As an innovation manager in the energy storage domain, you should not overlook the opportunity Distributed Energy Storage System brings to the table. Its advantages are clear, and its growth potential is substantial. Of all the energy storage trends we’ll see in 2023, DES will play a crucial role in addressing the energy crisis as the market grows. Here’s how.

DES combines advanced technologies and lithium-ion batteries to effectively store and manage energy within a power distribution network. Adopting DES enhances energy efficiency, strengthens grid stability, and boosts the integration of renewable energy sources. With DES, buildings can act as active participants in the electricity distribution system, allowing them to store energy for later use and reduce peak time charges. This is achieved by smoothing out timing differences between energy production and usage.

The system comprises a bi-directional inverter and DC-charged batteries housed in a robust chassis for reliable performance in even harsh conditions. So, what does the market size of DES look like?

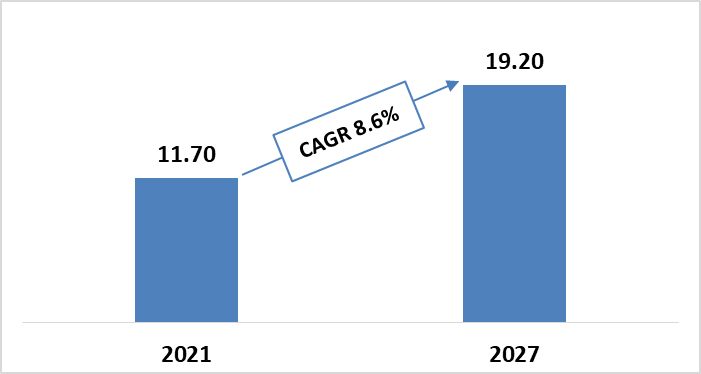

Global Distributed Energy Storage Market

The global DES market was valued at $11.70 billion in 2021 and is expected to grow to $19.20 billion by 2027 with a CAGR of 8.6%. The Asia-Pacific region holds the largest market share, driven by rising electricity demand, increasing buying power, and investments in renewable energy initiatives.

The International Energy Agency (IEA) estimated that the annual expenditure needed to fulfill global energy demand would reach $1.9 trillion in 2021. Distributed energy storage systems assist in the conservation of excess energy generated for use during power outages. In 2021, according to the IEA, China’s investments in renewable energy production were approximately 30% of global investments. (Source)(Source)(Source)

Distributed Energy Storage System Advantages

Significant environmental benefit – Distributed energy storage is an important component of modernizing the energy system by offering smart grids and related services. There will be significant climate advantages if it is used to increase reliance on renewables. Electric vehicles utilized as distributed energy storage can greatly impact the environment.

System-level capacity – DESSs add value to the system by deferring or avoiding investment in generation and transmission assets. Their utilization capacity determines DESSs’ system capacity value during peak load times. When DESSs are utilized to enhance supply or reduce consumption on the grid in place of central generators that would normally be employed in the event of a contingency, such as a forced outage, they provide operating reserve value. (Source)(Source)

Distributed Energy Storage System Challenges

Expensive setup and battery costs – The upfront cost of distributed energy storage systems is significant, and the ongoing maintenance costs are even higher. Rising pricing of numerous key minerals used in battery manufacture, supply chain disruptions caused by the Russia-Ukraine conflict, and COVID-19 lockdowns in some regions of China have all acted as a barrier to the expansion of the market.

Thermal exhaustion and expensive capital investment – Even though the Distributed Energy Storage industry is quickly expanding, the thermal instability issue of batteries is impeding its expansion. Internal cell faults, mechanical failures or damage, or excess voltage are the primary causes of thermal runaway, which results in high temperatures, gas buildup, and potentially catastrophic rupture of the battery cell, ending in fire or explosion. Aside from that, this market necessitates a substantial capital expenditure to manufacture such a system. As a result, the aforementioned issue will hinder the expansion of this market. (Source)(Source)(Source)

Distributed Energy Storage System Companies

1. Siemens

To address the challenges of cost, supply security, and CO2 reduction while providing a sustainable industry-specific solution, Siemens delivers an optimized mix of distributed energy resources (DER) supported by smart energy management.

It incorporates various fossil and renewable energy generation technologies (diesel, photovoltaics, wind, combined cycle power plants, and combined heat and power systems). Long-term energy storage systems, such as electrical or hydrogen storage systems, are used to store energy.

Siemens’ energy management solutions ensure that power generation, consumption, and storage are controlled in a dependable, optimal, and efficient manner. Furthermore, Siemens software can adapt the distributed energy solution to the energy market. (Source)(Source)

Important Deals

In 2019, Siemens strengthen its distributed energy resources (DER) potential by acquiring KACO‘s new energy string inverter business. (Source)

In 2020, Macquarie Group and Siemens AG established Calibrant Energy, a venture that would invest in the emerging energy-as-a-service (EaaS) industry in the United States. Calibrant Energy would create the energy infrastructure at free cost and then manage it for businesses, municipalities, and hospitals. (Source)

2. Johnson Controls

Johnson Controls provides distributed energy storage (DES) solutions to address the ongoing demand to minimize environmental impact. The rechargeable lithium-ion battery is the core of Johnson Controls’ DES systems. The company’s distributed energy storage solutions combine massive arrays of industrial-strength lithium-ion batteries with specialized software and control systems to enable flexible energy optimization. The DES system can integrate with utility system infrastructures to absorb excess grid power or contribute needed electricity to sustain the entire power grid. (Source)

Important Deals

In 2022, Johnson Controls announced the acquisition of Asset Plus, a specialist provider of energy reduction and zero-carbon measures for the UK public sector. Asset Plus provides strategic guidance and project management for energy efficiency measures and retrofitting in complicated building settings. This includes low-carbon heating via Air Source Heat Pumps, low-energy LED lighting, and solar power integration, which are critical in assisting businesses in achieving critical net zero carbon emissions. (Source)

In 2022, Johnson Controls announced a partnership with 3Degrees that aims to accelerate building owners’ and operators’ progress toward net zero by leveraging 3Degrees’ large-scale environmental commodities solutions, such as Renewable Energy Certificate (REC) transactions, long-term renewable energy sourcing, carbon credit portfolio, transportation decarbonization, and climate advisory services. (Source)

3. ABB

ABB provides a Distributed Energy Storage (DES) system, a packaged solution for storing energy for later consumption. The two essential components of the system are the DC-charged batteries and the bi-directional inverter. This equipment is enclosed in a shipping-friendly shell that can tolerate harsh conditions.

ABB’s DES system includes peak shaving, load shifting, voltage management, renewable integration, and backup power. (Source)(Source)

Important Deals

SMC Global Power Holdings Corp. (SMC), one of the Philippines’ major power suppliers to the national grid, teamed with ABB to deploy BESS facilities as part of its nationwide BESS Project to help improve grid performance. The contract won by ABB in 2019 would support two 20 MW installations and an additional 40 MW facility, both of which have been operational since 2021. The remaining locations were to be operational by 2022. (Source)

Distributed Energy Storage System Startups

1. MET3R

MET3R assists businesses with electric car fleets in optimizing charging sessions, reducing grid impact, and making their operations more sustainable. The business also assists grid management in better understanding and controlling EV charging demands and monitoring the status of distributed energy assets (DERs) on the low-voltage network.

One of its products, ZenGrid, provides grid managers and utilities with a 360-degree perspective of the network and connected managed assets via a single interface. (Source)(Source)

2. ChargeNet Stations

ChargeNet Stations focuses on SaaS, cleantech, electric vehicle supply equipment, and distributed energy resources.

The firm is constructing the most extensive EV charging network in the United States, offering sponsored charging to drivers in places they visit frequently.

ChargeNet’s Stations software platform enables quick-service restaurants to provide consumers with a superior EV charging experience while fulfilling their hunger. ChargeNet’s hardware-agnostic SaaS platform, ChargeOpt(TM), combines EV chargers and renewable energy to turn parking lots into profit centers. (Source)(Source)(Source)

Important Collaborations

In 2022, ChargeNet Stations collaborated with ChargerHelp! to increase uptime for ChargeNet Stations’ rapidly increasing network of quick-service restaurant parking lots across California. (Source)

3. Synthica Energy, LLC

Established in the United States, Synthica Energy provides bioenergy conversion plants to generate renewable natural gas. Each year, they divert one million tons of organic feedstocks from landfills and produce enough energy to power 30,000 homes. The startup’s anaerobic digestion plants are safe renewable energy facilities incorporating modern engineering and safety technologies. Furthermore, the technologies are compatible with existing energy and gas infrastructures, necessitating no system changes. (Source)(Source)(Source)

Important Collaborations

In 2021, Hamilton RNG Holdings, LLC signed definitive agreements to develop innovative food waste digester projects in Ohio and Kentucky to produce renewable natural gas (RNG). Hamilton RNG is a partnership between UGI Energy Services, a division of UGI Corporation, and Synthica Energy, LLC. (Source)

4. NineDot Energy

NineDot Energy develops innovative energy solutions that make urban areas cleaner, more resilient, and less expensive. The company’s current development priority is constructing and operating battery storage facilities in the New York City metropolitan area. They also focus on enabling vehicle-to-grid (V2G) capabilities in their projects. (Source)

NineDot Energy has spent years figuring out how to operate in New York City’s crowded and ever-changing distributed-energy market. In 2022, the company announced plans to invest $100 million in developing, building, and operating 1.6 gigawatt-hours of sustainable energy systems by 2026, focusing on lithium-ion battery installations in very small individual packages of 5 megawatts or less. (Source)

Important Collaborations

In 2022, Revel, NineDot Energy, and Fermata Energy announced that the first Vehicle to Grid (V2G) program connected to the New York City grid is currently operational at Revel’s Red Hook, Brooklyn warehouse. Revel collaborated with Fermata Energy and NineDot Energy to develop a bidirectional charging system that can charge and discharge electric vehicles (EVs) to transmit energy stored in their batteries back to Con Edison’s grid in New York City. (Source)

5. VOLTA Reserve Power

Distributed energy resources can also serve as backup generators in the event of a power outage. These include instances following heavy storms or days with high energy demand. The distributed backup generation is linked to the lower-voltage distribution lines of the electric utility. It helps to offer clean, reliable power to more users while reducing losses along power lines.

VOLTA is a startup established in the United States that provides scalable platform solutions for renewable energy and sustainable green buildings. They create battery backup generators to store energy provided by renewable sources. They then discharge the stored power to specific loads or applications such as emergency backup, peak shifting, load allocation, and demand response. (Source)(Source)(Source)

Important Deals

In 2021, Volta Power Systems collaborated with specialist vehicle maker Draxxon on the DX-816 fully-electric towable command center. The DX-816 center enables enterprises to incorporate drones, or Unmanned Aircraft Systems (UAS), into the other control and command systems whenever additional surveillance is required. (Source)

Conclusion

Currently, distributed energy storage is used on a small scale and is generally based on batteries. These systems are expensive, and policy incentives, such as time-of-use electricity pricing, are not always available. However, this is beginning to change as battery prices drop and utilities seek to avoid costly infrastructure upgrades.

Additionally, increased use of distributed generation has provided incentives for using distributed energy storage. Distributed storage is poised to become a major part of the energy system in the future.

Interested in other energy storage trends of 2023? Download our exclusive report by filling out the form below:

Authored By: Vipin Singh, Market Research

Edited By: Nidhi, Marketing