The future of connected things, which seemed a little sci-fi just a few years ago, is now right at our doorsteps. Gadgets for smart homes, connected cars, industrial sensors that share data every second, and all the building blocks of this future are being tied together by 5G.

It has now become more important than ever for companies from various niches to join the innovation race of 5G and secures their share in this huge market, which is only going to get bigger. In fact, according to sources, the 5G industry is expected to become a USD 277 Billion Market by 2025, registering a CAGR of 111%.

Be it consumer electronics manufacturing companies, telecom giants, or industrial equipment makers, everyone wants to get their share of this multi-billion dollar market and the competition is fierce.

But do you know where this competition is even more intense?

Among the 5G chip makers.

Since these companies are going to make the backbone hardware for almost all kinds of 5G based devices, the stakes are pretty high here.

How high?

Well, according to different forecasts, the global 5G chipset market – which was valued at USD 1-1.3 billion in 2019 – is expected to reach USD 22.41 Billion by 2026 and USD 40.45 billion by 2027.

(MarketsandMarkets) (Grandview Research)

It is going to register a double-digit CAGR between 2019 and 2027, becoming a multi-billion market in the coming years.

Now how this competition is going and who are the players?

To get a handle on the research activity and other variables by the players, we decided to explore every aspect and conduct detailed research on the 5G chipset domain, which resulted in this report.

Just like the huge future of this market, our insight-rich report ended up being pretty huge too (30,000+ words). To make it easy to consume, you can get a PDF copy for later reading too.

The PDF also covers a lot of aspects in detail and contains a lot of other information that we weren’t able to add to the article. You can grab a copy by filling this form below.

Global 5G Chipset Market: Market Dynamics

Key Drivers

1. Increased Demand for Mobile Data Services

A 5G chipset happens to be an essential component for 5G-enabled smartphones, laptops, routers, and telecom base stations.

The 5G standard network is expected to significantly affect the growth of mobile broadband users. The early adoption of 5G subscriptions is estimated to cause higher prices, but these prices are expected to drop down gradually with the evolution of 5G technologies. This is expected to increase the number of 5G mobile broadband users and thereby enhance the growth of the 5G chipset market.

The demand for mobile data services is primarily driven by the growing use of services and applications in both consumer electronic devices and business-to-business (B2B) communication systems that are currently using/testing data-intensive applications such as virtual and augmented reality, and 3D and ultra-HD video content. Growing mobile data traffic would force network operators to provide more bandwidth to consumers; this factor is expected to propel the demand for 5G mobile broadband technology in the future.

The establishment of a 5G standard requires very high infrastructure cost in the deployment of multiple low-power base stations (small cells) to meet the growth in demand for higher network capacity. The continued emphasis on developing new and innovative chipset modules for telecom base stations to reduce the overall size and power consumption is expected to open new opportunities in the market for 5G chipsets over the forecast period. These 5G chipset components are capable of operating within the mmWave band of frequencies. They are designed to reduce the base station power consumption, size, and weight by 25%.

2. Increased Demand for IoT Connections

Internet of Things (IoT) continues to proliferate throughout the globe as several smart cities, smart infrastructure, and smart grid projects are being undertaken in different parts of the world. According to GVR’s report, global IoT connections are anticipated to exceed 2.5 billion by 2027. Several manufacturing companies have started deploying IoT devices to monitor machine performance in real-time to reduce the overall downtime and enhance operational efficiency. The subsequent increase in demand for IoT devices is expected to drive the demand for new 5G chipset modules over the next few years.

3. Increased Demand for M2M Connections

Machine-to-Machine connections are the technologies that typically use sensors to capture data and provide critical input to various types of machines to perform different tasks. These technologies require high bandwidth throughput and extremely low latency for higher performance. An increase in the number of applications, which require M2M connections is real-time shipping, smart logistics, autonomous driving, immersive commerce, drone delivery, flexible manufacturing, immersive entertainment, disaster management, and precision agriculture. Some of the applications, such as drone delivery are at a nascent stage. However, the drone application is expected to be used significantly with the evolution of the 5G network, which in turn is expected to offer a huge 5G chipset market opportunity.

Key Restraints

1. High Hardware Cost

Factors such as the cost as well as the scarcity of the system in comparison to its counterparts are two major restraining factors for the 5G chipset market.

Continuous increase in data traffic within mobile broadband systems and growing demand for improved data rates from various end-use applications are expected to create a need for the densification of radio access networks or deployment of additional network nodes. To achieve network densification using small cells, wide-scale deployment of fiber optic cable is required.

This infrastructural upgrade is likely to be first rolled out in brownfield sites in the most densely populated locations, followed by greenfield deployment in new cell sites. Network densification in high-frequency 5G bands (mmWave) that are prone to signal loss is anticipated to play a major role.

The deployment of additional optical fiber cables and small cells will draw huge investment for the successful rollout of 5G services. Software-defined network and network function virtualization — which promise to reduce the total capital expenditure involved in 5G — are still in the R&D phase.

This factor is expected to have a high impact on the 5G rollout in the coming years.

2. Data Security and Information Privacy

Data security and information privacy concerns can potentially impede the adoption of the 5G chipset components over the next few years. Concerns over the security of the data being exchanged over next-generation networks are rising all over the world. Several governments have responded to these concerns by drafting favorable policies and stringent regulations to ensure data security and information privacy.

3. Economic Impact of COVID-19

The recent shut down of businesses across China, owing to the threat of Coronavirus, is expected to influence the 5G chipset market negatively, as prices may increase over time, due to no production and exhaustion of stocks maintained by the manufacturers in few months.

The effect of coronavirus is growing on the global technology supply chains, impacting the various interconnected sectors of the electronics industry. With the outbreak of the virus at the dawn of 5G’s mainstream deployment phase, it has the potential to intrude on the progress of the next-generation wireless standard, as the crisis slows or threatens to slow the production of key smartphone components, such as semiconductor chips and displays.

Key Opportunities

1. Development of 5G Technology

The 5G chipset market is set to experience exponential growth because of its wide range of applications. Studies and research on this subject introduced a wide range of areas and spheres where 5G chipsets will have major applications. With the latest technological developments, the market has spread its operations and applications all across the globe.

2. Growing Number of R&D Activities

Growing research and development activities and investments related to 5G in different countries are creating new opportunities for the 5G Chipset Market. In countries such as China, Japan, South Korea, and India, this is the major contributing factor for these regions to be the fastest-growing in the global 5G chipset market.

Additionally, the major market players such as Huawei Technologies, ZTE Corporation, Nokia Corporation, and others are investing a significant amount for initiating the field trials with major mobile service carriers such as China Unicom, China Mobile, and SoftBank. This will further provide lucrative growth opportunities for the 5G chipset market during the next few years.

3. Government Initiatives for Smart Cities

By 2025, it is expected that there will be around 30 global smart cities, and 50% of these are expected to be located in North America and Europe. These steps are supported by global investments, which are expected to amount to USD 1.8 trillion, between 2010 and 2030, in all the infrastructure projects in urban cities. This is one of the major factors fueling the demand for 5G chipsets, primarily owing to their application in smart city connectivity applications.

According to the United Nations, 68% of the world’s population is anticipated to shift to urban areas by 2050. In addition, the total expenditure on the Internet of Things in the Asia-Pacific region is expected to increase at a high rate. For instance, the South Korean government decided to invest $350 million in around 300 companies that it estimates to get globally competitive within the next four years to develop an IoT ecosystem within the country.

Key Challenges

1. Modernization of Policies, Regulations

Currently, there is no structured governance framework regarding the installation and deployment of 5G technology and its infrastructure. The local and national governing authorities can make the deployment easier by defining the policy frameworks that may help in attaining investments. Moreover, simplifying permit processes and regulations regarding building and buying signals by eliminating red-tapism can also help operators. Government authorities can bring together network operators, investors, local governing officials, and the private sector by modernizing policies and regulations.

Thus, policy and regulatory modernization may be a challenging factor for the growth of the 5G chipset market, during the forecast period.

2. Technologies and Infrastructures

Network and design engineers are trying to develop a network that can handle growing data traffic efficiently. While designing such networks, research and design engineers face challenges such as heat dissipation in MIMO antenna and frequency interference in the 5G network.

5G technology is expected to be operated in different frequency ranges, which include low frequencies (f < 1Ghz), high frequencies (1GHz < f < 6 GHz), and very high frequencies (above 6GHz). The millimeter-wave spectrum, also known as frequencies above 6 GHz is required to distinguish the 5G network from 4G.

According to the Regulatory Authority for Electronic Communications and Posts, it is not possible for 5G to run entirely on millimeter-wave frequencies as the propagation qualities of these bands make it difficult to achieve widespread coverage, particularly in more sparsely populated areas. Moreover, these bands are not technologically advanced when it comes to delivering consumer market communication services.

Are you interested in knowing who owns maximum 5G patents? Which companies are leading the race of owning 5G technology through patents? Our exclusive report on 5G SEPs tells who owns the maximum standard patents. The report covers the actual count of 5G SEPs that our research team has manually shortlisted from 12000+ patents. Click here to Read it.

5G Chipset Market: IC Type

Demand for 5G-enabled smartphones and high chipset costs resulted in the largest share of ASIC in the 5G chipset market.

In 2020, the ASIC segment is expected to hold the largest market share, contributing about 48% of the total revenue, and will continue to dominate throughout the next few years.

Further, the mmWave IC segment is estimated to register the fastest CAGR of 55.3% during 2020-2026, owing to the high demand for integrated circuits (ICs) in the automotive sector.

Deployment of 5G networks, which will soon be rolled out at a massive scale, smartphone OEMs and telecom players are rapidly gearing toward this shift. Major telecom service providers, globally, are upgrading their network to 5G to provide ultra-high network and data speeds.

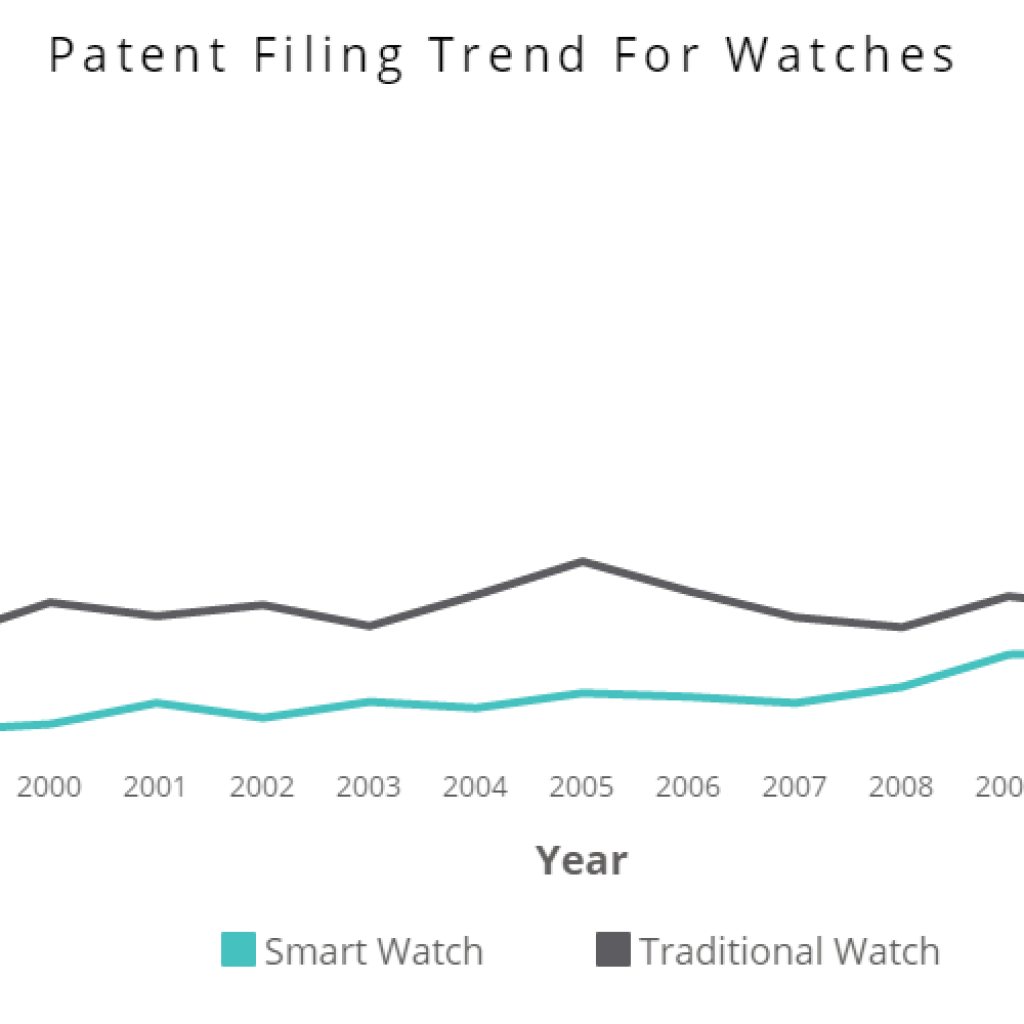

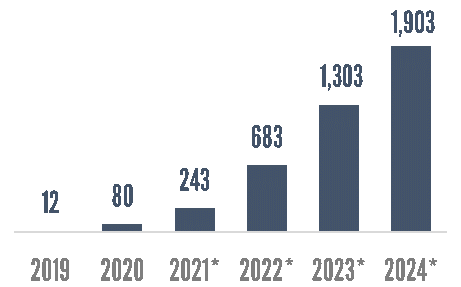

GLOBAL 5G MOBILE SUBSCRIPTION FORECAST, MILLION UNITS, 2019-2024

According to Ericsson’s Mobility Report of June 2019, more than 80 million 5G mobile subscriptions were anticipated, globally, by the end of 2020. This is indicative of the fact that the market is poised to grow throughout the next few years.

Many companies are in the process of developing ASIC chipsets to emerge as early providers and showcase commercial readiness for 5G.

Source: Ericson, *Forecasted

In fact, higher performance increased densities, and decreased space requirements are some of the primary advantages of ASIC technology that are encouraging many 5G chipset manufacturers to choose this technology over others. ASICs-based System-on-a-Chip (SoC) product designs have become popular because they are more power-efficient and have increased operating frequency capabilities, addressing the high-volume, mass production requirements.

However, the technology also suffers considerable drawbacks, which in many cases hinders the growth of ASIC 5G chipsets. Some of the primary disadvantages that 5G chipset designers face with ASIC technology include lack of flexibility, the high price of development, time taking manufacturing processes, and difficulty to test or debug. However, out of all the restraints, high costs, and risks associated with construction time prevent designers from using ASICs.

Also, it has been determined that 50% of all the ASIC designs fail on the first try to operate in the targeted system, increasing the risk of having to do multiple iterations, which lead to delays in the project schedule increasing and also increases the nonrecurring engineering (NRE) costs of the product.

However, recent technological advancements are helping several 5G chipset manufacturers to make use of ASIC technology. The advent of structured ASIC, having elements of both ASICs and field-programmable gate arrays (FPGA) like architecture has led to the cost of production becoming cheaper when compared to a full-blown ASIC, which requires the addition of a modifiable layer on top of the base ASIC layer.

5G Chipset Market: Operational Frequency

The high share of sub-6GHz is attributable to the initial offerings of 5G chipset components supporting the sub-6GHz band by key market players for smartphones, connected cars, and laptops.

The continued rollout of the Industrial Internet of Things (IoT) and the growing popularity of autonomous cars have triggered the necessity for higher bandwidth and faster data networks. The chipset demand for supporting the mmWave band is expected to grow over the forecast period (2019-2027) as a result.

Moreover, several IoT devices would be installed over the next few years in line with the growing adoption of smart home applications and these IoT devices would require high-speed and high-bandwidth connectivity to operate seamlessly. The demand for a new chipset supporting the 5G New Radio (NR) mmWave carrier frequency would increase subsequently, thereby driving the growth of the mmWave segment over the forecast period.

The sub-6GHz + mmWave segment is expected to register a noticeable CAGR over the next few years owing to the continued introduction of the modern chipset components supporting both the sub-6GHz and mmWave bands in a single module.

5G Chipset Market: End-User

The rise in demand for consumer electronics such as smart televisions, smartphones, and other electronics offers lucrative opportunities for the 5G chipset market, globally.

The fastest-growing market belongs to that of the automotive & transportation, which is expected to be affected widely with the introduction of the 5G chipsets.

Autonomous vehicles are expected to become a reality in the coming years with the help of emerging 5G technologies. The current 4G network is compatible with sharing status updates, real-time information, and request rides. This provides a compatible platform for companies, such as Uber and Lyft. However, 4G cannot support technologies that need high speed and give vehicles spontaneous human-like reflexes. This is where 5G comes into the picture. Semiconductor giants such as Intel and Qualcomm, are creating chips that help vehicles convert themselves into data centers on wheels helping autonomous vehicles to make on-site, complex, and real-time decisions.

The consumer electronics market is one of the prominent markets for 5G chipsets across the globe, and it is also one of the fastest-growing industries owing to the growing innovation in technology and the adoption of connected devices. According to ZVEI, German Electrical and Electronic Manufacturers’ Association, the global electric market is expected to reach EUR 4.7 trillion by 2020.

With 5G, the demand for smartphones is expected to increase even further. According to Ericsson’s mobility report 2019, the smartphone subscription by 4G and 2G/3G in 2019 stood at 5.6 billion, and 4G held the major share of the market. Over the coming years, the demand for 5G enabled smartphones is expected to grow significantly.

Moreover, consumer electronics shipments are on the rise as well owing to the increasing global demands, and the demand is further augmented with the advent of connected devices. For instance, according to the Consumer Technology Association, the wholesale revenue of consumer electronics shipments in the US alone during 2019 stood at USD 301 billion, a significant increase when compared to USD 266 billion during the previous year. This growth is expected to further increase with the global deployment of 5G.

With the increasing investments in the 5G network and chipsets, smartphone companies are rigorously investing in 5G-enabled smartphones. It will not only help in catering to the demand at the nascent stage but also boost the company’s market share.

Moreover, consumer electronics is expected to hold a prominent share of the global IoT market currently and will be competing with IIoT for global IoT market share in the next few years. In fact, according to The Internet & Television Association, the number of IoT connected devices is expected to reach 50.1 billion within the next few years from 34.8 billion in 2018. Such developments are expected to further augment the demand for a 5G chipset in the segment.

Besides, smart appliances are expected to see significant applications and observe growth in their sales over the forecast period owing to the increasing penetration of smart homes. Vendors such as Samsung that offer integrated solutions in the consumer electronics space are expected to benefit from such developments. According to Advanced Energy Economy, the smart appliances market revenue in the US during 2018 stood at USD 7,481 million.

Industrial Automation: The manufacturing companies across the world are under immense pressure, due to shorter product and business lifecycles and intense volatility in the business. The profit margins are getting squeezed as the workforce is aging, and components are becoming increasingly more varied and complicated to manufacture.

Internet of Things (IoT), coupled with the 5G network, is expected to enhance the aforementioned business issues associated with industrial automation. The enhanced network provides opportunities for manufacturers to build smart factories and leverage emerging technologies, such as artificial intelligence (AI), machine learning, augmented reality, and automation.

In the future, smart factories are expected to comprise several sensors to monitor various aspects of the working environment. The 5G network is likely to offer low-latency, wireless flexibility, and high capacity performance to the smart factories, enabling them to overcome challenges in the production environment. As a result, it creates immense opportunities for chipset manufacturers to invest mainly in devices used in industrial automation. In industrial automation, 5G acts as an enabler to new operating models. Notably, the wireless industry needs to engage with future customers and potential users.

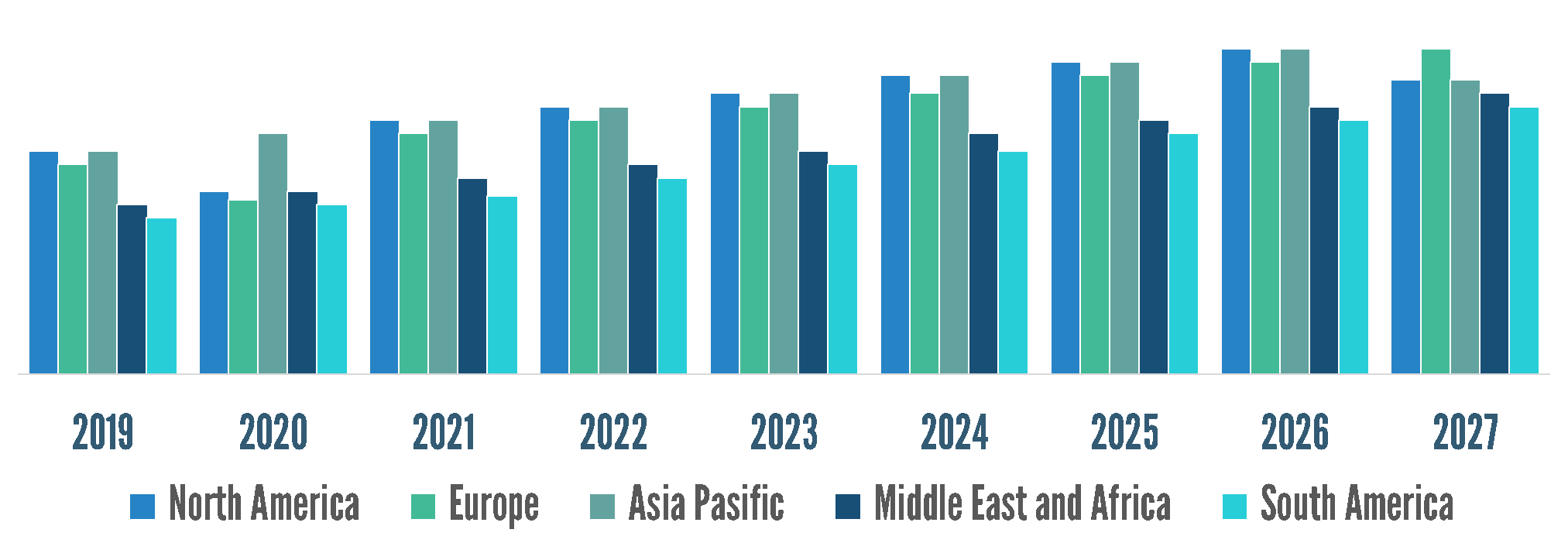

5G Chipset Market: Regional Insights

North America is expected to account for the significant market share of the 5G chipset market, and dominance is mainly due to the high rate of adoption of advanced technologies in the market.

The U.S. remains the engine of growth, accounting for over 90% of the total North American market value. The strong market position of the region is primarily based on several factors including the presence of a large base of established manufacturers, sophisticated IT infrastructure, and relatively greater penetration of technologies like IoT, Big Data, and artificial intelligence across different industry verticals. The multitude of research and resulting investments dedicated to developing next-generation network technologies bodes well for the market growth in the region. In addition, increased initiatives taken by the U.S. government in a bid to ensure better rural connectivity will drive market demand during the forecast period.

The region is home to Qualcomm, a dominant player in smartphone communications chips, making half of all core baseband radio chips in smartphones. It is also one of the biggest U.S. technology companies, playing a major role in the global 5G chipset market.

According to reports from Ericsson, North America is anticipated to lead the 5G mobile technology, with all the major operators stating their intentions to deploy 5G early. By the end of 2023, more than 48% of all the mobile subscriptions in North America are expected to be for 5G, which would fuel demand for 5G chipsets.

The US federal government is planning to build a centralized 5G wireless network across the country by 2021. This is expected to further expand the scope of the market studied in the country. Moreover, the US is witnessing robust investments in building smart homes, deploying smart industries, and rolling out smart cities. At the same time, the preference for high-graphics online gaming is growing among consumers in the U.S. In addition, the country is also emerging as an early adopter of self-driving cars and smart transportation infrastructure. All these developments are expected to drive the demand for 5G chipset components in the U.S.

The Asia Pacific holds the second largest share and this is attributable to the rapid rise in the investments in developing 5G-enabled smartphones and base stations supporting 5G New Radio (NR) frequencies. In this region, Japan, Korea, and China are the key countries where demand is being generated, and the majority of the players are located. Further, the market in the Asia Pacific (APAC) is expected to gain the highest growth. The Asia Pacific is foreseen to become the most profitable business destination for 5G chipset manufacturers during the forecast period 2019 – 2027.

The growth of the 5G chipset market in APAC will mainly be driven by growing developments (such as R&D activities, investments, and partnerships among companies) related to 5G in countries such as Japan, China, South Korea, and India. Companies such as ZTE (China), Huawei (China), Ericsson (Sweden), and Nokia (Finland) are heavily investing in 5G and initiating field trials with some of the leading mobile service carriers, such as AT&T (US), China Mobile (China), SoftBank (Japan), and China Unicom (China). Leading players from different sections of the industry’s value chain are also engaging in 5G network field tests and trials.

The Asia-Pacific region is expected to hold a prominent share of the market, owing to the sheer number of pure-play foundries operating in China and South Korea. According to SEMI, China has the most fab projects, globally, with 30 new facilities under construction. The country’s foundry industry can be split into two categories – domestic and multinational, where international vendors, such as Intel, also operate foundries. The large presence of OSAT manufacturers across the country has enabled the entry of international players in the country. North America follows the Asia-Pacific region in terms of production.

Government initiatives supporting investments in smart city projects and 5G technology are expected to help the 5G chipset market gather steam in the region. Countries including China, South Korea, and Japan are spending huge amounts on developing 5G infrastructure. For instance, China has already laid down a five-year plan covering a USD 400 Billion budget for 5G related investments.

The exponential spread of COVID-19 worldwide had an adverse impact on the 5G chipset manufacturing facilities in the Asia Pacific, which have been temporarily shut, leading to a significant slowdown in production. The outbreak could result in several supply chain participants shifting their production facilities outside China.

According to the data released by the customs department in China, China’s exports have shown a rapid decline by nearly 17% in the first two months of 2020 as compared to the last year. In addition, it has also been analyzed that currently, the overall manufacturing sector in the Asia Pacific has been severely impacted due to the outbreak of COVID-19; thereby, the market for 5G chipset is also hampered in the region.

For instance, various leading players, including Huawei Technologies and Samsung Electronics have showcased a slowdown in their 5G chipset production and exports in the region foreseeing the decline in the global demand for 5G chipsets. Therefore, a decline in the production of these 5G chipsets coupled with temporary bans on international trades in China, the U.S, and South Korea are estimated to hinder the overall market growth over the coming years.

5G market is expected to open a great number of opportunities for a wide range of players in software, hardware, and semiconductors, most of them from Asia, increasing the dependence of the United States on foreign players.

Europe: The 5G chipset market is fragmented in nature due to the presence of several end-users, and the competitive dynamics in the market are anticipated to change during the coming years. In addition to this, various initiatives are undertaken by governmental bodies to accelerate the 5G chipset market further. A stable political climate leads to a few policies and regulatory changes in the European region. Policies in this region are beneficial for the growth of the business, which is one of the reasons behind the development of the semiconductor and IT industry in Europe.

However, after the occurrence of BREXIT, Europe has faced major political fluctuations, leading to frequent policy and regulation alteration. Nonetheless, the region has managed to keep its political issues away from impacting the business growth in European regions. The policies in Europe are certainly favorable for the growth of the market owing to the rising industrialization and commercialization in the provinces, which includes the development of semiconductor components.

GLOBAL 5G CHIPSET MARKET DYNAMICS BY REGION, 2019-2027

5G Competitive Report: 12 Leading 5G Companies along with their Research Activities, Partnerships, and Patent Analytics

Global 5G Chipset Market Observation

The 5G chipset is the principal component in consumer devices, customer premise equipment, and network infrastructure equipment, which allows the end-user to form the wireless network based on the 5G standard. A chipset’s function is to essentially manage the flow of information that passes through the computer for the proper functioning of the computer.

The market for 5G chipsets is still in the developing/testing stage and expected to witness strong growth on complete commercialization, evolving beyond the early adopter stage quickly to reach the mass market in the coming years.

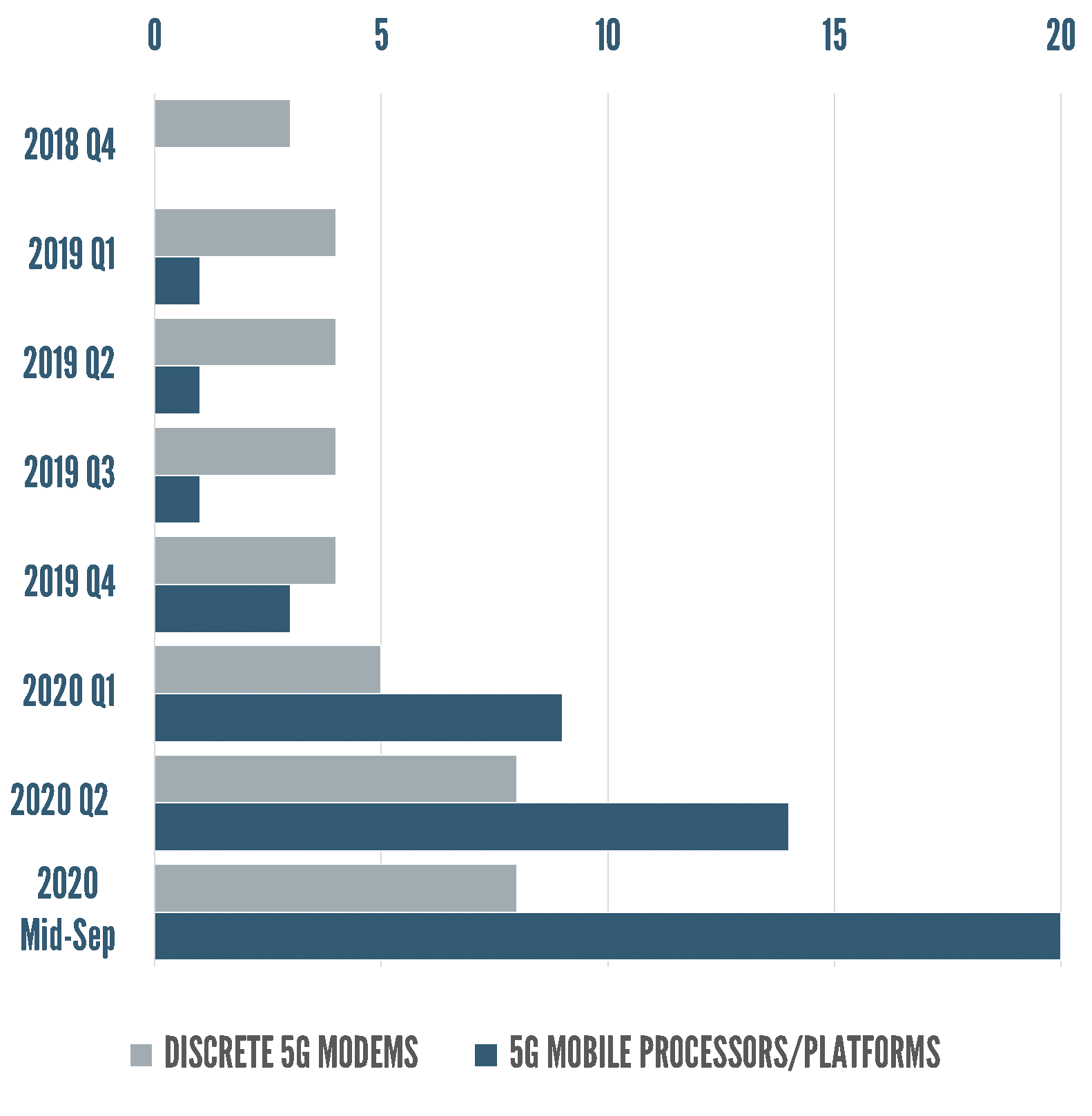

The focus of this report is discrete cellular modem chipsets, as well as mobile processors, SoCs, and platforms (only those containing modems) used in devices with 5G connectivity, as well as chipsets designed for devices using 3GPP-defined IoT technologies. Note that research did not cover information on separate baseband processors, DSP chips, or separate RF front-end transceivers, nor silicon designed primarily for base stations used as network infrastructure.

In recent months, the 5G chipset market has seen several announcements that point to both an increased maturity and competition in the market. While Qualcomm has announced its third generation discrete 5G baseband, the X60, aimed at the high-end portion of the market, several mid-end 5G chipsets have been announced, not only by Qualcomm but also by its competitors.

While the first integrated 5G SoC (System on Chip) announced can be dated back to September 2019 with the Samsung Exynos 980, followed by Huawei/HiSilicon Kirin 990 5G, all targeting the high-end market, the end of 2019 and beginning of 2020 has seen several other 5G SoC announced and launched by Qualcomm (SD765/765G with its updated version the SD 768), Huawei (Kirin 820 and 985 5G), Samsung (Exynos 880) and Mediatek (Dimensity 1000L and 1000+ as well as the lower end Dimensity 820).

This profusion of chipset announcement and launch indicate that competition is going to increase for Qualcomm, especially in China, where the aggressive 5G deployment will also benefit domestic players with the need for affordable 5G phones for mobile carriers. And indeed, the first two months of 2020 were dominated by the expansion of the offering for this segment of the market. The launch of Qualcomm Snapdragon 768, just a few months after the announcement of the SD765/765G in December can indeed be seen as an answer to the likely positioned Dimensity 820 / Exynos 880 / Kirin 820 which all address the same target.

As an indication that the expansion of 5G is set to go on and reach a new lower-end market, Qualcomm announced the Snapdragon 690. Interestingly there are now more 5G SoCs than discrete 5G basebands in the market.

All these new chipsets have in common that they only support the sub 6 GHz frequency range, which is basically the reason for more limited performance than higher-end chipsets supporting mmWave but also for the reduced price range required for the market that they target. Given the initial focus of operators on the deployment of 5G in those frequency bands, especially as new features such as DSS enable further deployment in even lower bands, the absence of mmWave should not be an issue.

COMMERCIALLY AVAILABLE 5G MODEM CHIPSETS, END 2018 TO SEPTEMBER 2020

There is an increase in the choice of chipsets for 5G devices, with products commercially available from Hi-Silicon (Huawei), Mediatek, Qualcomm, Samsung, and UNISOC (formerly Spreadtrum). All five players have been expanding their product ranges.

By September 2020, GSA had identified 20 commercially available 5G mobile processors/platforms and 8 commercially available discrete 5G modems from the five semiconductor companies mentioned above. In addition, GSA had identified 2 pre-commercial 5G modems. The maximum peak theoretical speed claimed to be offered by any of the commercial discrete 5G modems currently reaches 7.5 Gbps DL and 3.67 Gbps UL.

What is the difference between available 5G chipsets?

The number of features sometimes makes it difficult to differentiate all 5G chipsets, but we have covered some of the major features where 5G chipsets might differentiate.

1. Support for Standalone Mode

While the 1st generation of 5G modem only supported the Non Standalone mode, all 5G chipsets now support both Non-Standalone(NSA) and Standalone(SA) mode. This way of deploying 5G makes it independent from 4G and both the user plane and the control plane are handled by a native (and virtualized) 5G Core. The existence of NSA-only devices on the networks explains why SA won’t simply replace NSA but will likely coexist for some years to come.

2. Aggregating FDD and TDD spectrum

Capability to aggregate up to 2 carriers of 100 MHz (FDD and TDD) in the sub 6 GHz frequency band: this enables increased performance in the sub 6 GHz, as early chipsets were not capable of aggregating FDD and TDD spectrum, which is quite common to have for an operator.

3. Aggregating up to 800 MHz of spectrum in mmWave

Capability to aggregate up to 800 MHz of spectrum in the mmWave: indeed, lower-cost 5G chipsets can support up to 400 MHz of bandwidth.

4. Aggregating sub 6 GHz and mmWave spectrum

Capability to aggregate sub 6 GHz and mmWave spectrum for increased maximum throughput up to 7.5 Gbps (Qualcomm x60): This is especially important for increased coverage and will ease the transition for operators from NSA to SA.

5. Support for mmWave band

Much of the industry is split between those that can do mmWave and those who cannot. This will be a key variable to consider as mmWave is considerably more difficult to deliver, and very few players can do mmWave commercially. However, the benefits to capacity and bandwidth delivered by mmWave will eventually make it an inevitability everywhere where dense deployments are needed. Also, because the deployment in those frequency bands has so far been limited outside Verizon, the absence of support for mmWave is not an issue and an opportunity to develop lower end/cheaper 5G chipsets, while still providing an enhanced user experience over 4G.

6. Support for DSS Dynamic Spectrum Sharing

Support for DSS (Dynamic Spectrum Sharing) feature, which enables the dynamic deployment of 5G in 4G bands, as standardized within 3GPP (instead of dedicating a fixed portion of the spectrum to RAT as was usually done with refarming).

Despite much noise around mm-wave bands deployment abroad, the sub-6 GHz device ecosystem is doing well and especially the 3.5 GHz band which provides interesting capabilities with a mix of coverage and capacity when wide bandwidth configuration is used (100 MHz). More precisely, the n78 band (3.5 GHz) – the most popular frequency band in terms of devices – announced mirroring the sizable number of networks believed to use this frequency band. Given the wide availability of that band worldwide, this is not a big surprise but definitely an interesting fact for European 5G networks. While not providing as much bandwidth as mm-wave bands (largest possible bandwidth configuration is 100 MHz), it can provide a much larger coverage. As compared to lower frequency bands, it still supports higher capacity and is better suited to massive MIMO deployment in the field because of the much smaller antennas required.

Thanks to features such as Dynamic Spectrum Sharing, a 5G device ecosystem for “legacy frequencies” is also being built with devices, which announced supporting several of those bands (such as the much-used 1800 MHz, 2100 or APT 700 MHz) and even though no 5G network have been yet deployed in those bands. In one quarter, the number of devices supporting those frequency bands has grown substantially indicating a clear interest from operators in those frequencies as they prepare to leverage their existing assets in complement to mid-frequency bands.

| FREQUENCY BAND RANGE | NUMBER OF DEVICES ANNOUNCED | AVG PROGRESS MAR 20 / DEC 19 |

| 39 GHz (mainly the US) | 22 | 37.5% |

| 28 GHz (mainly the US) | 41 | 51.9% |

| n257 (JP, SK, and US) | 13 | 62.5% |

| n258 (Australia, China, Europe) | 5 | 66.7% |

| n261 (Verizon) | 23 | 43.8% |

| between 3.5 and 5 GHz (Global) | 190 | |

| between 1.8 and 2.6 GHz (Global) | 351 | 56.6% |

| < 1.8 GHz (Global) | 148 | 43.7% |

Source: gsacom, halberdbastion and IDATE *

Note that one same device might be listed several times in different category when supporting several bands at the same time

Not surprisingly, much of the mm-wave device ecosystem is driven by the need to support US 5G networks but this will gradually change in 2020 as the use of other mm-wave band use occurs in countries such as Korea and Japan. While no devices had been announced for the n258 (26 GHz) band in December 2019, (the mm-wave frequency of choice in Europe and China for latter deployments), this band has humbly jumped from 0 to 3 devices, which for now remains marginal.

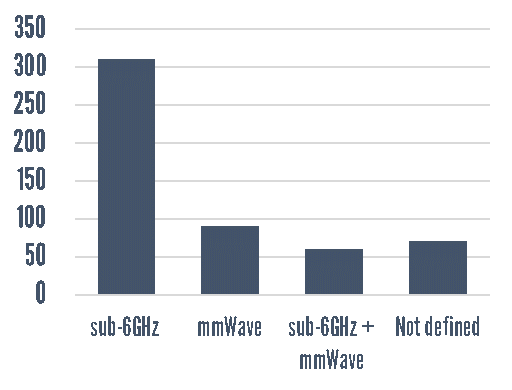

ANNOUNCED DEVICES WITH KNOWN SPECTRUM SUPPORT, BY BROAD CATEGORY

GSA has identified some spectrum support information for almost 83% of all announced devices: the number of announced devices identified as supporting sub-6 GHz spectrum bands has exceeded 300 devices for the first time; this is 77.3% of all announced 5G devices.

21.7% are understood to support the mmWave spectrum, while just 16.2% of all announced devices are known to support both mmWave and sub-6 GHz spectrum bands.

Only 36 of the commercially available devices (18.9% of them) are understood to support services operating in the mmWave spectrum, but 88.9% of the commercially available devices are known to support the sub-6 GHz spectrum.

While initial 5G devices often had either sub-6 GHz or mm-wave RF systems, the year 2020 should also see the first mm-wave + sub-6 GHz devices. The reason for not including support for both frequencies is to be found in the different geographical/market choices regarding frequency bands for deployment, but also in the cost that those additional frequency bands incur. At this stage, the RF and antennas add a significant toll to the total Bill of Material (BOM) of 5G devices without even considering power consumption, thus the time has not yet come for worldwide 5G devices supporting all the 5G frequency bands.

One important aspect though is that 5G devices that will be released in 2020 will support sub 6 GHz FDD and not just TDD. While TDD mode is important for mid and high-frequency bands, FDD is key for lower frequency bands (those frequency bands used for 2G, 3G, and 5G). While those bands will sport more limited throughput, they will be key for 5G roaming, as the operator will be vying for expanded coverage and SA deployments.

Tomorrow, as lower-tier 5G solutions are released in the market thanks to a wider 5G baseband/SoC portfolio, the premium price for 5G devices should decrease. This decrease in the price will come principally at this stage of cost optimizations and “reduced” 5G performance as compared to high-end 5G solutions.

5G Device Ecosystem

The continued investments in deploying next-generation telecom network infrastructure have also increased the overall demand for next-generation chipset components.

The number of announced 5G devices has continued to climb rapidly, surpassing 400 devices for the first time, accompanied once again by continued growth in the number of 5G devices that are commercially available. By end of August 2020, 401 devices had been announced (just over double the number of announced devices at the beginning of 2020), of which 190 were understood to be commercially available (up from 162 at the end of July and approaching the total number of devices announced in January 2020) (GSA).

By the end of August 2020, GSA had identified:

18 announced form factors phones, head-mounted displays, hotspots, indoor CPE, outdoor CPE, laptops/notebooks, modules, Snap-On dongles/adapters, industrial-grade CPE/routers/gateways/modems, drones, robots, tablets, TVs, cameras, USB modems, a switch, a vehicle OBU, and a vending machine.

93 vendors who had announced available or forthcoming 5G devices.

401 announced devices (including regional variants, and phones that can be upgraded using a separate adapter, but excluding operator-branded devices that are essentially rebadged versions of other phones), including 190 that are understood to be commercially available.

181 phones, (up 19 from July), at least 138 of which are now commercially available (up 25 in a month). Includes three phones that are upgraded to offer 5G using an adapter.

100 CPE devices (indoor and outdoor, including two Verizon-spec compliant devices not meeting 3GPP 5G standards, and enterprise-grade CPE/routers/gateways), at least 24 of which are commercially available.

64 modules, at least 11 of which are commercially available.

23 hotspots (including regional variants), at least 11 of which are commercially available.

6 laptops (notebooks).

6 tablets.

91 other devices (including drones, head-mounted displays, robots, Snap-On dongles/adapters, a switch, TVs, USB terminals/dongles/modems, cameras, a vehicle OBU, and a vending machine).

Not all devices are available immediately and specification details remain limited for some devices.

The release of 5G baseband and RF systems is the first step before commercial devices. Usually, when a new radio technology is released, basebands are developed and implemented in relatively simple devices such as mobile WiFi hotspots, before more complex devices such as smartphones, where integration is always more challenging. Before fully commercial devices can be made available, several steps are required.

Chipset sampling – Device design – Chipset mass production – Device compliance and certification – Device mass production.

This time, with 5G, Fixed Wireless Access was one of the first use cases, rather than mobile usage and the first commercial devices announced have been 5G home routers, such as the one announced by Huawei at MWC 2018 in Barcelona, or the one by Samsung. Those early devices have been more specifically designed for carrier partners Verizon in the US and in South Korea, and have already received their approval from the FCC. Those first devices are available in indoor and outdoor versions. Since then, the ecosystem has continued its expansion alongside that of smartphone devices.

Smartphones and modules, the most popular form factors indicate an already relatively rich ecosystem powered by 5G basebands.

The fact that smartphones are the 1st category of devices announced together with modules is a noteworthy fact. CPEs and modules are usually the first devices to go to the market when a device ecosystem is building up but smartphones usually come afterward. In detail, most of the devices launched in 2019 have been based on Qualcomm Snapdragon 855 along with an X50 modem but in 2020, most devices will be based on second-generation 5G baseband and heated competition with first devices powered by Mediatek 5G solutions.

An interesting thing to notice is the fact that because of the longer replacement rate in some countries (closer to 4-5 years compared to an average of 2 years) for smartphones, some MNOs will rather sell 5G-ready devices (i.e devices supporting 5G even though 5G has not yet been deployed in the network) than 4G-only devices.

The rationale for this carrier demand is to be able to switch as many users as possible on the less-costly 5G network when it is deployed.

In countries where the 5G launch is imminent, the same decision could be taken by operators and also device manufacturers that want to be able to respond to the consumer demand not to invest in 4G phones when 5G is coming soon.

5G Chipset Market: Scope of Competition

The 5G baseband market is quite different from the 4G and earlier generation baseband market. Actually, each new generation of cellular technologies has seen players leaving the market and new ones emerge. As an example, Texas Instrument left the baseband market with 3G and Infineon sold its cellular asset to Intel. In 4G, several players left the baseband market, such as Broadcom, despite several acquisitions or Fujitsu. With 5G, Intel was the first to leave the (device) baseband market by selling its cellular assets to Apple.

In 5G, Qualcomm is still considered the leader in market share but recently, the rise of Mediatek with its Dimensity range of 5G modems, now commercially available is somehow changing the competitive landscape. While Samsung and Huawei, number one and two in the smartphone market are mostly using their chipset internally, this situation might change in the future, as both chipset manufacturers have been mentioned as selling their chipset to other device manufacturers, mostly Asian ones. In a not so distant future, they will both be joined by Apple, after the Cupertino company acquired Intel cellular assets for mobile devices. For now, Qualcomm is still benefiting from this situation, since Apple is not currently capable of using its own silicon for 5G connectivity and has inked a licensing deal with Qualcomm to use their 5G products.

Mediatek and Unisoc, two rising baseband players in the 5G field.

If Qualcomm, Huawei, and Samsung are the top three 5G baseband players, two other vendors (excluding Intel that dropped the 5G baseband market) have announced 5G solutions, Mediatek and UniSoC.

Mediatek, after announcing the Helio M70 back in June 2018 announced its integrated 5G SoC in May 2019 and launched its first OEM commercial product at the end of December 2019 with the Oppo Reno 3 that is now sold in China. With this mid-end solution, Mediatek is well geared to increase its position in the 5G device market. It also announced its lower-tier 5G solution at CES in January 2020 with the first commercial devices with this solution to be launched during the 1st half of 2020 (but that may very well slip in H2 due to the COVID-19 epidemic).

As for Unisoc which announced the Makalu Ivy510 at MWC 2019, it is targeting the (Chinese notably) mid-tier smartphone and IoT market. Unisoc was previously known as Spreadtrum and had a development partnership with Intel for LTE chipset for Chinese devices but the partnership over 5G has been dropped and Unisoc is now following its own route and it announced in February 2020 its 2nd generation 5G chipset, the T7520 SoC, which Unisoc claims as “the all-around leader in power consumption for both light-load and heavy-load scenarios and delivers a power consumption reduction of up to 35% for some data business scenarios.”, a claim, which of course remains to be verified.

After failing to grab 4G device customers (except Apple), Intel forced to quit the market

In April 2019, when Qualcomm and Apple announced they had dropped all their litigation worldwide and reached a 6-year license agreement together with a multi-year chipset supply, Intel followed with the announcement that they would quit the 5G smartphone modem market. Intel had announced two 5G basebands in November 2017 and 2018, the second one believed to replace the first one, but although Intel stated that those products would be available during the 2nd half of 2019, there was skepticism on its ability to achieve this timeline. Reportedly, Intel had difficulties in developing its 5G smartphone baseband and faced multiple delays in the development of its 5G offering.

In the context of a severe legal battle with Qualcomm over IP licensing and royalties, Apple had tried to diversify its sourcing of 5G connectivity solutions and was known as Intel’s (by far) biggest customer for cellular baseband. Because of Intel’s delays in the development of its 5G solution and market pressure for Apple to develop a 5G iPhone, Apple saw the solving of its dispute with Qualcomm as the most relevant way of resolving this issue. This, plus Intel’s difficulties in its development led Intel to leave the 5G baseband market, reportedly focusing on network infrastructure instead.

This news is of particular interest in the development of the 5G device ecosystem. Despite the supply agreement with Qualcomm, Apple is believed to be continuing the development of its own 5G chipset, something that will still take time for Apple, 2023-2025 being the horizon often mentioned by analysts for an Apple modem to reach a commercial iPhone.

At the end of July 2019, Apple purchased most of the Intel 5G business for that matter for 1 billion USD. This will enable Apple to integrate its modem more closely in its own Ax SoC and thus reduce power consumption and release place for other components thanks to the reduced footprint within the device.

Mid-range 5G chipsets set to invade the smartphone market.

In 2020, 5G chipsets have continued their expansion in lower-tier smartphones with several announcements already mentioned. In order to maintain the right Bill of Material for its mid-tier platform, Qualcomm has created a new baseband, the X52, which is comparatively less powerful than the x55 that was announced in February 2019.

Indeed, this x52 supports half the throughput of the x55 that will be paired with the Snapdragon 865 because of the capability to aggregate only half of the spectrum that the x55 is capable of aggregating. As an example, the x55 can aggregate up to 800 MHz in the mmWave bands (8×100 MHz) while the x52 in the SD 765 can only aggregate 400 (4×100 MHz). The same goes for sub-6GHz where the x55 can aggregate up to 2×100 MHz vs 100 MHz for the x52.

In the end, this choice reveals the strategy to streamline 5G support down the tier-range. The same strategy was used for the launch of the recently announced Snapdragon 690 with the creation of the x51 modem. As an indication of the 5G smartphone ecosystem evolution, while the average selling price of 5G smartphones was around 650 EUR in China in 2019, low-end 5G smartphones around 130 EUR could see the light of the day by the end of 2020 according to Huawei.

Conclusion

The 5G chipset market is still mature and contains the potential for a lot of companies to make a good position in the market.

Now, we have discussed all the main factors of the 5G chipset industry. It’s time to know about the companies researching it.

In our next article, we have talked about the companies that researching the 5g chipsets.

5G is just starting out, the real potential is yet to see. The 5G chipset industry is a big part of it, so the companies aren’t going to take it lightly.

So, take a look at that major 5G Chip Makers.

And since this fast-paced, rapidly evolving 5G industry isn’t going to stop any soon, we can help you navigate it. Let’s discuss how you can protect and monetise your company’s assets-

References

- Credence Research, 5g Chipset Market, Research report, 2019

- Allied Market Research, 5G Chipset Market, Research Report, Dec 2018

- Market and Markets, 5G Chipset Market, Research Report, 2019

- Grand View Research, 5G chipset Market Analysis, Research Report, May 2020

- Verified Research, 5G Chipset Market, Research Report, 2019

- Quince Market Insights, 5G Chipset Market, Research Report, August 2020

- Mordor Intelligence, Global 5g Chipset Market 2020 – 2025, Sample Research Report, 2020

- Forencis Research, 5G Chipset Market, Research Report, 2019

- InkWood Research, Global 5GChipset Market Forecast 2019-2027, Research Report, 2019

- Research and Markets, Europe 5G Chipset Market, Research Report, November 2019

- 5G Observatory, Quarterly Report 8, Up to June 2020

- GSA (Global Mobile Suppliers Association), LTE, 5G & 3GPP IoT Chipset Report, September 2020

- Forbes, Who Is ‘Really’ Leading In Mobile 5G, Part 2, Article, 2019

- GSA (Global Mobile Suppliers Association), 5G Devices Ecosystem September 2020: Global Update, 2020