If patents are your bread and butter, you know as much as I do that a thorough patent portfolio analysis is critical before deciding to buy them. However, the situation gets complicated by thousands of patents in the portfolio.

It begs the question: Should I hire specialists to conduct a thorough examination? Is it worth delving deeper into this particular patent collection?

This is where a guide to score a patent set objectively can come in handy. These factors serve as a roadmap to assess a patent set’s worth before doing a subjective analysis and expert screening.

Eventually, to obtain a strong, valuable, and enforceable patent portfolio, a close partnership with IP experts who understand the unique needs of your business is critical.

Make informed decisions and acquire patents that yield a high return on investment.

1. Expiring in <3 Years

When acquiring patents, the company goes through a series of investments in addition to the acquisition cost. This includes manufacturing, marketing, and regulatory compliance. Patents with a short remaining lifespan (less than 3 years) might not provide enough time to recoup these investments, along with acquisition costs. In comparison, longer remaining terms can offer more potential for the return on investment.

2. Family Size

A larger patent family indicates that the invention is protected from multiple angles, making it harder for competitors to design around it and ensuring a broader scope of protection. Therefore, a larger patent family provides a more comprehensive and resilient shield against potential infringement and competitive threats for a buyer. Thus safeguarding the company’s market position and giving it an edge against the competition.

3. No. of granted family members

The number of granted patents within the family demonstrates the validity and strength of the technology. One IPO survey from the IP owner’s association shares that almost 3/4 of respondents in the survey agree that inter-relationships among patents in their company’s portfolio are essential. They see thicketing as an effective means of preventing infringement.

More granted patents of a family could imply a higher chance of enforcement against potential infringers.

4. Granted / Examining / Abandoned / Fee Due and Revived

Differentiate between granted, examining, abandoned, and fee-due patents and those revived after abandonment. Granted, patents offer strong enforceability and immediate protection, while the patents still in examination have an uncertain fate. On the other hand, abandoned patents are not enforceable anymore and are, therefore, unprofitable. Whereas a fee-due patent could have potential value if revived.

Analyzing the status of the patents will help determine the cost of the patent, assess the risk involved, and plan monetization strategies around them.

5. Citing Patents

Patents that are cited by others are likely influential in the field, indicating that they cover important technologies and have the potential to generate licensing revenue.

Below is an example from one of our projects where big players cited one of the patents from the set. This patent can be useful for these companies and thus offers the potential for licensing. In a nutshell, such patents are worth investigating further.

6. Litigated Patent

Litigated patents might be subject to legal disputes that could affect their value. Understanding ongoing litigation can help assess potential legal risks. This eventually helps in selecting the portfolio as well as negotiating its cost.

7. Licensed Patent

Licensing indicates that other parties find value in the technology, potentially providing an additional revenue stream for the buyer.

8. SEP Patent

SEPs hold significant value because they are essential for implementing industry standards, making them crucial for manufacturers and potentially generating substantial licensing income.

Spotting such patents in the portfolio means a probable higher return on investment. However, there is no indicator to find out whether you have uncovered all the essential patents to be declared or there are still some hidden gems in the portfolio. That is where we use our extensive manual process to spot the true SEPs.

9. BOS Score

The BOS Score is based on our in-house tool, which finds patents that received a rejection (102/103 type) due to a specific patent. Using this score helps find patents with the most blocked assignees and, therefore, a greater opportunity for licensing.

Below is a snippet of the data extracted from the BOS tool, which shows the blocked patent assignees from one of the patents. Since the blocked assignees are huge players, buying such a patent would greatly benefit monetization.

10. Maintenance Fee Paid

Paying maintenance fees is necessary to keep the patent in force. Ensuring these fees are up-to-date is crucial to maintaining the patent’s validity. While you can manually check the patent maintenance fees for different countries, with GreyB’s Tool, Pruner, you can perform simultaneous searches for multiple patents and rank them according to their monetization value.

11. Reassigned Patent

Patents that have changed hands multiple times might have complex ownership histories. Each transfer of ownership involves legal agreements, contracts, and potentially even disputes. This complexity can impact the ability to enforce or license the patent effectively. It can hinder the ability of the current owner to enforce the patents, as courts and regulatory bodies may require extensive documentation to prove ownership. These factors can lead to higher negotiations in licensing/selling the patent.

12. Time Taken to Grant

A shorter time to grant might suggest a straightforward invention, while a longer time could indicate complex technology or challenging prosecution issues. A longer time to grant indicates that the technology is thoroughly assessed for its uniqueness and prior art concerns. The company can strategically leverage this patent in its market and potentially explore licensing opportunities.

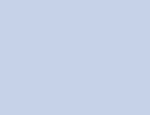

13. Geographic Coverage (other than US)

Patents with international coverage are more valuable if your business operates globally. Different jurisdictions provide protection in distinct markets. Therefore, international coverage provides overseas protection and multiple monetization opportunities.

14. Length of First Claim

The length and complexity of the first claim reflect the scope of protection. A broader claim might provide more comprehensive coverage. The metric is measured in terms of the number of characters present in the first claim (as shown in the image below) and the complexity of low, medium, and high.

15. Priority year

The year in which the first application in the patent family was filed indicates how long the technology has been under protection.

An earlier filing year suggests that the technology has been safeguarded for extended periods, potentially allowing the patent holder to establish a stronger market position. Longer time also indicates that the technology might be mature and can be easily commercialized. A recent filing year would be ideal if a company is looking for a cutting-edge innovation that hasn’t been tested in the market.

Conclusion

These factors collectively are just one part of assessing the strength, value, and potential risks of acquiring a patent portfolio. Once the objective analysis is performed, you have a clear picture to decide how to proceed with the patent set.

However, the objective analysis just scratches the surface of the complexities that must be analyzed before patent acquisition. A crucial factor is that the weightage of these factors is to be customized based on your specific business goals and industry dynamics.

As a result, even when a patent set looks attractive after the objective patent portfolio analysis, it is important to mine through the potential portfolio with expert screening and subjective analysis.

Found a patent portfolio that ticks all the right boxes of objective analysis? Time to go in-depth to find its real value.

Acquire high ROI patents by making informed decisions.

Authored by: Annie Sharma, Marketing, and Divyanshu Singh, Patent Monetization