Independent Data Monitoring Committee to stop the trial for enrolment due to profound efficacy.

The European Medicines Agency (EMA) started reviewing VIR-7831 for the early treatment of COVID-19 in April 2021. This review aims to provide EU-wide recommendations for early medicine use before any formal Marketing Authorisation Application. The Australian Therapeutic Goods Administration (TGA) has also granted VIR-7831 a provisional determination, marking it as the first anti-SARS-CoV-2 monoclonal antibody to receive this designation. This status accelerates the registration of promising new medicines with preliminary clinical data.

VIR-7831 is also part of several other clinical trials, including the BLAZE-4 trial, which evaluates it in combination with other neutralizing antibodies for low-risk adults with mild to moderate COVID-19, and the AGILE trial, which assesses it in adults with mild to moderate COVID-19.

VIR 2218

VIR-2218 is an investigational subcutaneously administered small interfering ribonucleic acid (siRNA) developed by Vir Biotechnology to treat chronic hepatitis B virus (HBV) infection. It incorporates Enhanced Stabilization Chemistry Plus (ESC+) technology to enhance stability and minimize off-target activity, potentially resulting in an improved hepatic safety profile and increased therapeutic index.

The safety, tolerability, and efficacy of various combinations of VIR-2218, selgantolimod, nivolumab, and TAF in adults with chronic HBV is evaluated in the multi-center, open-label Phase 2 clinical trial. The Phase 2 MARCH trial of VIR-2218, in combination with VIR-3434, an investigational HBV-neutralizing monoclonal antibody, is particularly significant. Preliminary 48-week post-treatment data from Part A of the MARCH trial demonstrated a reduction in HBsAg levels and informed the protocol for Part B, which evaluates whether the combination can result in a functional cure for chronic HBV infection.

VIR-2218 has been combined with VIR-3434 in the MARCH trial to achieve a functional cure or life-long control of HBV without life-long therapy.

The other combinations in which this drug is used are:

Hepatitis B:

- VIR-2218 + PEG-IFN-α

- VIR-3434 ± VIR-2218 ± PEG-IFN-α1

- VIR-2218 + BRII-179

- VIR-2218 + TLR82 + PD-13

Sotrovimab

Sotrovimab, or Xevudy, is a humanized monoclonal antibody designed to fight COVID-19. In October 2023, the FDA updated Sotrovimab’s EUA, restricting its use to regions where the BA.2 sub-variant of Omicron remains below 50%.

Studies are ongoing to evaluate Sotrovimab’s efficacy against emerging variants and explore potential combinations with other drugs for enhanced effectiveness. Researchers are also investigating Sotrovimab’s use in preventing COVID-19 in immunocompromised individuals and as a post-exposure prophylaxis option.

The therapeutic is administered as a single intravenous infusion. It works by attaching to the SARS-CoV-2 virus, preventing it from entering and infecting cells.

VIR-7229 is another virus-evasive drug that VIR biotechnology is developing. It is still in preclinical stage.

Other drugs that the company is working on include:

- VIR-2482 and VIR-2981 for Influenza A and Influenza A+B.

- VIR-1388 for HIV.

- VIR-8190 for RSV/MPV.

- VIR-1949 for Pre-cancerous HPV lesions.

Products Filed for Approval in the US/EU

| Serial No. | Year | Description |

| 1 | 2021 | GSK and Vir Biotechnology seek FDA Emergency Use Authorization for VIR-7831 (GSK4182136)W, a dual-action SARS-CoV-2 monoclonal antibody as targeting treatment of mild-to-moderate COVID-19 in at-risk adults and adolescents in the US. |

Collaborations

VIR And GSK Agreement

Vir Biotechnology announced amendments to its 2020 research collaboration agreement with GSK on February 13, 2023. This revision allows Vir to pursue the discovery, development, and advancement of next-generation solutions for COVID-19 and potential future coronavirus outbreaks independently or with new partners. However, Vir and GSK will still collaborate to ensure global access to sotrovimab, where authorized, and develop new treatments for influenza and other respiratory diseases.

Vir plans to independently develop a promising portfolio of next-generation coronavirus solutions, leveraging their infectious disease expertise.

The original collaboration between GSK and Vir, initiated in April 2020, was dedicated to the R&D of solutions for coronaviruses, including SARS-CoV-2. This partnership leveraged Vir’s monoclonal antibody platform technology to expedite the development of new antiviral antibodies. In 2021, the collaboration expanded to include R&D for influenza and other respiratory viruses.

VIR And Generation Bio Agreement

In 2020, Vir Biotechnology and Generation Bio entered into a joint research agreement to investigate the possibility of using Generation Bio’s non-viral gene therapy platform to increase the impact and reach of Vir’s present or future human monoclonal antibodies (mAB) against SARS-CoV-2. The firms felt that Generation Bio’s technology and Vir’s potent neutralizing antibodies would provide effective, long-term protection against SARS-CoV-2.

VIR Biotechnolog And Gilead Sciences, Inc.

The biotech company signed a clinical collaboration agreement with Gilead Sciences in 2021 to study innovative treatment combination tactics and find a functional cure for chronic hepatitis B (HBV). The firms intended to launch a Phase 2 trial investigating combination therapy for both treatment-experienced and treatment-naive HBV patients. Both businesses kept full rights to their product candidates and discussed the potential next steps for future combination studies based on the Phase 2 trial results.

6. BioMarin Pharmaceutical

BioMarin Pharmaceutical Inc. specializes in developing and commercializing therapies targeting genetic diseases. One of its breakthroughs is ROCTAVIAN (valoctocogene roxaparvovec), a gene therapy for treating adults with severe Hemophilia A. This treatment has garnered attention due to its potential to significantly reduce the mean annualized bleed rate by up to 80% and the need for Factor VIII therapy by 94%.

It is expected to play a pivotal role in the company’s growth, with BioMarin projecting revenues to approach $3 billion by 2024.

The company is also exploring VOXZOGO’s potential in treating hypochondroplasia and plans to initiate clinical programs for idiopathic and genetic short-stature conditions in 2024.

BioMarin has cash, cash equivalents, and investments totaling $1.64 billion in September 2022. The company’s revenue in Q3 of 2022 was $505.3 million, marking a 24% year-over-year growth. This financial robustness, coupled with a series of regulatory approvals for products like VIMZIM, NAGLAZYME, PALYNZIQ, KUVAN, VOXZOGO, BRINEURA, and ALDURAZYME, positions BioMarin as a leader in the biotech and biopharma industry.

Research and Development Priorities and Strategies

R&D Expenses

BioMarin Pharmaceutical’s annual R&D expenses for 2022 were $0.65 billion, a 3.31% increase from 2021. The company’s annual R&D spending for 2021 was $0.629 billion, a 0.11% increase over 2020.

The R&D expense grew in 2022, primarily due to increased spending in research and early development programs owing to increasing expenses associated with producing clinical products, Investigational New Drug (IND)-enabling studies for expected IND filings and pre-clinical activities. VOXZOGO-related expenses are decreased as manufacturing costs are capitalized and regulatory activity costs are reduced.

Innovative Medicines

The company provides product and financial support for external research in rare diseases and genetic disorders to meet its objective of scientific innovation and work on unmet medical needs. Its substantial research and development capabilities give rise to multiple novel commercial medicines for patients with rare genetic illnesses. BioMarin also entered into various collaborations and license agreements with technology firms and academic research institutions to develop new products further from its research and development activities.

Future Growth

BioMarin specializes in developing and commercializing therapies for rare genetic disorders. Their diverse pipeline includes commercial, clinical, and pre-clinical candidates, focusing on addressing significant unmet medical needs and offering substantial benefits over existing treatment options.

The firm generated approximately $2.1 billion in total revenue in 2022, including a significant contribution from the ongoing rollout of VOXZOGO, and continued to make significant progress in its product development pipeline.

The company’s future growth and development partly depend on its capacity to successfully generate new goods from R&D initiatives.

Popular Drugs

Popular drugs from BioMarin Pharmaceutical include

ROCTAVIAN™

ROCTAVIAN™, popular as valoctocogene roxaparvovec-rvox, is a pioneering gene therapy developed by BioMarin for severe hemophilia A in adults. This innovative therapy is indicated for patients with congenital Factor VIII (FVIII) deficiency with FVIII activity less than 1 IU/dL and who do not have antibodies to adeno-associated virus serotype 5 (AAV5).

It received FDA approval on June 29, 2023, as the first gene therapy for treating severe hemophilia A in adults. The production is managed at BioMarin’s facility in Novato, California, ensuring the ability to meet commercial demand throughout the product’s lifecycle. ROCTAVIAN was planned to be made commercially available in late 2023 in the U.S., with hemophilia treatment centers beginning to screen eligible individuals.

VOXZOGO™ (vosoritide)

VOXZOGO® (vosoritide) is a revolutionary treatment developed by BioMarin for children with achondroplasia, a genetic disorder affecting bone growth. It is the first and only FDA-approved therapy to increase linear growth in children with this condition with open growth plates (epiphyses). The treatment is administered daily as a subcutaneous injection and is a C-type natriuretic peptide (CNP) analog.

VOXZOGO works by stimulating the CNP pathway, which helps in bone growth, addressing the underlying cause of achondroplasia. It was granted marketing authorization in the European Union on August 26, 2021.

Brineura (cerliponase alfa)

Brineura, also known as cerliponase alfa, is an enzyme replacement therapy developed for treating a specific form of Batten disease known as late infantile neuronal ceroid lipofuscinosis type 2 (CLN2) or tripeptidyl peptidase-1 (TPP1) deficiency. This rare, inherited disorder primarily affects the nervous system, with symptoms beginning between ages 2 and 4, including language delay, recurrent seizures, and difficulty coordinating movements.

The European Commission granted marketing authorization for Brineura, valid throughout the European Union, on May 30, 2017. In the United States, the FDA approved Brineura on April 27, 2017. It was the first FDA-approved treatment to slow the loss of walking ability in symptomatic pediatric patients of three years and older with CLN2.

Other popular products developed by BioMarin Pharmaceutical are:

- Naglazyme (galsulfase)

- Palynziq

- Vimizim

- Kuvan

- Aldurazyme

Products Filed for Approval in the US/EU

| Serial No. | Year | Description |

| 2023 | The FDA has granted approval for the supplemental New Drug Application (sNDA) of VOXZOGO® (vosoritide) to enhance linear growth in pediatric patients diagnosed with achondroplasia and open epiphyses (growth plates). VOXZOGO was designated for use in children aged five and above. With this extended approval, it now encompasses children of all age groups with open-growth plates. | |

| 2023 | BioMarin Pharmaceutical Inc. has received FDA approval for ROCTAVIAN™ (valoctocogene roxaparvovec-rvox), a gene therapy designed to treat severe Hemophilia A in adults in the US. |

Drugs Losing Exclusivity

- BRINEURA – BRINEURA is set to lose its Orphan Drug Exclusivity in the United States by 2024, followed by the expiration of Biologic Exclusivity in 2029 and the conclusion of European Union Orphan Drug Exclusivity in 2027.

- PALYNZIQ – BioMarin anticipates the loss of orphan drug exclusivity in 2025, followed by the expiration of Biologic Exclusivity in 2030 and the European Union’s orphan drug exclusivity concluding in 2029.

- ROCTAVIAN – The drug will lose its exclusivity as the European Union’s orphan drug in 2032.

- VIMIZIM – Its biologic exclusivity is scheduled to expire in 2026, with the European Union’s orphan drug exclusivity concluding in 2024.

- VOXZOGO – The company anticipates the loss of exclusivity of VOXZOGO as an orphan drug in 2028, followed by the expiration of the European Union’s orphan drug exclusivity in 2031.

Read more about BioMarin Pharmaceutical Patents expiring soon.

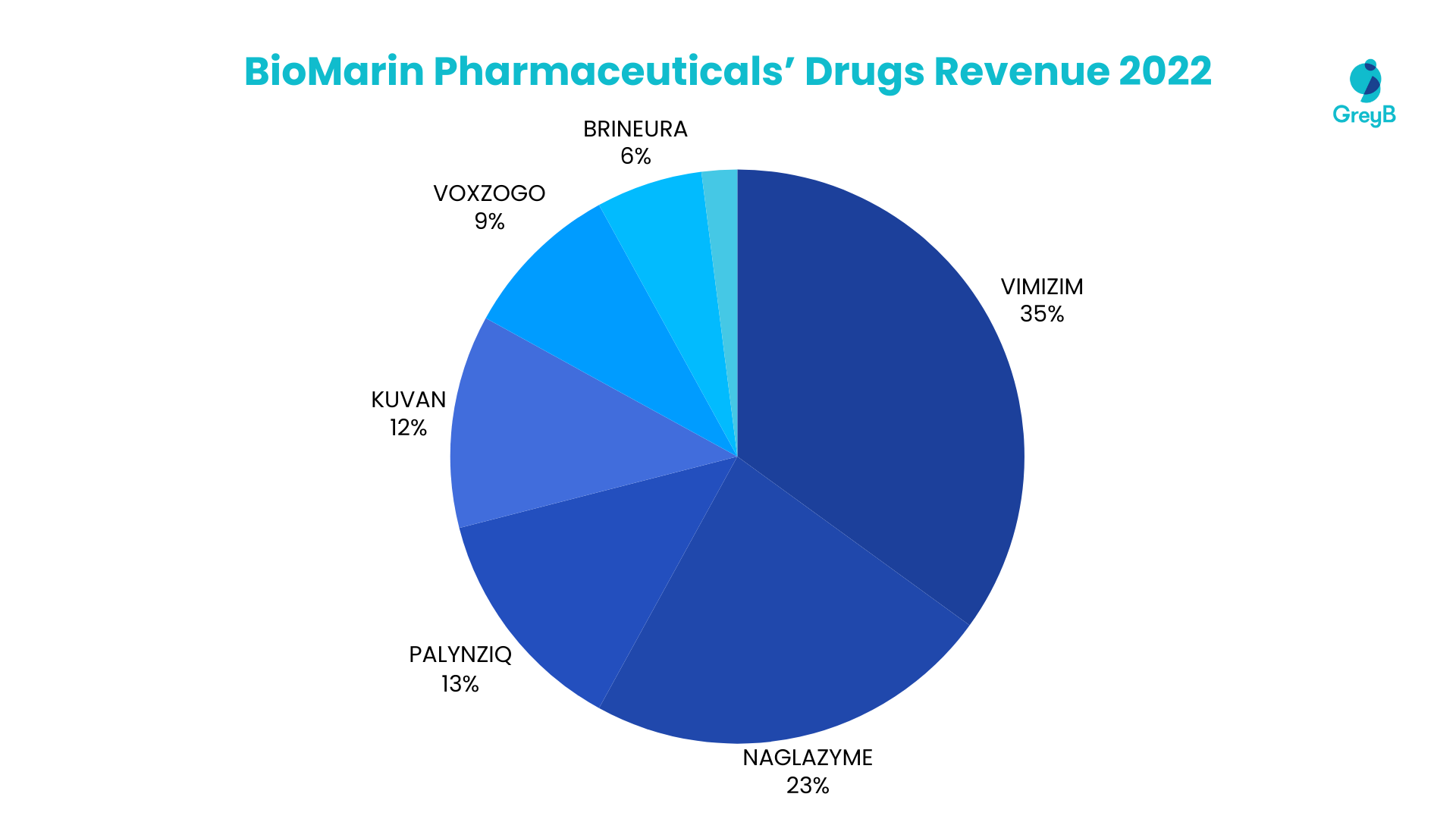

Revenue Contribution from Drugs

BioMarin Pharmaceutical’s 2022 revenue is driven by essential therapeutic drugs, with a notable distribution among its portfolios. VIMIZIM takes the lead, contributing 35% of the total revenue, followed closely by NAGLAZYME at 23%. PALYNZIQ and KUVAN contribute 13% and 12%, respectively, among the significant contributors. VOXZOGO and BRINEURA follow suit, representing 9% and 6% of the revenue, respectively. The remaining 2% is attributed to other products within BioMarin Pharmaceutical’s diverse portfolio.

Top 6 Medicines and Vaccines Account for 98% of the Total Revenue in 2022

Collaborations

BioMarin Pharmaceutical and Deep Genomics

The company announced a preclinical collaboration with Deep Genomics in 2020 to develop oligonucleotide therapeutic candidates in four uncommon disease indications with significant unmet needs using Deep Genomics’ artificial intelligence drug discovery platform (The AI Workbench).

Deep Genomics granted BioMarin an exclusive option to acquire Deep Genomics’ rights to each program for development and commercialization. Deep Genomics used its AI Workbench to find and validate target mechanisms and lead candidates in the cooperation, while BioMarin has to progress them into preclinical and clinical development.

BioMarin Pharmaceutical and The Allen Institute

BioMarin Pharmaceutical and the Allen Institute partnered in 2021 to explore innovative gene therapies for rare genetic illnesses of the central nervous system using technology pioneered at the Allen Institute. The company was granted an exclusive license to each program for R&D and commercialization. The scientific research community has learned that many central nervous system illnesses impact specific brain circuits or cell types rather than the overall brain.

BioMarin and Skyline Therapeutics

The biotech giant formed a strategic partnership with Skyline Therapeutics in 2021 to find, develop, and commercialize Adeno-associated virus (AAV) gene treatments for genetic cardiovascular disorders. Based on Skyline Therapeutics’ patented vector engineering, design expertise, and manufacturing capability, the integrated AAV gene therapy platform was utilized to explore new gene therapies. The focus was on hereditary dilated cardiomyopathies (DCM).

MiNA Therapeutics and BioMarin Pharmaceutical

In 2023, MiNA Therapeutics and BioMarin confirmed a multi-target research cooperation and option license deal. The collaboration enabled the identification, potential development, and marketing of RNAa therapeutic options for various uncommon genetic illnesses.

Under the terms of the agreement, BioMarin will use MiNA Therapeutics’ patented RNAa algorithm and technology platform to find and analyze RNAa compounds targeting a variety of genetic illnesses that now have no or few therapeutic options.

BioMarin And GKV-Spitzenverband

BioMarin announced an agreement with the German National Association of Statutory Health Insurance Funds (GKV-SV) regarding the reimbursement for ROCTAVIAN® (valoctocogene roxaparvovec-rvox), a gene therapy for severe hemophilia A. It marks the first time a gene therapy for hemophilia has received an agreed federal price in Germany.

ROCTAVIAN, administered as a one-time intravenous infusion, is priced at €28,933.53 per vial, translating to around $900,000 per patient, considering average patient weight and vial requirements, along with expected rebates and discounts.

This agreement, crucial for around 2,000 adults with severe hemophilia A in Germany, represents a significant advancement for the hemophilia community. Furthermore, BioMarin and GKV-SV have established an outcome-based prospective cohort model, allowing future reimbursement adjustments based on real-world patient data. Two patients in Germany had received ROCTAVIAN commercially by the end of 2023, with 60 more being eligible. Concurrently, final price negotiations with the Italian Medicines Agency are also in progress and expected to conclude by the end of 2023.

7. Amgen Inc.

Amgen operates worldwide with its expanded reach to around 100 countries and a broad and diverse product portfolio. It focuses on critical therapeutic areas, including oncology, cardiovascular disease, bone health, neuroscience, nephrology, and inflammation. This focus is exemplified by its cutting-edge science in biologics, where it has developed novel drugs and biosimilars.

The company has shown substantial growth and financial health, with a 4% increase in total revenues and a 6% rise in earnings per share in Q3 2023, fueled by an 11% global volume growth. This performance is anchored by key products like Repatha, EVENITY, and Tezspire, alongside strategic acquisitions such as Horizon Therapeutics and ChemoCentryx, which have diversified Amgen’s portfolio, especially in rare diseases.

Amgen focuses its efforts on developing solutions and drugs for a range of severe illnesses across six therapeutic areas, including Oncology/Hematology, Cardiovascular Disease, Inflammation, Bone Health, Nephrology, and Neuroscience.

Amgen’s medicines typically target diseases with limited treatment options or provide alternatives to existing treatments, emphasizing their commitment to unlocking the potential of biology for patients suffering from severe health conditions in these areas.

Research and Development Priorities and Strategies

New Biomanufacturing Facility

The company invested $4.4 Billion in R&D in 2022. Amgen’s R&D priorities and strategies are centered around continuous innovation and addressing the demand for medicines treating severe illnesses like cancer and heart disease. Its biomanufacturing facility in Holly Springs, North Carolina, set to be operational by 2025, exemplifies this commitment.

This facility, aimed at maximizing efficiency and meeting high environmental standards, signifies Amgen’s dedication to advanced biological manufacturing and sustainable practices. The company also focuses on diverse talent recruitment and community engagement through the Amgen Foundation and its educational initiatives.

Pipeline

The company’s pipeline includes potential first-in-class oncology assets and innovative therapies like maridebart cafraglutide in obesity, signaling a trajectory of continued growth and market leadership.

One of the most significant developments for Amgen is the FDA’s priority review of tarlatamab for small cell lung cancer (SCLC), a potentially groundbreaking treatment in their pipeline. The successful development and approval of tarlatamab could significantly enhance Amgen’s oncology portfolio, reflecting positively on its research capabilities and strategic focus.

Transformative Medicines

Its R&D strategy focuses on developing transformative medicines across inflammation, oncology, and general medicine, with an emphasis on first-in-class and best-in-class therapeutics. Their innovative mid- and late-stage portfolio, which includes promising programs like AMG 451 for atopic dermatitis and efavaleukin alfa for autoimmune diseases, demonstrates the company’s commitment to addressing diseases with significant patient needs using state-of-the-art biotechnology.

The company leadership in the inflammation therapeutic area is highlighted by Otezla (apremilast), the first and only oral treatment for all severities of plaque psoriasis, and TEZSPIRE (tezepelumab-ekko), the first and only biologic for severe asthma without phenotype or biomarker limitation in the label.