The success of any company in selecting the right products for a particular market is deeply connected to their grasp of customer needs, desires, and expectations. It is essential to continuously refine product strategies, which include determining the product offerings, managing product life cycles, and launching new products. These strategies form an integral part of a company’s broader marketing strategy and involve extensive research to identify the most effective tactics for success, especially in industrial goods.

For fast-moving consumer goods (FMCG) companies like P&G, Shiseido, Estée Lauder, AB InBev, Colgate-Palmolive, etc., innovation is driven by an intimate understanding of evolving consumer needs and desires. These brands closely monitor social media chatter, customer feedback, purchasing data, and cultural trends. The marketing teams set innovation priorities based on this deep consumer knowledge.

This level of consumer insight is particularly critical in cosmetics. Companies must stay ahead of the competition and bring their products to market faster than their rivals. This requires predicting competitors’ product strategies and making informed decisions accordingly.

This article will explore how to stay ahead in a highly competitive market by examining the development of effective product strategies for FMCG companies.

Why is it crucial to Understand Competitor Product Strategies in the FMCG industry?

Competitive product analysis is crucial in the fast-moving consumer goods (FMCG) industry due to its highly competitive nature and the need to stay ahead of competitors. Here are some key reasons why competitive product analysis is important in FMCG:

Understanding the competitive landscape: Competitive product analysis helps FMCG companies gain insights into their competitors’ strategies, products, and market positioning. By analyzing competitors’ offerings, companies can identify gaps in the market and make informed decisions about product development and marketing strategies.

Identifying market trends: FMCG companies must stay updated on market trends to meet consumer demands effectively. Competitive product analysis allows companies to identify emerging trends, such as changes in consumer preferences, new product innovations, and shifts in distribution channels. This information helps companies adapt their strategies and stay competitive in the market.

Differentiating products: In a crowded market, differentiation is key to attracting consumers. Competitive product analysis helps FMCG companies identify unique selling points and areas where they can differentiate their products from competitors. This analysis enables companies to develop products that meet specific consumer needs and stand out in the market.

Improving product development: By analyzing competitors’ products, FMCG companies can gain insights into product features, packaging, pricing, and marketing strategies that resonate with consumers. With this information, companies can create more competitive and appealing products.

Enhancing marketing strategies: Competitive product analysis provides valuable information about competitors’ marketing tactics, such as advertising campaigns, promotions, and branding strategies. By understanding what works for competitors, FMCG companies can refine their marketing strategies and effectively communicate the value of their products to consumers.

Identifying opportunities and threats: Competitive product analysis helps FMCG companies identify opportunities and threats in the market. By understanding competitors’ strengths and weaknesses, companies can capitalize on gaps in the market and mitigate potential risks. This analysis enables companies to make informed decisions about market entry, expansion, and product positioning.

Why is it hard to Decode Product Strategies in FMCG?

Decoding the product strategy of an FMCG company is particularly complex due to the industry’s rapid pace, the fiercely competitive market landscape, and the diverse strategic approaches adopted by the companies. These approaches often involve continuous innovation, dynamic pricing models, and aggressive marketing tactics.

Further, weak signals that drive product strategy are also hard to find.

Here’s a closer look at why it’s difficult to figure out the next product line or strategic moves of an FMCG company:

1. Scatter Data

Connecting an FMCG company’s different activities and strategies across multiple areas, such as intellectual property, products, marketing, investments, mergers and acquisitions, and partnerships, is challenging.

The relevant information is scattered across various sources, making it difficult to get a complete picture. Additionally, collecting data from numerous sources is not enough; companies need to analyze and extract meaningful insights from this data to understand the company’s evolving strategies.

2. High Level of Market Competition

FMCG markets are typically saturated with numerous competitors, both large and small. Companies in this sector constantly innovate and adjust their strategies to gain a competitive edge. This high level of competition makes it difficult to predict a company’s next move as they strive to keep their strategies confidential to avoid giving an advantage to competitors.

3. Rapid Pace of Innovation

The FMCG sector is known for its fast product life cycles and the rapid pace of innovation. Companies frequently introduce new products, reformulate existing ones, and retire older products. This constant flux makes tracking and predicting strategic trends challenging, as the product landscape always evolves.

4. Consumer Behavior and Trends

Consumer preferences in the FMCG sector can change swiftly and are influenced by various factors, including social trends, economic conditions, health and wellness shifts, and technological advancements. Keeping pace with these volatile consumer trends requires FMCG companies to be highly adaptive and often secretive about their forward-looking strategies.

5. Diverse and Global Markets

FMCG companies often operate in multiple geographic markets, each with consumer preferences, regulatory environments, and competitive dynamics. A strategy pursued in one market may not be relevant in another, complicating efforts to deduce a company’s overall product strategy from outside.

6. Complex Supply Chains

The complexity of supply chains in FMCG can affect product strategy, including sourcing, manufacturing, and distribution decisions. External observers may find it difficult to deduce strategies when they cannot see the full picture of these internal operations and how they are aligned with the company’s product plans.

7. Marketing and Branding Efforts

Marketing plays a significant role in FMCG strategies, and outward-facing marketing efforts may not always fully reveal the strategic intent behind a product’s development or positioning. Companies might use promotional tactics that serve multiple strategic objectives, obscuring their true strategic directions.

8. Regulatory Changes

The FMCG sector is heavily regulated, and regulation changes can significantly influence product strategies. Companies might need to quickly adapt their strategies in response to new regulations, which can be unpredictable and vary significantly by region.

Due to these factors, understanding an FMCG company’s product strategy requires a multidimensional analysis of market trends, competitive behavior, consumer insights, and marketing and branding activities. It often involves piecing together various information from multiple sources to form a coherent picture of a company’s strategic direction.

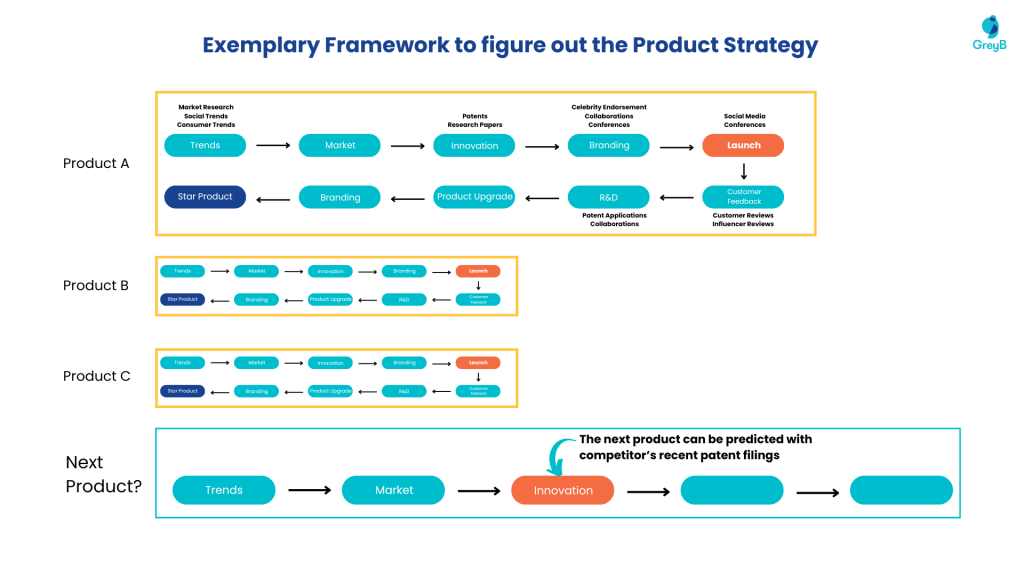

A Framework to Figure an FMCG Company’s Product Strategy

The framework involves multiple product roadmaps to find a pattern that can be used to figure out the next product release.

First, a holistic approach to pattern recognition and weak signal detection is required. Beyond just monitoring the usual channels like search trends and social listening, successful foresight demands tracking dispersed data points like:

- Regional micro-influencer launches and promotions

- Scientific research and Patent Filings

- Local forum/community chatter and reviews

- Supply chain movements of novel ingredients

- Search/ad-bidding data from smaller indie brands

Then, assembling these signals into a coherent narrative unveils potent product roadmap insights.

The process is repeated for other products to find a pattern.

When the pattern emerges, it helps predict the company’s next product and launch timeline.

To find its next big product, its recent patent applications can be analyzed to see if they contain innovations in new ingredients, processes, materials, etc.

Based on the information, one can conclude that the next product will be, say, a sunscreen with herbal ingredients mixed with retinol for sensitive skin.

Further, the timeline of products A, B, and C, from patent filings to the launch date, will provide an approximate time for predicting the next product release. This can provide actionable insight to other players in the domain.

Looking to perform a competitive analysis and see where other players in your industry are heading?

Fill out the form below:

Authored By: Mayank Maloo and Vikas Jha, Solutions.