When it comes to valuation of a company, the market seems to react promptly to product releases, but intangible assets seem to be hardly relevant to investors. This is happening even though there are multiple empirical studies in existence, suggesting a strong positive correlation between high stock prices and innovation – R&D and Patent data.

Silicon Valley Skyline LLC, a legal counseling firm for startups recently validated its hypothesis that patent filing rate of a company could help predict stock prices in advance. In addition, there are many experts who have voiced a similar opinion on the correlation.

While earnings growth remains a reliable indicator, we’d be well served to add patent filings to our repertoire, too. It’s an even earlier indicator of stock price performance.”

~ Louis Basenese, Chief Investement Strategist, WSD

Despite all this, patents don’t end up in the final numbers when the stock valuation is done. Which should not really be the case. To make a stand for inclusion of patents while valuating stocks, we have listed three reasons that could help decision makers understand why a change in the process is needed, i.e., how patents could affect both the position and the value of a company in the marketplace.

And as an added bonus- we have also explained the concept of Patent Impairment- something you ought to know about- since it turns out, some patents could also decrease your stock valuation. More on that later.

PS: Since we live in the era of skimming and if there is a particular reason you’re already aware of and are thinking, let’s skip this one, I’ll check out the next one, We made it easy for you.

You can jump to any specific section using the below links.

- How Patents Strengthen A Company’s Market Position?

- How does a Patent Lawsuit Affect Stock Price?

- How Patent Licensing Impacts Stocks?

- What Is Patent Impairment and How it Affects Stock Prices?

Onto the Reasons, Shall we?

How Patents Strengthen a Company’s Market Position?

Patents can contribute a crucial role in sharpening your competitive edge in the market. But often, decision makers gets overwhelmed by the cost and complexity involved in building a patent program for their business and maintaining the patent portfolio after that. In case if you’re also in a position where you need to build a patent strategy for your business, I have a webinar for you.

In this webinar, Tom Franklin, a seasoned patent attorney with 25 years of experience in building and managing portfolios will share how you can build a winning patent strategy for your organization and do so without crushing your budget or time. Click here to join.

Patents offer a huge marketing and commercial advantage to companies differentiating them from the competition. Leading to high ROIs, the advantages of a patent portfolio as marketing arsenal are multifold. Here’s how:

- Patents are generally filed for a new product that is supposed to be leading its category, thus allowing companies to spike up their margins and translate as better market share.

- Filing a patent gives a company a proprietary market advantage. Amazon filed a patent for its one-click system that they deployed for order processing. This gave Amazon a protection which brought them a huge advantage against competitors. Xerox also monopolized the copier market for 20 years during which they made double-digit margins.

- Analysis of patents can help companies anticipate any changes that are about to take place in the technology and market space, and with this prediction, they can come up with new products and services, like Texas Instruments did when they acquired Amati Communications for their DSL patents.

It is noteworthy that although Amati had lost $30 million the previous year in sales and other expenses, it received an unprecedented $395 million in the acquisition as they held key patents to DSL Technology. This is a great example of how patents can increase the net worth of a company.

- In technology-intensive companies especially, patents can strengthen the market position of a company by improving their financial performance. A major bulk of a company’s value now lies in its patent portfolio rather than the physical assets. With the pressure for maximizing returns for shareholders, patents can be leveraged to tap revenues by adopting the monetization route.

One good example is Texas Instruments, who in the middle of bankruptcy started licensing its patents and in few years, earned more than billion dollars in royalties.

Another example is Lockheed, who filed a patent for its 3D flight simulator technology and used it in video games. This move substantially upped their stock prices and attracted investments from Silicon Graphics and Intel.

Relevant Read: Looking for ways to monetize patents without spending thousands on claim charts and consultancy fees? Here are four Clever Strategies companies use to monetize patents without spending millions.

- Patents can also be leveraged to preventing competitors from venturing into the market. For instance, some years ago, Avery Dennison Corporation was developing new film for labels, which they were to manufacture for P&G. Realizing that Dow Chemicals was also stepping into the market, Avery strengthened their existing patent portfolio by filing more patents, preventing Dow Chemicals from venturing into the particular market.

- Selling patents can also have a great impact on share prices of companies. For instance, when America Online (AOL) sold a portfolio of more than 800 patents to Microsoft in April 2012, AOL shares rose by 43% the day the $1.1B deal with Microsoft was announced.

All of these examples depict how patent filing has resulted in a surge in stock prices and strengthened the market position of companies, which speaks volumes about the importance of a strong patent portfolio.

In fact, when Kodak ignored to build a patent strategy around its instant photography technology, a much smaller competitor Polaroid sued Kodak for patent infringement causing Kodak huge losses that lead to a payment of $925 million in damages, shutting down its manufacturing units and much more.

How does a Patent Lawsuit Affect Stock Price?

Whenever a company files a lawsuit indicating patent infringement by another company, its stock prices start to rise. It is based on the anticipation of the investors that- a company wouldn’t file infringement charges unless they were completely certain that the lawsuit was going to turn in their favor. And when they win the lawsuit, there will be an influx of cash.

On the other hand, the company against which the motion has been filed will witness a dip in their stock prices. In other words, the filing firm experiences a positive stock return and the defendant firm experiences a negative stock return.

Let us explain with an example.

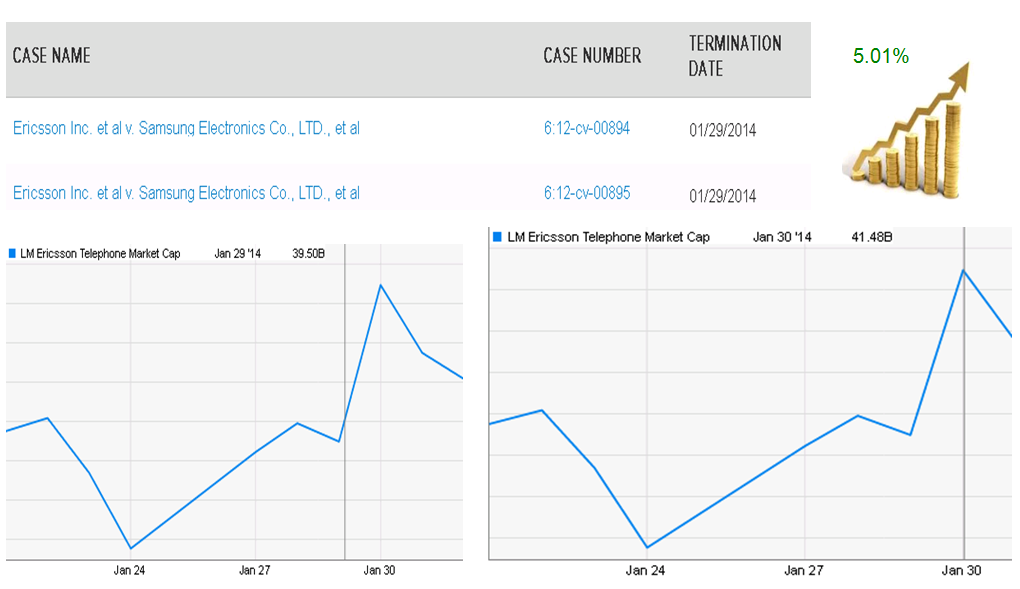

In 2012, Ericsson sued Samsung for infringement of patents involving technology for clear voice transmission, network efficiency, and touchscreen functions.

In 2014, Ericsson won the lawsuit and as a result, Ericsson’s stock prices rose 2.4% by 1123 GMT (6:23 ET). In a day Ericsson gained 5.01% while the stock prices of Samsung fell by 1.2%.

The positive impact of Patent infringement is always greater than the negative impact because of the fact that, if one form is suing another firm for infringement, it means that the technology is doing well.

Now one might wonder- “Is the same valid for ITC Section 337 litigations?” Do stock price gets affected when infringement is filed under Section 337?

Yes, it does.

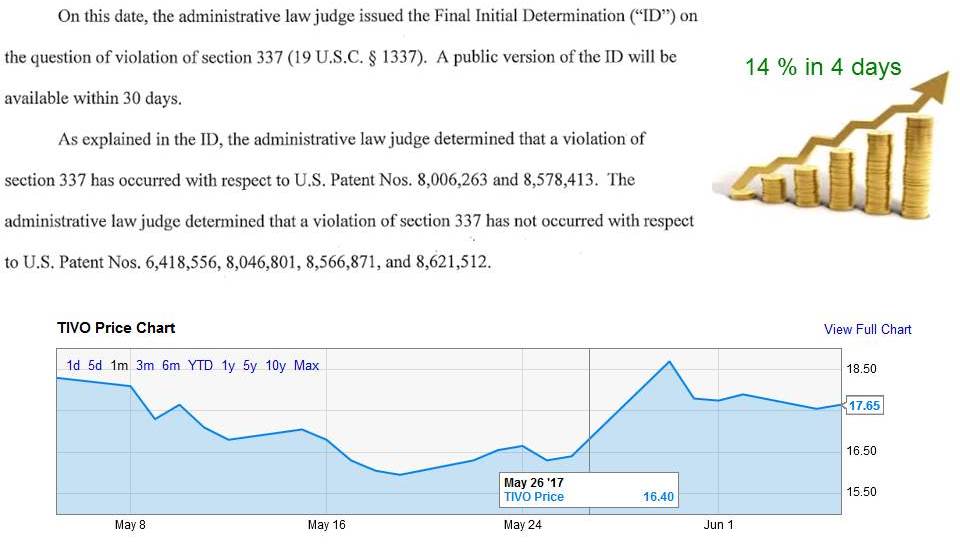

In a recent case between TiVo’s Rovi Corp and Comcast, ALJ David P. Shaw issued a notice of the Final Initial Determination (ID) on the question of violation of section 337. In his words,

As explained in the ID, the administrative law judge determined that a violation of section 337 has occurred with respect to U.S. Patent Nos. 8,006,263 and 8,578,413. (Source)

In four days of the notice of Final Initial Determination, the share prices of TIVO increased by nearly 14%.

Source- ycharts.com

When it comes to ITC litigations, which are way more stringent than federal and district court patent lawsuits, the impact on share prices can get intense, since infringement, when proved could ban infringer’s product from being imported into the US by customs department and extreme measures like cease and desist letters could be taken against the defendant. Hashtag Defendant Doomed.

Did You Know: ITC litigations are quite on the rise these days and being a defendant sure is tough. With way less time in hand, to reply to action, the best way to emerge victorious in an ITC litigation is to invalidate the patent in question, being infringed. But, time can get scanty and still there would be tons to do.

Blowing our own trumpet, we at GreyB will have you covered, just the same way we helped these three defendants invalidate the patents that were being infringed by them. Read the story here to find our methodology to conduct these kinds of searches – We invalidated these patents being infringed under ITC Section 337. Here’s how.

How Patent Licensing Impacts Stocks?

When Ericsson signed a patent licensing deal with Apple in 2015, its shares rose by 8%. The licensing deal clearly meant more influx of cash leading to a higher valuation which directly reflected on the rise in stock prices.

According to a Reuters report, dated December 21, 2015, the estimated overall revenue from intellectual property rights in 2015, according to Ericsson, hit 13 to 14 billion crowns ($1.52-$1.64 billion) up from 9.9 billion in 2014 as a result of the agreement.

When a company decides to buy a patent, it must also consider the total agreeable market for it. If the market is already saturated with companies selling fundamental patents, there isn’t much scope for profits. Hence, a new patent which truly adds value and can bring in considerable market profits can open up avenues for cash flow from companies who want licensing rights and subsequently investors as the stock prices continue to rise.

What is Patent Impairment?

The value of a patent depends upon several factors, one being the lifetime of a technology. Once a patent reaches a stage where the costs accrued in its issuance/ obtaining it is far greater than the cost it can be sold, the value of patent decreases.

The impairment is accounted for as an expense and hence reduces the carrying amount of an asset. This leads to the decrease in the company’s net worth. It doesn’t have a huge impact on the company’s future financials but investors use this to get an accurate idea of the valuation of the assets of the company.

If a company has a bunch of such patents which are no more valuable, pruning of patent portfolio is highly recommended, where patents which are of no use to the company are abandoned. This also reduces the pressure of paying maintenance fee for the patents.

Wondering which patents to keep and which ones to abandon? In this article, we have discussed a few factors that could help you tell apart the bad ones from the good. Killing bad patents can increase the value of your patent portfolio.

Conclusion

Patent citations always have a huge economic impact. Research conducted in recent years on the correlation between patent and stock prices have attributed the rise in stock prices to the innovation that is created by the patents and the value addition it brings to the firm.

Managing a patent portfolio is equivalent to managing an investment portfolio. However, deciding upon which patent is a worthy investment is a matter of expertise which technology consultants can help you with. Their good judgment will be able to exactly predict – what kind of market a certain technology can tap, how reliable it is and how it can bring profits. Their insights can support investment decisions.

If you need help in the direction, here is what you should do.

Authored by: Shikhar Sahni, AVP, Operations.

Relevant Read: If you ever had the slightest doubt that Patenting system stifles Innovation, you are about to be proved wrong. In this thought piece, Anjali highlighted four statistics that prove Patenting system, in fact, promotes Innovation.

https://greybnew.dev.zippisite.com/4-statistics-prove-patenting-system-good