In 2021, Saputo laid out a four-year strategic plan to accelerate organic growth. With that aim, Saputo launched new products, spent loads of money on acquisitions, and partnered with companies. But as they say, the best-laid plans of mice and men often go awry.

Spruce and Moody’s analysis of Saputo raises questions about Saputo’s strategy. However, is that all you need to know while strategizing to establish your position in the dairy industry?

This competitive analysis of Saputo Inc. evaluates the strategies adopted by Saputo to remain competitive and sustain its position as a market leader. Additionally, it identifies areas of opportunity for the other players in the dairy industry.

Key Highlights

- Plant-based cheese, Hibiscus Berry Goat Cheese, and new Italian Cheese in the Stella brand are among Saputo’s new products in 2022.

- Half of Saputo’s revenues came from the US market. However, the company’s international operations account for a significant portion of its revenue. Europe and Oceania are two of its key growth markets.

- The company’s key focus consumer trends are clean labels, sustainably sourced, variety and innovation, and channel revolution.

- The company made two investments in 2022 and 3 acquisitions in 2021 to expand its cheese and healthy food portfolio.

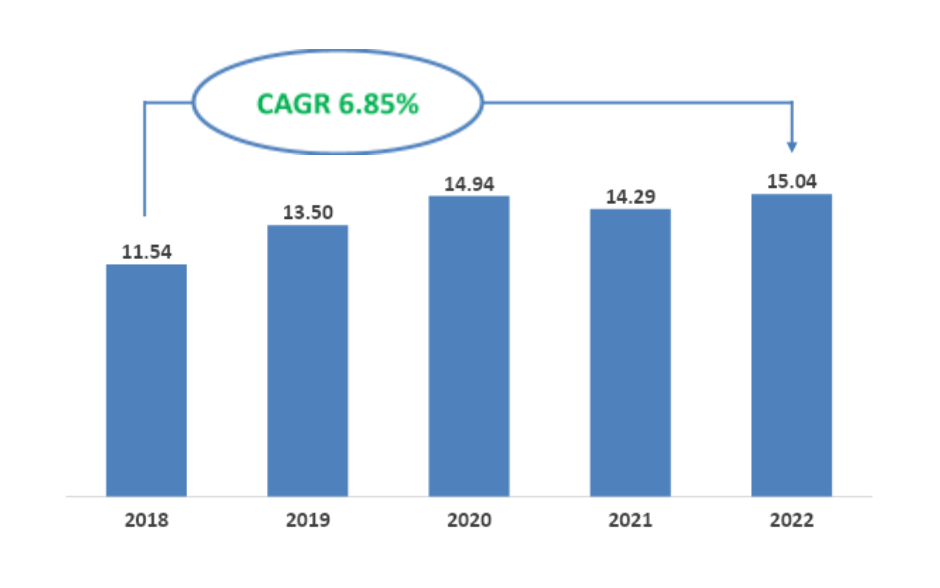

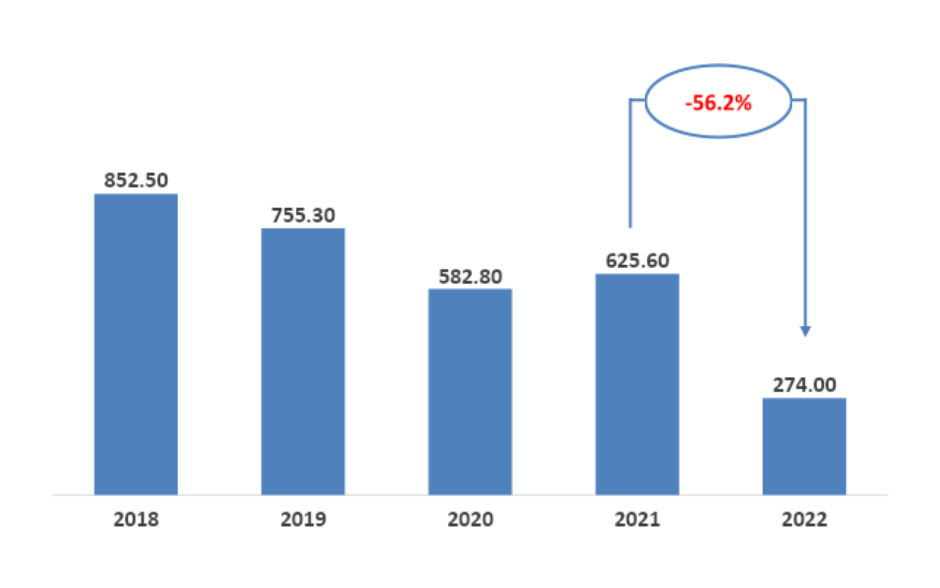

- Saputo’s revenue grew from CAD 11.54 billion in 2018 to CAD 15.04 billion in 2022. Net earnings, however, have declined to CAD 274 million from CAD 852 million last year.

- Saputo’s growth has been deemed risky by Spruce and Moody’s. This is because of its increased execution risks, higher investments, continuous cost inflation, and labor shortages.

One element of the strategic plan that has dramatically changed is the company’s focus shift from volume to value. Could this change the course of Saputo’s declining market? What other strategy changes is the Canadian dairy giant planning to make? How will it affect the dairy industry?

Being a top player in the dairy industry, you would surely have to know the recent innovation trends in the dairy. Here’s the pdf that will let you know the innovation trends of the dairy industry.

Saputo’s Growth Strategy

The Canadian dairy giant’s growth strategy includes accelerating product innovation by strengthening the core portfolio with more value-added components. The company’s strategy includes new products and formats, such as the fast-growing dairy alternatives category. (Source)(Source)

The Saputo Promise Plan

The Saputo Promise is essential to the company’s operations and growth. Saputo’s focus since 2020 has been the execution of its first three-year plan for the Saputo Promise (2020-2022), with a clear ESG framework and governance. The organization has made significant progress across its plan and has achieved most of its three-year goals.

Over the previous five years, Saputo has incorporated its Promise into its long-term incentive compensation by developing strategies to generate, support, and enable sustainable growth. Saputo’s accomplishments include the following:

- Environment: To accelerate its performance, the Company has defined specific climate, water, and waste targets to be met by 2025. It has also budgeted a three-year investment of CAD 50 million (2021-23).

- Responsible Sourcing: Saputo has introduced its 2025 Supply Chain Pledges to handle sustainability concerns and to promote the dairy industry’s overall transition to net zero.

- People: To achieve more gender-balanced representation, Saputo reached 25% of women in senior management in 2022. It is an increase of 10% over the previous five years, and 60% of Board members are currently women.

- Community: Saputo has provided over 6 million kilograms of healthy products to individuals in need. Additionally, it has invested CAD 67 million (2018-2022) to assist in building healthier communities where it operates.

The Saputo Promise 2023-25 Plan aims to keep the Company’s strategy relevant to today’s most critical environmental, social, and governance (ESG) concerns. The company has started to execute to meet its three-year objectives. The plans of Saputo Promise focus on enhancing gender representation, diversity, and inclusion. It also intends to reduce environmental impacts by fulfilling its 2025 Environmental Pledges. This includes assisting in transitioning to a sustainable food system through its Supply Chain Pledges, and improving the nutritional quality and performance of Saputo’s worldwide product portfolio to satisfy consumer expectations. (Source)

Global Strategic Plan (GSP)

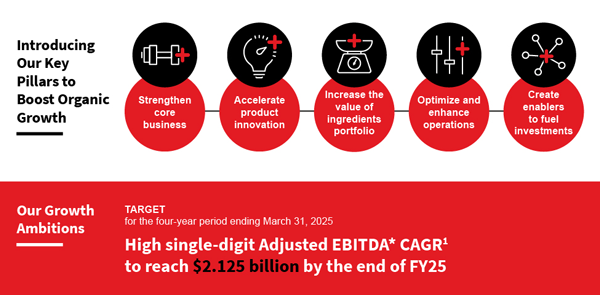

Saputo released its Global Strategic Plan in the fourth quarter of 2021 to accelerate growth over the next four years. The plan aims to reach an Adjusted EBITDA of CAD 2.125 billion ($1.761 billion) by the end of fiscal 2025.

The new plan would employ a three-pronged approach to keep the business moving forward. The plan’s pillars include strengthening core business, accelerating product innovation, increasing the value of the ingredient portfolio, optimizing and improving processes, and creating enablers to drive investments. (Source)

In 2022, Saputo announced further capital investments and consolidation initiatives to streamline its manufacturing footprint in its USA Sector. The investments are essential to its Global Strategic Plan. It aims to improve operations and accelerate organic development across its platforms. To enhance capacity, the company intends to invest CAD 45 million in converting its long-standing mozzarella cheese manufacturing facility in Reedsburg, Wisconsin, to a goat cheese manufacturing factory. (Source)

Global Strategic Plan (GSP) – Growth Ambitions

Products Launched in 2022

Plant-Based Cheese

Saputo Dairy USA has recently introduced Vitalite. It is a vegan-certified, plant-based, and dairy-free cheese with exceptional flavor, texture, aesthetic appeal, and melting performance. The plant-based product line includes Plant-Based Mozzarella Style Slices and Shreds, Cheddar Style Slices and Shreds, Grated Parmesan Style, and Creamy Original Spread. The idea for Vitalite came from the need to provide more appealing options to people following a plant-based or flexitarian diet.

According to Chef Nikki Trzeciak, Saputo’s Executive Chef and Senior Manager of Culinary and Sensory, the goal is to empower home cooks to create traditional foods they connect emotionally to without compromise. She says, “We want home cooks to feel liberated in the kitchen and inspired to create traditional foods they have an emotional connection to without compromise.” (Source)(Source)

Vitalite – Plant-Based Cheese

Hibiscus Berry Goat Cheese Log

Saputo Cheese USA has recently launched a range of Montchevre products catering to sweet and savory desires. The lineup includes a Hibiscus Berry Goat Cheese Log and a range of Topped Goat Cheeses, providing consumers with various snacking choices for every occasion. The Hibiscus Berry Goat Cheese comes in 4oz portions, with easy-to-peel packaging and a log-shaped structure for slicing or crumbling.

Meanwhile, the Montchevre Topped Line offers creative goat cheese alternatives to people who prefer simple, upgraded snacking and entertaining options. According to Jenny Englert, Saputo’s Senior Marketing Manager, they hope to inspire consumers in the early stages of their decision-making process with the Montchevre Topped Line. She says, “In the goat cheese category, consumers tend to purchase on impulse, usually triggered by a craving or recipe.” With the Montchevre Topped Line, Saputo Cheese USA aims to inspire consumers to get creative with their goat cheese pairings, even branching out and creating their own goat cheese ‘toppings’ for future snacks and gatherings. This new range of Montchevre products will surely provide consumers with endless snacking possibilities. (Source)

Montchevre Products – Hibiscus Berry Goat Cheese Log and Topped Goat Cheeses

New Italian Cheese Line – Stella® Brand

Saputo Dairy USA unveiled a new Italian cheese line under the Stella brand. Stella Cheese focuses on the full-flavored, classic recipes that fueled its new cheeses’ popularity. The Stella Import range embodies its origins with rich, savory cheeses. (Source)(Source)

Stella Parmigiano Reggiano Wedge and Stella Grana Padano Wedge

Top Markets

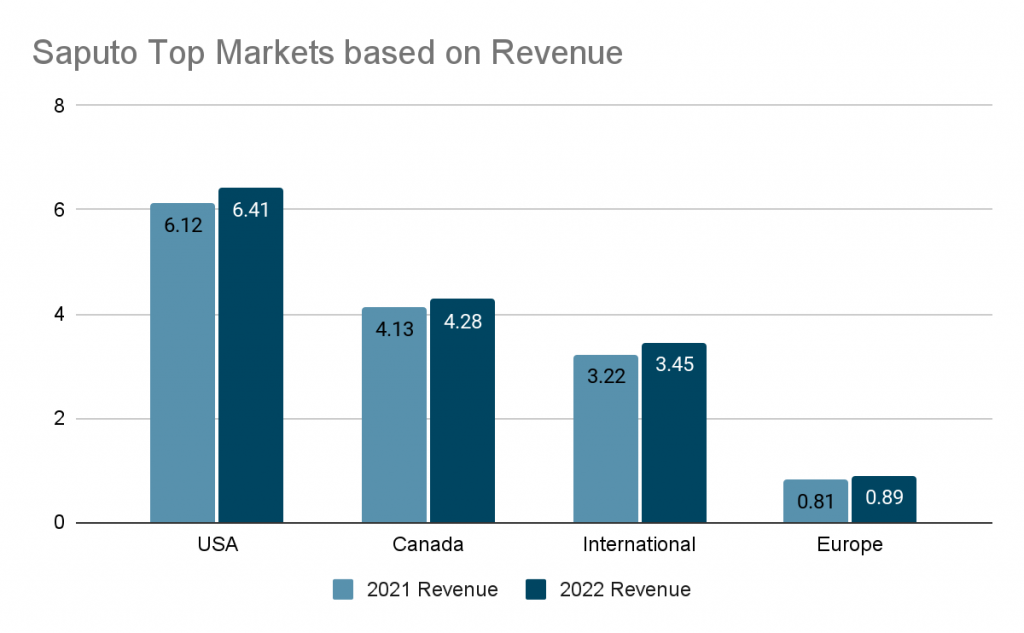

Saputo’s largest market is North America, with a strong presence in Canadian and US markets. Saputo is the largest dairy processor in Canada and one of the top three cheese producers. In the United States, Saputo is the fourth-largest cheese producer and is significant in the fluid milk and cultured dairy markets.

In addition to North America, Saputo operates in several countries, including Argentina, Australia, Belgium, Germany, the United Kingdom, and Uruguay. The company’s international operations account for a significant portion of its revenue. Europe and Oceania (which includes Australia and New Zealand) are two of Saputo’s key growth markets.

Saputo’s revenue is derived from a diversified mix of domestic and international markets. It mainly focuses on expanding the company’s global presence and improving operational efficiencies to drive growth and profitability.

Saputo has four significant markets per Revenue, i.e., Canada, USA, International, and Europe. (Source)(Source)

Market Expansion Plan

Australia

In November 2022, Saputo announced further restructuring initiatives to improve operational efficiency and strengthen its competitiveness in Australia. The Company would streamline operations at its Leongatha, Victoria, and Mil-Lel, South Australia plants.

These actions in the Company’s International Sector are expected to gradually result in annual savings and benefits, beginning in the fourth quarter of fiscal 2023 and reaching about CAD 14 million (CAD 10 million after tax) by fiscal 2025. (Source)

New Mexico

In 2022, The City of Las Cruces stated that Saputo would expand its Cheese USA facility. The expansion has produced nearly 300 new full-time jobs. It also involves a $30 million capital expenditure four years ahead of the company’s anticipated completion date of December 31, 2026. The expansion included the construction of four new string cheese manufacturing factories. (Source)

Operations and Research Facilities

The company has 67 manufacturing facilities and approximately 18,600 employees across its five divisions. Its operation mainly includes producing, marketing, and distributing dairy products, as well as non-dairy products. (Source)(Source)

It has a state-of-the-art commercial culinary facility adjacent to Wisconsin’s largest manufacturing facility. It is the intersection of their product innovation work and food service application. They replicate real food service kitchen scenarios to understand how each product would best benefit the menu offerings and performance demands. (Source)

Saputo Dairy has its Innovation Centre, the Saputo Dairy UK Innovation Centre, located on the campus of the agricultural university, Harper Adams, home to the company’s R&D and technical teams. It houses state-of-the-art development kitchens, laboratories, and a pilot plant. (Source)(Source)

Focused Consumer Trends

Clean Label

The number of consumers following vegan, plant-based, and flexitarian diets and mounting climate change and animal-welfare concerns is fast growing. The global vegan cheese market is expected to grow at a compound annual rate of about 10%. Saputo recognized the opportunity in the vegan cheese space and made strategic investments in the UK to prime itself for bringing vegan cheese to the marketplace. Saputo Cheese USA Inc. has brought the Vitalite brand of plant-based, vegan-certified, dairy-free cheese from the UK to the United States. (Source)

Sustainably Sourced

Consumers are increasingly demanding to produce healthy foods in an environmentally friendly manner. Saputo’s Environmental Committee oversees and manages all environmental efforts locally with support from their divisional environmental teams. To further their impact, Saputo has committed to accelerating their global climate, water, and waste (including packaging) performance by 2025, backed by a three-year investment of CAD 50 million and a governance framework to foster company-wide ownership and accountability. (Source)

Added Variety and Innovation

Saputo Cheese USA Inc. aims to accelerate product innovation by strengthening its core portfolio with more value-added components and new products and formats. In addition, the company plans to increase its manufacturing capacity in the fast-growing dairy alternatives category as part of its strategy. In line with this, Saputo Cheese USA Inc. recently launched several new products under the Montchevre brand, including a Hibiscus Berry Goat Cheese log and a line of Topped Goat Cheeses.

Jenny Englert, Saputo’s Senior Marketing Manager, notes that more U.S. households than ever are buying and consuming this soft, tangy cheese for breakfast, lunch, and dinner. She says, “This increased demand for variety has sparked our Montchevre brand team to accelerate our innovation pipeline, adding a variety of new trending flavors and formats we are excited to release into the marketplace.” (Source)

Channel Revolution

The pandemic led to an unprecedented surge in eCommerce sales, with online platforms becoming essential for food producers worldwide to reach their customers during Covid-19. To keep up with this trend, Saputo introduced a direct-to-consumer platform for its Davidstow cheese brand, providing customers with an online option to purchase their favorite cheese. In addition, the company launched a D2C service in Montreal, which has since expanded to Quebec and Ontario. Carl Colizza, President and COO for Saputo’s North American Operations, emphasizes the company’s commitment to eCommerce development. He said, “We’re actively developing a robust IT platform to support our commercialization plans in B2B to B2C and in the direct-to-consumer channel. Our e-commerce capabilities will be enhanced and ready for exciting new developments, specifically in the direct-to-consumer interface.” Saputo’s investment in eCommerce capabilities reflects its focus on innovation and staying ahead of the curve to meet customers’ evolving needs. (Source)

Acquisitions

Saputo Acquired Carolina Aseptic and Carolina Dairy businesses for healthy food offerings

In 2021, Saputo finalized the acquisition of AmeriQual Group Holdings, LLC’s Carolina Aseptic and Dairy businesses. The transaction was completed for $118 million in cash and without debt. After acquiring the Carolina Aseptic and Dairy businesses, the company positioned itself better and addressed the expanding demand for aseptic protein beverages and healthy snacks. (Source)(Source)

Saputo Acquired Wensleydale Dairy Products Limited to add its UK cheese brand to its portfolio

In 2021, Saputo declared that it had entered into a deal to acquire the activities of Wensleydale Dairy Products Limited. The company joined Saputo’s Dairy Division (UK) under its Europe Sector, has two facilities in North Yorkshire, and employs around 210 people. The transaction was completed for £ 23 million in cash and without debt. With this strategic acquisition, Saputo was delighted to add another solid and prominent UK cheese brand to its portfolio. Wensleydale Dairy Products’ cheeses are also shipped worldwide. (Source)(Source)

Saputo Acquired Bute Island Foods Ltd. and Reedsburg Facility

In 2021, Saputo completed two significant acquisitions, Bute Island Foods Ltd. and Wisconsin Specialty Protein, LLC’s Reedsburg factory. The transaction concluded for a total of CAD 187 million. Bute Island Foods Ltd. is an innovative producer, marketer, and supplier of dairy-alternative cheese products for the retail and food service markets under the award-winning vegan Cheese brand and private label brands.

Wisconsin Specialty Protein, LLC’s Reedsburg factory in the United States produces value-added ingredients such as goat whey, organic lactose, and other dairy powders and employs roughly 40 employees. Due to these purchases, Saputo was able to diversify and boost the value of its ingredients offering, enhancing its portfolio in the United States and worldwide. (Source)

Saputo Acquired Lion Dairy & Drinks Pty Ltd. (Specialty Cheese Business)

In 2019, Saputo purchased the specialty cheese division of Lion Dairy & Drinks Pty Ltd. for A$280 million in cash and debt-free terms. This acquisition assisted Saputo’s Dairy Division (Australia) in significantly expanding its product range while adding to and complementing its existing activities. (Source)(Source)

Saputo Acquired Dairy Crest Group PLC

In 2019, Saputo purchased Dairy Crest Group Plc, a dairy firm based in the United Kingdom. Saputo purchased Dairy Crest’s entirely issued ordinary share capital for £6.20 per ordinary share, placing Dairy Crest’s share capital at about £975 million. By acquiring and investing in a well-established and successful industry leader with a robust, experienced asset base and a management team, Saputo was able to expand its worldwide presence and enter the UK market. (Source)

Saputo Acquired The Activities of F&A Dairy Products, Inc.

In 2018, Saputo purchased F&A Dairy Products, Inc.’s operational activities. Its operations carry out at two production plants in Las Cruces, New Mexico, and Dresser, Wisconsin (USA). The transaction was concluded for US$85 million in cash and without debt. The activities of F&A Dairy Products were added to and supplemented by Saputo’s Cheese Division (USA). (Source)

Saputo Acquired The Activities of Shepherd Gourmet Dairy (Ontario) Inc.

In 2018, Saputo purchased the assets of Shepherd Gourmet Dairy (Ontario) Inc. for a debt-free purchase price of CAD 100 million. In Canada, Shepherd Gourmet produces, sells, and distributes a variety of specialty cheeses, yogurt, and Skyr Icelandic-style yogurt. The deal allowed the Company’s Dairy Division (Canada) to extend its specialty cheese presence and yogurt offering in Canada. (Source)

Investments

In 2022, Saputo upgraded and expanded three cheese manufacturing facilities in the United States to support the expansion of its retail business. The company spent approximately $169 million to strengthen its industrial asset base. The project began in the second quarter of 2022 at the US plants. It is expected to be completed in around two years. Saputo also planned to close two factories in Australia. According to the firm, the capital investments and consolidation activities would result in yearly savings of $112 million by the end of the fiscal year 2025. (Source)

The company also announced plans for capital investments and consolidation measures to streamline its manufacturing footprint in the USA sector per Lino A. Saputo, Chief Executive Officer of Saputo. “The Company intends to invest CAD 45 million to help enhance capacity and convert Wisconsin’s long-standing mozzarella cheese manufacturing facility into a goat cheese manufacturing factory. It will help to strengthen its position in the expanding specialty cheese categories and boost productivity. The latest series of investments and consolidation activities will enhance our cheese operations’ competitiveness and long-term performance in our USA Sector while increasing efficiency and productivity.” This move demonstrates Saputo’s commitment to staying competitive in the ever-evolving cheese industry while increasing its operational efficiency and productivity. (Source)

Financial Condition

Revenue and Net Income

Saputo recognizes revenue when control of an asset passes to the customer, and most of its revenue generates upon product shipment. In the fiscal year 2022, the company’s revenue was around CAD 15.04 billion, representing a year-on-year increase of approximately 5.2% from CAD 14.29 billion in 2021. The revenue has gradually grown, rising from CAD 7.3 billion in 2017.

Lino A. Saputo, Chair of the Board and Chief Executive Officer, expects a significant earnings improvement in the fiscal year 2023 and notes that the company’s teams are working to balance price, volume, and costs while improving margins over time.

Revenues increased due to higher domestic selling prices, pricing actions implemented across all sectors to offset rising input costs, and higher international cheese and dairy ingredient market prices. However, satisfying the export sales contracts entered into in fiscal 2021 at depressed commodity prices in the International Sector had a negative impact during the first six months of fiscal 2022. (Source)(Source)(Source)

In the fiscal year 2021, the net earnings of Saputo were valued at $625.6 million. This was an increase of $42.8 million or 7.3% compared to $582.8 million for the fiscal year 2020. But the net earnings again declined by (-56.2%) during 2021-2022. (Source)(Source)

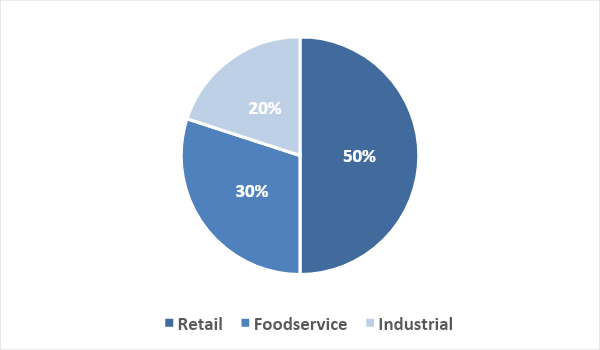

Revenue Breakdown as per Segment

In 2022, the revenue of Saputo was valued at CAD 15.04 billion and was broken down into three market segments through which the sales were made. (Source)

Investment Firms Sentiment Towards Saputo

Spruce Point thinks Saputo’s growth is declining.

Spruce Point states that dairy/milk consumption has been dropping in Saputo’s core markets. As a result, Spruce Point believes that dairy farmers must invest significant cash in modernizing their farms to battle emissions, raising their selling costs to milk and dairy processors such as Saputo.

Saputo had been sheltered, but one of the things impacting them and everyone else in Canada is the shift away from brands and into private-label jug milk. Canada was behind the Standard of Identity categorization in the dairy industry, which regulates what a producer must conform to call itself a producer. The margin is generally less in these categories since it is hard to differentiate. Saputo has grown approximately 0%–1% organically in Canada. Cheese growth in the United States has halted, ice cream remained static, while some other categories are increasing.

Saputo was far too enthusiastic about the availability of milk. However, local files revealed significant margin declines in the amount of milk. In addition, Saputo has mentioned SKU optimization, the need to minimize complexity in its commercial, manufacturing, and supply chain activities, and reported severe challenges in the US sector.

Spruce Point remained concerned about Saputo’s rising environmental compliance costs, resulting from the company’s outdated manufacturing facilities and recurrent compliance difficulties. According to the Guardian, Saputo has yet to adequately respond to all of the UK Environmental Agency’s concerns. According to Spruce Point, Saputo has an unsustainable cost structure in a low-growth, low-margin industry.

Moody’s changes Saputo’s outlook to negative

According to Moody’s Investors Service, there are execution risks and higher investment associated with Saputo’s 4-year strategic plan implementation during increased operating volatility. In addition, Saputo experienced continuous cost inflation, labor shortages in the United States, and supply chain interruptions that hampered its ability to reduce leverage (debt/EBITDA) to 3x over the following 12 months from 3.5x as of December 31, 2021. As a result, several reasons interfered with Saputo’s Baa1 rating, according to Moody’s. Including,

- Saputo’s narrow product focus in dairy and cheese processing,

- Lower brand recognition and weaker margins relative to peers,

- Execution risks and higher investment associated with the implementation of Saputo’s 4-year strategic plan. (Source)

Top Partnerships Made By Saputo

Saputo Dairy UK and Hochland Deutschland GmbH for the Cathedral City brand expansion

On January 01, 2022, Saputo Dairy UK and Hochland Deutschland GmbH reached a long-term partnership to manage the cheddar cheese brand Cathedral City in Germany and Austria. The partnership aimed to take over responsibility for the Cathedral City brand in the German and Austrian markets, expand its distribution nationally in both countries and further develop the brand. Cathedral City has been the biggest cheddar cheese brand and established a more extensive footing in Germany and Austria through collaboration. Both companies combined their strengths and jointly addressed the existing potential in the cheddar segment in Germany and Austria. (Source)(Source)

Partnership with Grand défi Pierre Lavoie (GDPL) to embrace healthier lifestyles

In 2019, Saputo renewed its long-standing collaboration with the Grand défi Pierre Lavoie (GDPL). Over four years, Saputo invested over $2.1 million to fund two hallmark events and support this societal transformation of embracing a healthier lifestyle. The two events were La Course, a 270-kilometer youth running relay, and the 1000-kilometer bike relay. Saputo values community involvement. The Company donates 1% of its pre-tax profits to community programs and organizations that promote a healthy lifestyle for people of all ages yearly.

Sandy Vassiadis, Vice President, Communications and Corporate Responsibility at Saputo, said, “Saputo is delighted to renew this long-term partnership. We are committed to promoting healthy lifestyle habits for our employees and our communities, and the GDPL helps us deliver on this Promise. Our employees embrace the principles of active living, and this is a wonderful forum for them to do so in a way that betters the community at large.” (Source)

Saputo and La Tablée des Chefs for teaching high school students basic cooking skills

On May 07, 2019, Saputo announced the expansion of its partnership with La Tablée des Chefs. The new three-year commitment totaling over $500,000 was primarily aimed to benefit the Kitchen Brigades program focused on teaching high school students basic cooking techniques and the importance of a healthy lifestyle. With the Kitchen Brigades program active in 145 schools across Canada, Saputo’s contribution assisted La Tablée des Chefs in reaching more than 200 schools coast-to-coast by 2020.

“Providing high quality, nutritious products is part of our daily operations, while promoting a healthy lifestyle is at the heart of our values. By helping to promote smart eating habits and culinary skills, La Tablée des Chefs’ mandate aligns nicely with our objective to improve the well-being of those living in the communities where we operate,” said Sandy Vassiadis, Vice President, Communications and Corporate Responsibility at Saputo. (Source)

Saputo and 4-H Canada to support youth participating in cow and goat programs

In 2018, Saputo and 4-H Canada announced a three-year partnership on World Milk Day. This partnership aimed to support the more than 4,200 youth members participating in 4-H dairy cow and goat programs across the country, providing them with grants, awards, and opportunities to attend provincial, national, and international conferences to meet and share with other youth who are similarly passionate about dairy. Saputo contributed $660,000 over the next three years, investing in youth development within local dairy clubs, national and international dairy youth conferences, internships, contests, and the Careers on the Grow platform. The partnership also helped encourage youth members nationwide to explore careers in the dairy industry through global internships and 4-H’s Careers on the Grow job search platform. (Source)(Source)

Saputo and KidSport to remove financial barriers to Sports

On January 25, 2018, Saputo partnered with KidSport to remove the financial barriers to sports, such as registration fees and equipment costs. Since partnering in 2018, Saputo’s $1.2M total contribution has helped reduce financial barriers for families and enabled close to 4,000 children and youth to participate in organized sports in Canada. On February 09, 2021, Saputo and KidSport announced a three-year partnership renewal as Saputo continued striving to help get more children and youth off the sidelines and into the game.

“Since the onset of our partnership over three years ago, KidSport has truly exceeded our expectations as a passionate and engaged partner committed to improving the lives of children in need across Canada. Our goal is to help build healthier communities where we work, live, and play, and KidSport certainly knows how to make positive change happen in an impactful, meaningful, and lasting way,” said Sandy Vassiadis, Vice President, Communications & Corporate Responsibility at Saputo. (Source)(Source)

Saputo USA and Hyperlight Energy to partner to reduce greenhouse gas emissions.

In December 2021, Saputo USA and Hyperlight Energy announced a collaborative partnership that aimed to reduce greenhouse gas (GHG) emissions cost-effectively in an industrial setting. This partnership highlighted Saputo’s commitment to pursuing sustainable business practices as it sought to safeguard the environment while continuing to grow as a world-class dairy processor. In February 2020, Saputo pledged to make significant progress on its climate, water, and waste performance by 2025, with targets including reducing the CO2 intensity of its operations by 20%. Renewable energy initiatives, such as Hylux, were part of this strategy.

Saputo Dairy USA Director of Corporate Responsibility Kalee Sanino said, “We are committed to doing our part to help transition to a net zero food system by 2050. We see this collaboration with Hyperlight Energy as a way to leverage our strengths for the greater good and contribute to solving sustainability challenges present in today’s food system.” (Source)

Saputo Dairy UK and Wipak UK Ltd. partnered to reduce plastic waste.

Saputo Dairy UK partnered with Wipak UK Ltd to reduce the use of virgin plastic by 33%, using post-consumer recycled (PCR) material instead. The companies collaborated to create a packaging solution for Saputo’s block cheese products, supplied to leading retailer Marks & Spencer. According to Seb Wakerley, External Sales Executive at Wipak UK, “By sourcing PCR resins, we were able to manufacture a packaging solution that repurposed waste and diverted it from landfill or incineration.” Saputo Dairy UK’s Lead Packaging Manager, Neil Richards, states that this PCR project is a significant step towards the company’s pledge to accelerate global waste performance, reduce material use, increase recycled content, and ensure that all packaging is either recyclable, reusable or compostable by 2025. (Source)(Source)

Saputo Dairy UK and English Heritage & Cadw

In May 2020, Saputo Dairy UK announced the renewal of its Country Life British butter partnership activity with English Heritage and the Welsh historic environment service, Cadw. The campaign ran a whole year and once again offered consumers an exclusive ‘2 for 1 entry’ mechanic across promotional packs of Country Life butter, granting shoppers a complimentary entry with every purchase of a full-price adult ticket to English Heritage and Cadw historic sites across England and Wales. (Source)

Future Outlook

Saputo planned significant capital investments and consolidation activities in 2023 to further streamline and improve its manufacturing footprint in its USA Sector. In addition, construction is underway on a greenfield site in Franklin, Wisconsin, to consolidate and modernize the Company’s cut-and-wrap operations.

This new facility represents a CAD 240 million investment and is expected to be fully operational by the third quarter of fiscal 2025. The new initiative is expected to create 600 new jobs. The Company also plans to close its Big Stone, South Dakota, and Green Bay, Wisconsin, plants in the third quarter of fiscal 2024 and 2025, respectively. The three facilities’ closures will affect around 720 employees, who can relocate to other Saputo plants.

Strategic investments, a streamlined footprint, and optimized facilities will set the stage for notable improvements in our operational performance as we consolidate activities into world-class facilities. Also designed to increase production capabilities in some of our higher-margin value-added product categories, these initiatives will fuel our aspirations to further enhance our value proposition as a high-quality, low-cost processor in the USA.

– Lino A. Saputo, Chair of the Board, President, and Chief Executive Officer at Saputo

Saputo’s 2025 Supply Chain Pledges aim to address sustainability concerns and facilitate the dairy industry’s transition to net zero. To increase operational efficiency and competitiveness in Australia, the company has introduced several initiatives expected to result in yearly savings and benefits starting in the fourth quarter of fiscal 2023, reaching CAD 14 million by 2025. (Source)(Source)(Source)(Source)

Lino A. Saputo, Chair of the Board and Chief Executive Officer of Saputo has stated that the company’s strategic plan will involve reducing the number of plants in their US and Australian networks, with some minor adjustments in Canada and the UK. The two plants in Argentina are already running efficiently, so less tweaking will be needed there.

Next Read: Don’t miss this Dairy Industry Competitive Analysis of Arla Foods!

Authored By: Vipin Singh, Market research

Edited By: Nidhi, Marketing