As a seasoned innovator or senior patent counsel, you likely recognize that selling patents can be a swift avenue to generate income. However, it’s easy to fall into the tempting belief that merely obtaining a patent will automatically attract multimillion-dollar offers from eager buyers ready to bring your invention to market.

Because reality rarely aligns with such lofty expectations.

Nevertheless, understanding how to enhance the value of your patents before entering the market is essential. If you’ve been actively seeking strategies on how to sell a patent, our article is here to provide invaluable assistance.

Increase the value of your patents before selling them

Thorough due diligence and innovation strategies can help elevate the value of a patent manifold. Customizing your marketing strategy according to a prospective buyer can make a huge difference and impact, which likely cannot be attained using a “one shoe fits all” strategy.

But the main question is how do you craft such a strategy to sell a patent?

Well, this is where GreyB enters the picture. In our years of experience and expertise in the field of technology and IP analysis, we have devised the means to create tailored pitch decks and other marketing materials for your patent portfolio. This package can allow you to curate the value attached to your asset according to the interested parties and help you fetch a better price for it.

Best of all, we are just a click away:

Real-Life Success Story of Unlocking Maximum Value of a Patent Portfolio

Tom came to us with a set of patents related to minimally-invasive surgical methods to treat a particular condition and had the prospect of putting a dent in the norm. The current practices involved high-risk, invasive, and cost-inefficient surgeries. He wanted to sell the patents but did not know exactly how to. On taking charge of the case, we used a 360-degree approach to unlock the maximum value of his patent set before locating the right buyers.

Firstly, we conducted a patent due diligence – strength check, freedom to operate, ideas to file for continuations in part, as well as get the patents and the technology reviewed in an unbiased way by some of the leading industry experts in the domain, to build a solid case demonstrating the real impact that those patents carried. In case the due diligence pushes out information that works negatively against the portfolio, then we have the liberty to prepare in advance and try to offset some of the problems.

For example, a strength check study can reveal some of the hidden qualities within the portfolio, as well as put the patents against a strong prior art test to see if there are any amendments we can make to the current portfolio, file continuations in parts, etc. Freedom to operate search can help provide a clear picture of how the business can plan its expansions in other geographies and add untapped new value. For example, the potential buyer can get an idea of markets they can expand into after acquiring these patents.

In our project, we found that India and Africa have an emerging demographic that was largely uncaptured, and these patents can be used to tap into that market as well. Since Tom’s surgical patents were issued recently and in case of an acquisition, there is enough time for the prospective buyer to file continuation and continuation-in-part patents around Tom’s patents.

Tom had little budget actually to build a prototype and get it tested, so we brought several experts on board to review these patents and give a detailed review on how functional these patents were.

The figure is for representative purposes only

Further, we looked at the market trends and insights to see the CAGR of the market, which demonstrated a steep rise over the coming years.

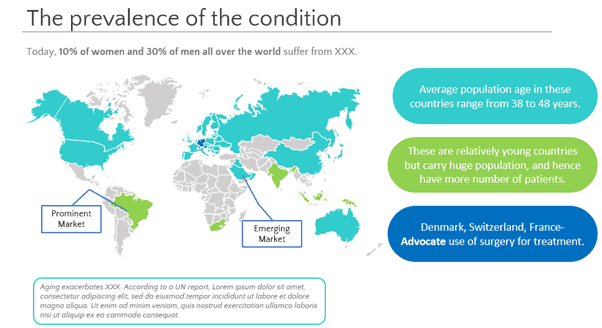

We also studied all the patent lawsuits, judgments, and appeals regarding current market products and tried to understand if the portfolio could offset some of the most daunting issues plaguing this surgical domain today.

An infringement study was also conducted to see if there was any product in the market that infringed those patents or vice versa. This way, we were able to prepare some very strong marketing materials that demonstrated a clinical and market case for the patents.

Then, we were able to build a strong financial case for the patents – from the patent purchaser’s point of view, it is extremely important to understand that they may need a clear picture of how a set of patents can help them make commercially viable products as well as offset some of the costs in order to make a competing product as a new sector entrant.

The below image is taken (recreated for confidentiality reasons) from the marketing materials we made for Tom to present to prospective buyers. It describes how his patented method compares to other products available currently.

Figure for representative purposes only

With the IP angle covered, we next checked market trends to help set the right value for the patents

We dug deep into the current surgical costs (even considering revision surgeries that occur due to complications that arise post-surgery), hospital costs, the role of insurers and health systems as payers as well as how much-uninsured people are willing to pay to get rid of these condition they were suffering from. We crunched the numbers to estimate how a rollout of our product will impact each of the above aspects to replace the current methods.

This helped make a very convincing value case for the patents that was based heavily on facts over abstract numbers. This also helped us answer a lot of questions that may be asked by prospective buyers and cleared a lot of fog.

Finding the right buyers to sell a patent

Through multiple approaches, we already had value for Tom’s patented tech. However, the actual task was to locate actual buyers for it.

We divided our prospective buyers into various categories and curated the marketing materials which better served their interests.

For example, the perspective of a venture capitalist is very different from a Fortune 500 company already in the field or an emerging technology company. This helped garner interest from active players in each of these domains, as the pitch deck and related materials addressed some of their questions on the get-go, to finally closing a deal that fetched far more value than it would have by simply placing the portfolio on an IP brokerage website.

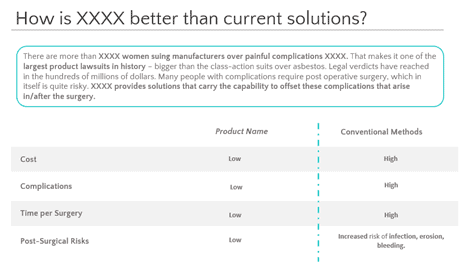

“I get that you did a lot of research, but how much really? I mean, how do I know how good you guys are at it?” – If you were thinking on the above lines, the below table should clear some doubts.

This is all the data we collect for each company, and we craft marketing material accordingly before reaching out to them for sale. We are pretty comprehensive.

| Data Extracted | Significance |

| Company Name | Name of the company |

| Category | Type of company – Corporate, Private Equity, Venture Capital, etc. |

| Priority | A priority rating is given based on a discussion with the client. Indicates whom to approach first. |

| Analyst Comment | Extra insights and comments from the analyst |

| Contact Details, Geography of Operation | The details of relevant business contacts, addresses, geographic areas of operation, etc. |

| Merger & Acquisition History | Merger and Acquisition information can give an insight into a company’s business goals. |

| IP Activity in the Tech domain | Relevant IP activity and portfolio in relevant tech domains to gauge the prospective interest of the company as a buyer of IP. |

| Revenue in the Tech domain | Revenue information can give an insight if the company’s profitability in the operating tech domain, which increases the chances of a sale. |

| Relevant Business Tie-ups | Business Tie-ups are another way to gauge a company’s strategic interest. |

| Litigation history | A litigation-happy company/a defensive company could be very interested in buying the IP portfolio for legal attack/defense purposes. |

Exemplary data is collected before the company reaches outs for sale.

The final step before contacting a probable buyer for your patent!

In Tom’s case, one strategically important activity that added a great deal of value was that we identified a cluster of suitable third-party companies with technology or patents that Tom would need to own or license that could either be engaged or acquired in order to solve possible infringement and time to market issues.

These cluster companies had the necessary turn-key expertise or services needed to move Tom’s patent through prototype and testing to production without him having to invest in developing those abilities on their own.

Essentially, we created a more or less complete strategy for an acquiring company to make a cogent business decision by showing and sourcing the technical capabilities required to bring our client’s patents and technology from paper to market with a reduced risk profile for development.

This was a win-win for both Tom and the company he would sell his patents to. The end client got a great patent portfolio that helped them bring the idea to market, and Tom got great value for his patents.

Conclusion

It is evident that the process of optimizing and selling a patent portfolio is comprehensive and, at times, time-consuming. Each set of strategies and tactics will vary depending on the unique characteristics of the patents and the market landscape. However, it is essential to remember that you need not navigate this intricate journey alone.

Consulting experts in the field, who have the knowledge and experience to navigate the intricacies of how to sell a patent, can prove invaluable.

Whether you are an inventor, an organization, or a law firm, remember we are just a click away.

Authored by: Sparsh Gupta, Infringement Team, and Matt Miskimin, Senior Adviser.