Mergers and acquisitions have been a core business strategy for companies across almost all industries. A key reason for M&A deals today is the need to harness cutting-edge technologies through targeted partnerships. This has led to a surge in M&As, focusing on companies that hold the coveted keys to groundbreaking innovations. As a result, analyzing IP for mergers and acquisitions has taken center stage.

Take Apple, for example. The tech giant has been acquiring startups with core technologies since 1988 and implementing them into its products to expand into various markets. From the iPod to the Apple Watch, Apple is actively acquiring startups like Anobit, Gliimpse, Beddit, etc., innovating breakthrough technologies and expanding their business line.

However, uncovering the true value of an IP portfolio before diving into an M&A deal can be quite a challenge. Especially when it comes to technology-centric domains like telecommunications and healthcare.

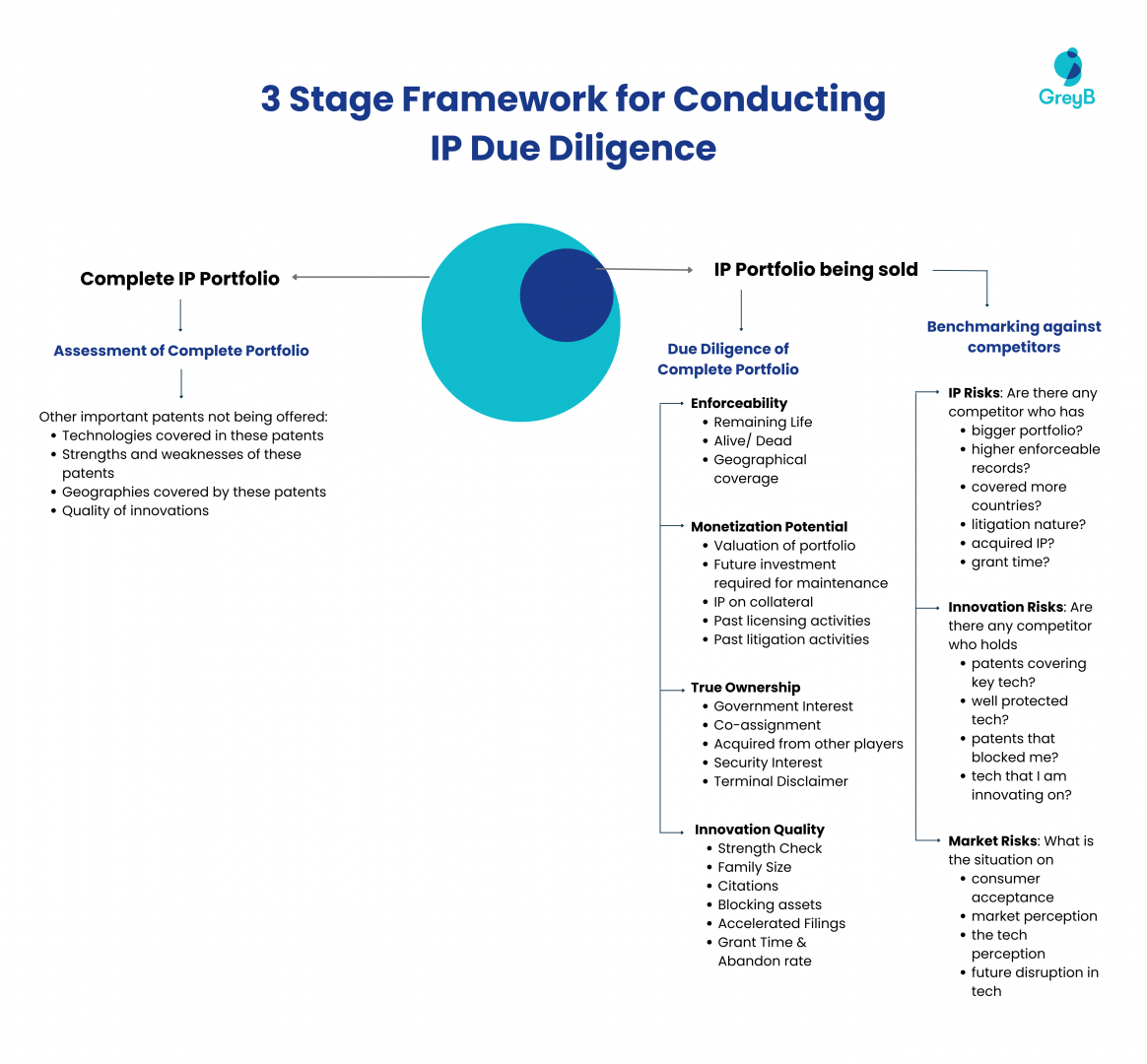

To make the process bulletproof, we have developed a comprehensive three-stage framework for conducting IP due diligence and benchmarking it against competitors. Here’s how it looks-

This article explores how this approach provides a holistic picture of IP assets, empowering decision-makers in the Mergers and Acquisitions landscape to make well-informed choices.

1. Assessment of the Complete Portfolio

When eyeing an acquisition, delve deeper into the entire IP portfolio of the seller rather than the immediate assets on the table. Some key patents might not be part of the offering or held under subsidiaries or different names.

Evaluating the complete IP portfolio ensures a thorough understanding of what IP assets are at play, allows for more informed negotiations, and can give you an upper hand in negotiating the deal.

A classic example of this is when German carmaker Volkswagen purchased the assets of Rolls Royce for about $780 million in 1998. However, only after the deal, Volkswagen realized that the deal did not include the Rolls-Royce trademark. Thus, they had all the assets of Rolls Royce but could not use its brand name. [1]

2. Due Diligence of the portfolio

Identifying the IP assets of interest is only the beginning. The next step is conducting due diligence to uncover its strengths, weaknesses, opportunities, and threats. To conduct due diligence and get a holistic view of the portfolio, at GreyB, we analyze the patents on four different pivots:

Enforceability:

Are the patents the patents enforceable (alive and granted)?

In which geographies are the patents enforceable?

Do the enforceable patents cover my geographies of interest?

What is the remaining life of these patents?

What is the remaining life of these patents in my geographies of interest?

How many patents are still under prosecution, and what is their current status?

Monetization Potential

History of patents being involved in licensing/litigations?

What is the valuation of the portfolio?

What is the future investment required to maintain this portfolio?

True Ownership

Who owns the patents now?

Who was the original filer of the patents?

Is there any co-assignment?

Are there any terminal disclaimers involved?

Is there government or any external interest involved?

Innovation quality

Is there any hidden prior art in the citations?

What is the family size?

Are other players citing the patents? If yes, then who?

How often has the examiner used it to reject other patents?

Are there any accelerated filings involved?

In how much time were the patents granted?

In one of our projects, a client intended to acquire IP assets from a medical diagnostics devices company. However, upon conducting due diligence, we found that the patent portfolio was strong in the US but lacked in Europe (one of the key markets for the client) with a low number of enforceable records (alive granted patents). Such insights can significantly impact the attractiveness of an acquisition.

At GreyB, we utilize 15+ parameters like granted patents to applications ratio, average remaining life, grant time, the average cost required to maintain the patents in the future, dead to alive patents ratio, number of patents blocked, number of continuations/divisional/continuation-in-part, pat snap patent valuation, average no. of citations in a year, and accelerated filings among others, to unearth the hidden strengths and weaknesses within an IP portfolio. These parameters cover IP, innovation, and market risks to help you understand the IP landscape.

3. Benchmarking against Competitors

Beyond the immediate portfolio, analyzing its potential requires gauging it against the competition. This panoramic view provides insights into the IP landscape owned by rivals and the potential risks they might pose.

For example, in a recent project on the IP acquisition of a startup, we found that despite its relatively small IP portfolio compared to its rivals, its innovations exhibited superior quality. Its portfolio was involved in blocking applications from industry-leading players and was repeatedly cited by them. This insight made the acquisition a strategic win for the client.

In conclusion, in an era where innovation reigns supreme, the role of M&A in fostering growth and acquiring new technologies is undeniably paramount. However, to unlock the true potential of an M&A deal, IP due diligence must be an integral part of the process.

GreyB’s three-stage framework can help business leaders understand the IP assets they are acquiring, ensuring they can seize the opportunity while mitigating any potential risks.

We help companies make informed M&A decisions and get the best ROI on the IP assets involved. Ready to talk?

Authored By: Harleen Singh, Patent Analytics