Would you believe me if I said patent abandonment strategy of companies like Delphi, Hewlett-Packard, and Xerox have resulted in the loss of millions of dollars for their respective organizations?

It is quite true. Each of these companies along with hundred others has lost millions of dollars in patent monetization just because of their one error in judgment — They didn’t look beyond their competition while trying to monetize their patents.

What do you mean? — You ask.

Allow me to explain albeit with the help of a practical example.

The Delusion of Detritus

In the month of September on the onset of the new millennium, Delphi automobiles filed an application titled “Apparatus and method for maintaining a threshold value in a battery” which was granted in less than 9 months with publication number US6249106.

The patent discussed methods and apparatus to protect a battery from discharging after reaching a particular threshold. Obviously, Delphi had battery drainage prevention in automobiles in mind while filing the patent, but the claims were drafted in a manner such that it did not limit the scope of the patent to automobiles alone.

In August 2005, the patent was lapsed due to failure to pay maintenance fees. One speculated reason behind patent abandonment could be that decision-makers felt electric vehicles might never gain traction and the patent would not serve any purpose.

Only if they were far-sighted. This was the biggest mistake they made.

Not talking specifically electric vehicles. This patent is a gold mine and it overlaps almost every other existing product in the world. Yes, smartphones too.

Remember those times when your phone is on low battery and you want to click a picture and you get a prompt saying- “Your battery is too low” and the only option you have is to hit Close. The now lapsed patent got that covered too.

Now, a few people might argue that this patent is broad and may not stand in court and thus Delphi would have let it expire. This might be true but there is no way to verify it (Unless a counsel from Delphi handling the portfolio during that time releases a statement).

However, we believe there are very fewer chances a company would abandon a broad patent for saving a few thousand dollars in maintenance fees. If a patent is good, there are various ways it could be used, like in negotiating deals or making it a part of a larger patent set for licensing.

Related Read: 4 Clever strategies companies use to Monetize Patents

If Delphi had known the potential of this patent, they would not have abandoned it without reaping the most out of it. Maybe a part of a larger patent set, a subject of a lawsuit — the decision makers at Delphi would have taken some sort of action if the potential was recognized.

Only if their thought process wasn’t limited to the application areas of the patent.

Maybe, Delphi threw away money like a baby.

https://giphy.com/gifs/baby-money-little-rascals-l0HFkA6omUyjVYqw8

Credits: Reaction GIFs

Editor’s Note: “Or maybe not”, you say? The authors of this piece mentioned Delphi as one of the examples as they feel it aptly summarizes the scenario in industry where valuable patents, broad or not, often meet their fate in trash can as companies fail to realize their potential just because they could not see its application beyond the core area the business operates in.

We agree with them, but we also know that our readers might have an opinion or two to share on the same. We’d love to hear your thoughts. Let’s get the discussion going in the comments section.

The Patent Abandonment Chronicle

Delphi is not the only company that abandoned patents that were not related to their core products. In fact, this is a standard practice among multiple companies to abandon patents that do not have a monetization/commercialization potential in the core areas of an organization’s business.

Take Hewlett Packard for instance. In March of 2004, HP was granted a patent titled Use of mouth position and mouth movement to filter noise from speech in a hearing aid. US6707921 discussed methods to provide sound to a user while filtering noise from speech.

Distinct, clear speech sans the noise using image sensing and processing. And that is just one part. The patent covers conversion of sound waves to digital and vice versa along with the transmission. The patent qualifies as a key patent in its field. It could have earned HP millions in royalties, only if it had not been abandoned.

StarKey and Siemens could have been the top licensees along with dozen other hearing aid companies. The University of Stirling — working on the research project to develop hearing aids that can lip-read and convert the information to sound — would have had to seek a license before continuing further R&D.

Only if HP looked beyond its actual core competition and licensed/sold the patent to hearing aid companies before allowing it to get lapsed. In the pursuit of saving a few thousand dollars in maintenance fees, HP ended up losing millions in royalties.

Having highlighted these instances, a few Why’s ponder upon the mind:

- Why are patents with immense licensing potential not recognized?

- Why are these patents allowed to lapse before they reap their ROI?

- What can be done to prevent such occurrences in the future?

To get the answer to the above questions, we need to take a step back and have a look at the current approach followed by companies while choosing which patents to license.

The Conventional Approach to Choosing Patents for Licensing

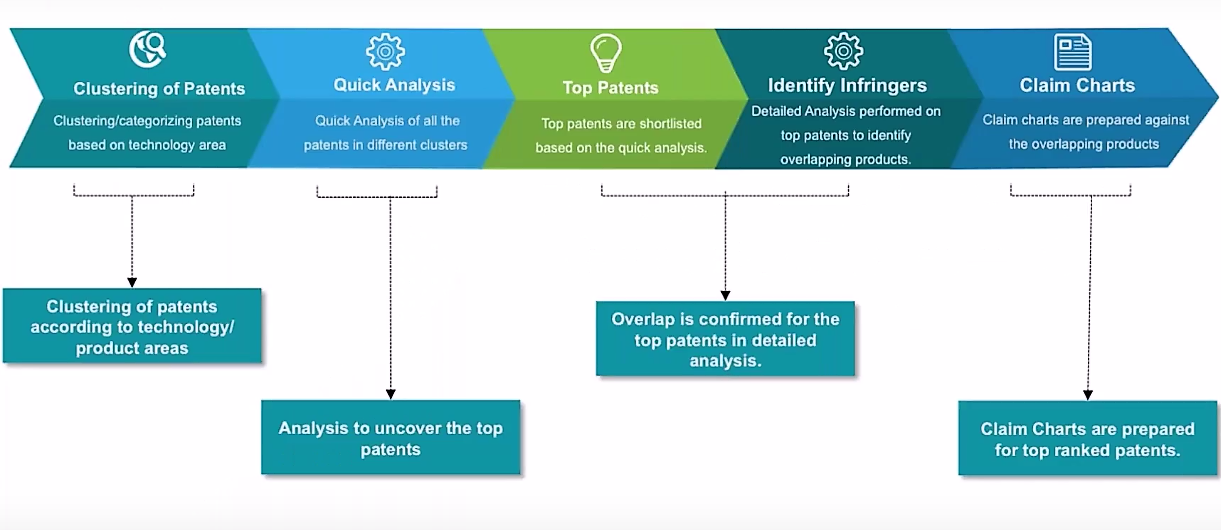

Ideally, companies with very large portfolios, follow a five-step process to finalize a list of patents that could be put in the market for licensing purposes.

First, the patents are clustered based on the technology domain, for manageability aspects. Next, a particular cluster of technology is chosen and top patents (patents with high monetization potential) from that cluster are figured. To achieve this, patents are ranked based on several factors, which we have discussed in detail in this blog post.

The top patents are further analyzed to identify products that overlap on these patents and claim charts are prepared to showcase how the product overlaps on the patent. Next, these claim charts are sent to corporations that own the products infringing on the patent and further talks ensue from thereon.

The top patents are further analyzed to identify products that overlap on these patents and claim charts are prepared to showcase how the product overlaps on the patent. Next, these claim charts are sent to corporations that own the products infringing on the patent and further talks ensue from thereon.

Now, corporations might either get the above process done internally or hire a service provider for the same. No matter who does what, with this approach, there are always possibilities of high potential patents being left out. The gold mines that could have a high ROI upon licensing are never recognized and often abandoned in the process.

The question is — How could this be prevented?

Fret not, one minor strategic tweak can change the game. What tweak? — you ask.

The Unconventional strategy to Mine Patents with High Licensing Potential

Clustering your portfolio based on the product line.

But how does that help?

It serves a dual purpose.

First, product based categorization can help identify patents that are core to your product line. This cluster of patents is paramount to your organization and you would not want to license/sell them, as they give you a competitive edge over others.

Filtering the best from the rest, you are left with a set of patents that are not being used by the organization currently, as the products might have reached the last stage of technology life cycle or have been updated with better feature set or simply discontinued; or were a good idea on paper, but the patent never took the shape of a product.

No matter what the case, you are left with a cluster of patents that are least useful to your product line and from here on, there are only two lanes to go — licensing lane or abandonment avenue.

In the conventional approach, you simply pick top patents from a technology cluster and license them after a quick analysis, while the rest of patents often get neglected and may even get lapsed.

In the current approach, with all the core patents out of the scene, you are only left with patents that have a high licensing potential or resource consumers with zero ROI.

The next question and this is the tricky part —

How to Identify Patents with High Licensing potential?

Why tricky?

Because at this point of time, if done in-house, while choosing patents fit for revenue generation, the question you’d ask yourself is —

Which of our competitors is working on a similar technology?

Having worked in the same niche for years results in a tunnel vision mentality, and the possibilities of some other application areas where your patents could be used is your least pondered upon thought.

Patents covering technology that your competitors are working on would be on your licensing priority list, while the rest of the patents, no matter how valuable, would be simply ignored.

Tunnel vision can be quite a bane.

The Right Approach to figure Patents worth Licensing

A simple change in the thought process is all it needs.

Instead of looking for patents on technology that your competitors are working on, you need to look for current trends in technology and identify the potential beneficiaries from your patents, irrespective of the domain of operation.

The idea is to look beyond your actual core competition.

Let me give you an instance to drive the point home.

FedEx — A logistics company has amassed a wide portfolio on logistics related patents. Defensive, for sure, in a domain that rarely witnesses any patent battles. How could FedEx make a bang for their buck without going offensive on any of its competitors?

“Maybe they might never earn licensing dollars”, says the conventional approach.

“Not the case”, utters the unconventional one.

Look Beyond is the mantra.

Whether you know it or not, the patents of FedEx, the logistics company, are currently being infringed by Domino’s, the pizza giant. Turns out, their delivery service is done in a way that infringes on FedEx’s patents.

Who knew a pizzeria would be infringing on a logistics company’s patents?

That’s the beauty of looking beyond your actual core competition. You would discover facts unknown and if you are lucky enough, with adequate research, file a continuation patent covering the application of your current patent in other application areas, amassing a portfolio with huge potential. (We have covered this strategy in a detailed blog post here- Filing Continuations to Enhance the value of your patent portfolio).

Which means, more licensing money in the future.

https://giphy.com/gifs/la6Ne7z15BXs4

Source: Reddit

Conclusion

When looking for abandoning or licensing your patents, it is always a good idea to look beyond your actual competition. Tunnel vision mentality is the worst hindrance in the objective of getting a good licensing ROI. The idea is to look beyond and brainstorm the usability of your patents in areas other than those you operate in, to get the big picture.

When you look at the big picture, nothing goes amiss. Not even that random patent lying in your portfolio unused that is a potential key patent for another niche.

Remember to Look Beyond.

Authored by: Anjali Chopra, Senior Business Analyst, Market Research, Deepak Syal, Director, Operations, and Muzammil Hassan, Manager, Infringement.