When Nick, a legal counsel representing a major Non-Practicing Entity (NPE) in the United States, approached us, his goal was to acquire 200 patents from a portfolio of 1000 within a strict two-month timeframe. It became evident that conventional manual methods would fall short of meeting this challenging deadline.

To provide some context, it meant analyzing around 22 patents per working day, with the added challenge of focusing on specific target companies. To tackle this, we developed a strategy to speed up the identification of high-value patents while also ensuring we didn’t miss any potentially valuable patents. In addition, we were able to create a shortlist of patents having multiple products infringing on them by utilizing the often-overlooked concept of patent marking.

Generic Parameters for Shortlisting High Monetization Value Patents

This preliminary step aimed to label patents with the potential for substantial monetization, setting the stage for subsequent manual assessments. [You can choose to skip the generic methods and directly go to the USP of this case – The role of patent markings in shortlisting high-value patents]

Step I – Technology Wise Classification

The set of 1000 patents encompassed various technology clusters, including Geolocation, Versatile Video Coding, Broadband, and more. Our analysis revealed that Optical Fiber technology dominated, constituting approximately 60% of the patents (~600). Consequently, we began our evaluation with this technology cluster.

We executed the following steps for each technology cluster chosen (we opted for the top four with significant market potential).

Step II – Sorting by Claim Length

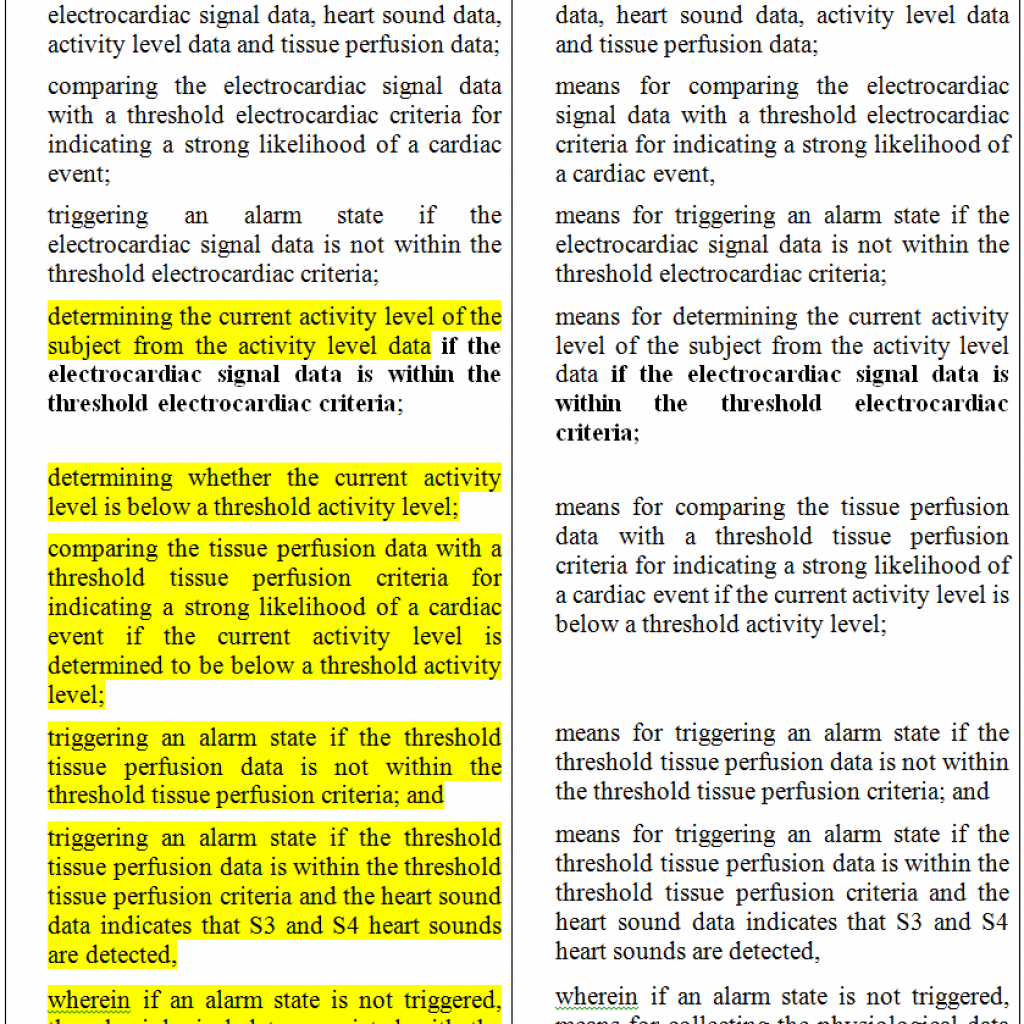

When analyzing patents based on the claim, it is important to note that longer claim lengths often contain more limiting elements, making it challenging to find overlaps. To address this issue, we filtered patents with claim lengths below a specified threshold (e.g., less than 500 words). Out of the 600 Optical Fiber patents, 500 met this criterion. This step was then executed concurrently for other technology clusters.

Step III – Filtering On The Basis Of Companies of Interest/Target Companies.

a) Forward Citations: One of the ways to hint that the patent technology has good potential is by the number of times patents of other companies have forward cited it. Additionally, these citations provide insights into the companies that are engaged in similar technology areas. As a result, it becomes easier to indicate the monetization potential of the patent.

b) Patent Applications of Target Companies That Have Received 102/103 Rejections Based on the Patents of the Portfolio: While this process takes a lot of time, our in-house IP tool, BOS, facilitated the identification of relevant insights by scrutinizing the prosecution data of US patents.

BOS generated a list of companies attempting to patent concepts resembling the patents within our portfolio, confirming that examiners used our input patents for 102/103 rejections in the applications of these companies. BOS also furnished details such as claim amendments, abandonment post-rejection, rejection dates, and more.

Combining the above sub-steps, we refined the list to include patents with target companies in their forward citations and those with applications rejected based on portfolio patents. Out of the initial 500, 350 patents remained after this filtering step.

The Major Roadblock:

The above three steps narrowed the portfolio to 350 patents, but the volume was still considerable for analysis within our two-month deadline. Determined to find an effective solution, we devised a new criterion to assess patent infringement potential: Checking Patent Marking or Patent Notices of target companies.

Step V – Patent Marking/Patent Notices

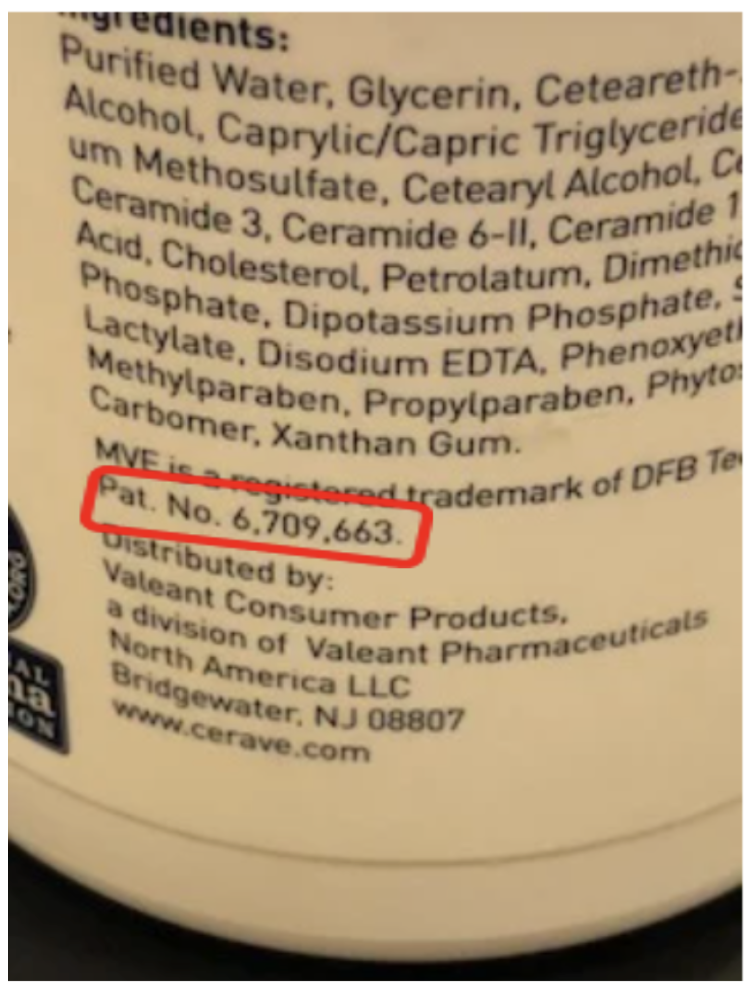

Patent Marking/Patent Notices are most valuable when checking a patent’s monetization potential through infringement damages. In the words of United States Patent Law Codes (specifically 35 U.S.C. § 287), here is how Patent Marking is defined –

“Patentees, and persons making, offering for sale, or selling within the United States any patented article for or under them, or importing any patented article into the United States, may give notice to the public that the same is patented, either by fixing thereon the word “patent” or the abbreviation “pat.”, together with the number of the patent, or by fixing thereon the word “patent” or the abbreviation “pat.” together with an address of a posting on the Internet, accessible to the public without charge for accessing the address, that associates the patented article with the number of the patent, or when, from the character of the article, this cannot be done, by fixing to it, or to the package wherein one or more of them is contained, a label containing a like notice. In the event of failure, so to mark, no damages shall be recovered by the patentee in any action for infringement, except on proof that the infringer was notified of the infringement and continued to infringe thereafter, in which event damages may be recovered only for infringement occurring after such notice. Filing of an action for infringement shall constitute such notice.” (Source)

Companies typically mark their products with patent numbers or provide notices on their official websites indicating which products are protected by patents. This serves as a public declaration of their patent rights. For example, product A is protected by patents X, Y, and Z (as shown below).

How Did This Data Aid in the Portfolio Analysis?

While this step usually eludes the researcher’s attention during portfolio analysis, this method proved to be the most critical for us. We identified almost all the target companies shortlisted by Nick have published their patent markings publicly. The webpage included some of the company patents and the respective products protected by those patents.

Therefore, we compiled a list of all the products along with patents that were declared against the products. We then matched it against the patents in Nick’s portfolio, which eventually gave potential gems in this case.

For instance, a subject patent, USXXXX543B2, was one of the 350 patents shortlisted by earlier strategies. Before initiating the project, Nick had expressed a particular interest in the company POP (name changed for confidentiality purposes).

Subject patent ‘543:

While reviewing the forward citations of ‘543, we noticed a citation by POP’s USXXXX567B1 patent.

Citation of ‘543 contains POP’s ‘567

Furthermore, during an exploration of POP’s website for patent notices, we observed that one of their products had been marked with the ‘567 patent from POP. Upon closer examination, we found that the ‘567 patent bore a striking resemblance to our subject patent ‘543.

Patent Notice Website of POP –

There was a significant overlap upon analyzing ‘543 against POP’s marked product. This discovery prompted us to apply the same methodology to the entire portfolio to uncover more valuable patents within a shorter timeframe.

We shared this strategy with Nick, and he was excited to hear about it and asked us to immediately execute it on the overall portfolio. As a result, this additional step enabled us to filter out approximately 150 patent families from the total set of 600, all of which were linked to marked products from three different companies.

By comparing this subset with the 350 patents we had previously narrowed down through other filtering steps, we aided Nick in finalizing a selection of 200 patents for acquisition, all within the specified two-month timeframe.

Conclusion

Patent Marking/Patent Notices may not seem important, but they can be very useful in identifying high-value patents and potential infringement cases. By analyzing how companies publicly declare their patent rights and comparing that to your own portfolio, you can quickly identify patents that are more likely to be profitable through licensing, litigation, or acquisition. Moreover, these criteria may indicate intentional infringement, which can lead to higher damages and increase the value of the patent.

If you’re unsure whether the portfolio you’re considering is worth investing in, you can turn to GreyB for their expertise.

Authored by: Moksha Saxena, Rishabh Sharma, Ayushi Roy, Infringement Team

Edited by: Annie Sharma, Editorial Team