If you are not innovating, you are planning your exit.

Paul Perreault, CEO, CSL Ltd.

We live in an era of stifling competition where the only factor that sets apart the top players from the rest is innovation. Innovation is one of the predominant factors that decide the success of an organization. In this era, where there are multiple vendors offering the same set of services, it has become paramount for organizations to invest in innovation, lest they want to be out of the business.

With the exponential growth of technology in the past few centuries, even the most niche of areas are expected to have a technological intervention, tailoring the field to keep updated with the latest technological trends.

One of those areas where technology has spilled its magic dust is the insurance industry. From paper to paperless, handwriting authentication to digital authentication systems, visiting-the-insurance-office-a gazillion-times to –having-all-the-information-in-your-smartphone-a-click-away – the insurance industry has embraced innovation to enrich lives and simplify things.

Technology is changing our lives every day. The insurance covers a majority of objects in and around us. This left us wondering how technology was playing its due part in the insurance industry. What kind of disruptive/incremental innovation was taking place in the insurance sector, harvesting the current technological trends?

To quench our curiosity, we decided to analyze the innovative measures of the top 50 insurance brands based on their brand value.

Here’s what we found:

Investing in Innovation – Everyone is doing it

Our analysis revealed that more than 40 of these companies invested their assets towards innovative measures, be it in the form of in-house R&D, partnerships, alliances or launching accelerators and incubators dedicated to innovative measures.

Insurance companies had kept up with the trends in technology and a majority of them had already been a part of the digital revolution by bringing their processes online. But is that it?

Fortunately No.

Getting systems on the online platform was just the beginning. The insurance sector companies are embracing technological intervention and innovating in areas, keeping abreast of the progress in technology. Be it in the form of joining the IoT race, embracing big data, leveraging artificial intelligence, investing in drones or being a part of the blockchain revolution, the insurance sector companies are leaving no technologies untouched.

Here are a few key observations from our analysis of innovative measures of these top 50 insurance corporations:

- Telematics, IoT, and analytics are the areas that primarily experienced the highest innovation rate.

- 8 out of 50 companies have at least one app dedicated to analyzing the driving performance of a person. TripSense, Drivewise, MyRate, and GoodRide are few among them.

- Programs like SmartHome and GoodHome are great examples of insurance companies leveraging the IoT technology to monitor homes, with amazing protocols to initiate appropriate insurance measures in case of a heist.

- Ping An Insurance leads the Chinese markets in innovative efforts. From mining social data to fostering digital models, from embracing technological solutions for better analytics to insuring against loss of virtual properties in games, Ping An is second to none when the discussion is on innovation.

- Drones have caught the fancy of insurance sector companies and these UAVs are leveraged to survey everything, ranging from disaster-stricken areas to monitoring agricultural lands, for risk assessment and faster claim handling.

- Blockchain, the technology behind Bitcoin, earned the interest of the Insurance sector too. In collaboration with three other companies, Swiss Life Group invested in a blockchain-centric venture in an attempt towards a smart contracting platform. Blockchain technology in itself is expanding rapidly and a lot of major companies are innovating in this domain too.

Analytics plays an important role in the majority of these companies – Be it decision-making based on vehicular data, behavior characterization based on social data or customer targeting based on petabytes of smart big data. The insurance sector companies leverage analytics to improve insurance-related processes.

Do Insurance companies have Patents?

After we touched upon the innovative measures of these insurance sector companies, the IP professional within made us ponder – What about protection? Did these companies take enough steps to protect the R&D dollars spent on innovation? Do insurance companies have patents?

We analyzed the patent portfolios of each of these 50 companies to find the answers to our questions. The findings were truly surprising and inconsistent with the innovation measure statistics.

The analysis revealed that out of 50, as many as 21 companies didn’t file even a single patent application. Surprisingly, out of these 21 organizations, 8 were based out of and operated in China.

Our innovation measures analysis revealed satisfactory innovative measures from Chinese corporations while Ping An ranked at the top of the list. Then, what could be the reason behind the lack of patent filing activity by Chinese companies?

Upon digging further, we found that the reason behind the lack of patent protection for the innovative measures of the Chinese insurance companies owes to the difficulty of getting insurance-related patents granted. Because of strict laws, it is very difficult to get a life/health-related patent granted in China, which could be a plausible explanation for the lack of patenting activity by Chinese insurance organizations.

The non-patent filing companies also included three Asian companies while eight European companies made to the list. The absence of patent filing activity might have multiple reasons ranging from non-patentable subject matter to the lack of need for protecting their innovation. Whatever might be the reason, it would suffice to say that unlike innovation, the protection of assets is the least thought about the concept for some companies within the insurance sector.

Did you know: Innovation and Protection constitute two of the three pillars for the success of any organization. Wondering what the third pillar is? Find out here – Innotecting- the recipe to an organization’s success.

Insurance companies have patents! Tell me more…

Fortunately, the majority of insurance sector companies believe that

“Innovation without protection is Philanthropy”

Our analysis revealed that 29 out of 50 companies invested assets towards protecting their innovative measures.

But then it leaves us to question – for what kind of innovations was protection sought? Which arena had the most patents filed in? Which countries were sought for protection? Who had the largest number of patents?

Editor’s Note: We had the exact same questions in mind a while ago related to the domain of Digital Oil Fields. Hell bent on understanding the innovation in the DOF technology, we conducted a study and found some brilliant insights. Written originally as a series of four articles, we have put together the insights and findings from the study in the form of a report for your ease of access – You can download a copy of the report here.

Finding answers was relatively easy as we embarked on the search to find the role of patents within these companies.

What exactly do these patents protect?

The insurance sector’s innovation measures data revealed that every trending technology had been explored by these companies and was leveraged to make processes better.

But how many of these innovative measures were actually protected by means of patenting activity?

Not many.

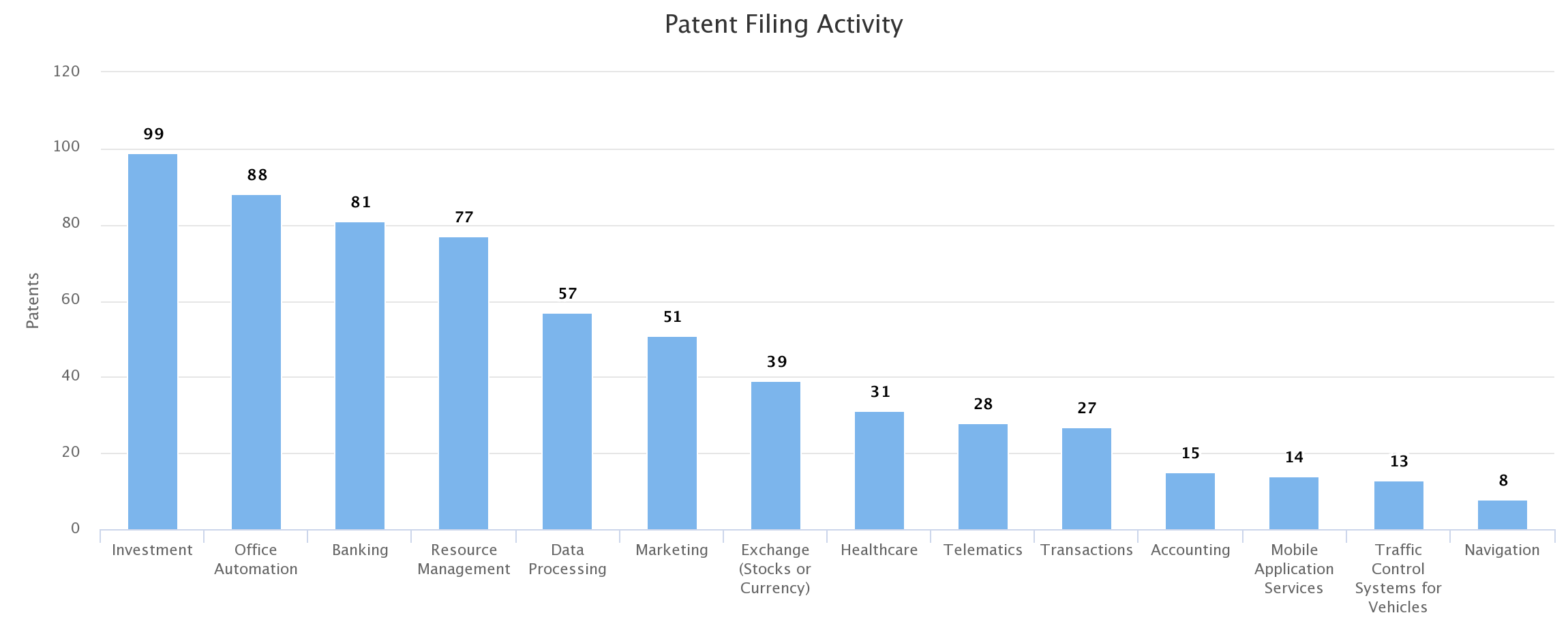

Though the innovative measures ranged across various technologies, the patent filing data revealed that Telematics and Analytics were the prominent area’s protection was sought in. The majority of patents (449 to be precise) were filed under CPC classification G06Q40/08: a class dedicated to protecting core insurance patents.

Further, Investment, Banking, and Accounting were the next core areas in which most of these patents were filed, which was a reasonable move, considering the domain in question.

The interesting fact to note here was that big companies like Allstate realized the value of patents and filed multiple patents to prevent their flagship products from being copied. For instance, Allstate filed 15 applications and had 11 patents under the G07C5 category – the class primarily responsible for registering or indicating vehicular data to protect the features of its flagship products: DriveWise and GoodRide.

The chart below reveals the top 12 categories in which the patents were classified. It should be noted that a patent may be classified in more than one category and the numbers were deduced accordingly.

The Potential Markets and Top Players in Insurance Sector

Geographical patent filing data can reveal a lot of insights about the markets of interest of an organization based on their patenting activity.

For the insurance sector, a look at the patent filing data revealed that 48% of these companies filed at least one world application, an indicator that companies were taking enough steps to not just protect their innovation, but protecting their innovations at all the right places.

Our study also revealed that the majority of the patent applications were filed in the US followed by Japan. It was interesting to note that 26 out of 29 companies had filed at least one patent application in the US, whereas 11 out of 29 had at least one Japanese patent application.

So who are the major filers in each of these markets?

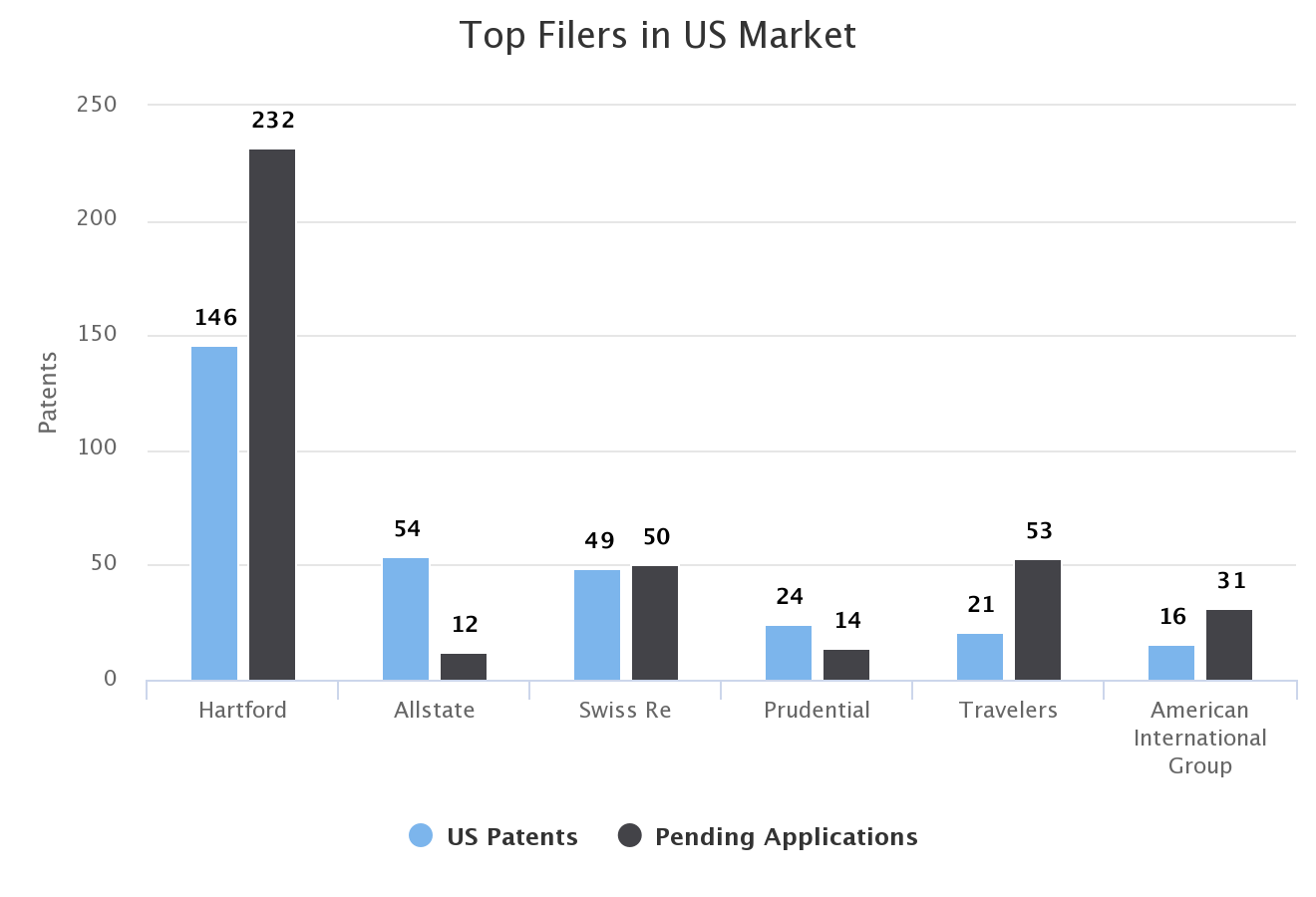

The analysis of the applications filed since 1996 revealed that Hartford was the clear winner in the US market after scoring 146 grants while having 232 pending applications. Allstate is the most proactive at filing patents while enjoying a high grant rate in the US, whereas European organization Swiss Re filed 99 applications in the US out of which it scored 49 grants.

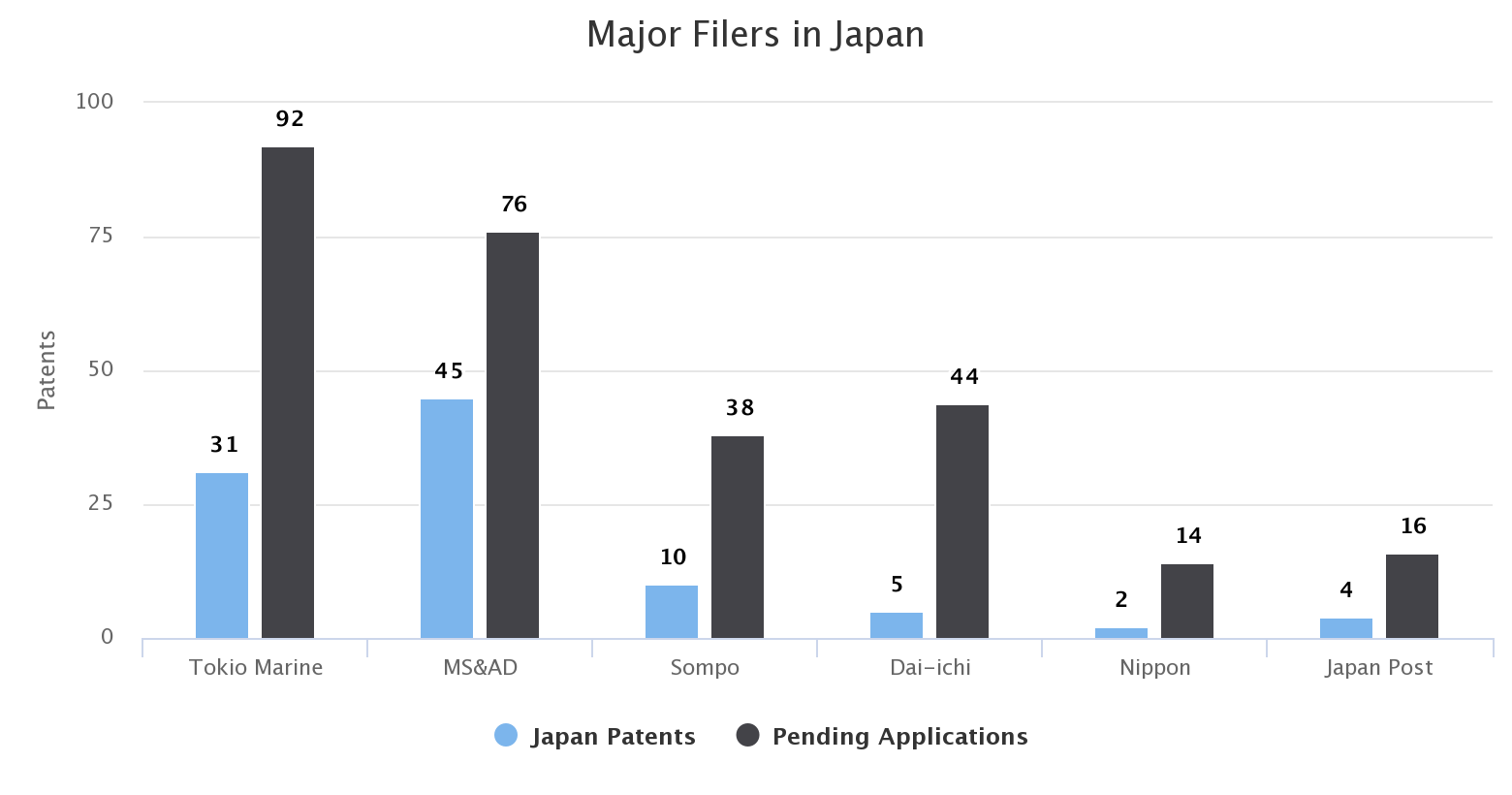

Now that we know the top filers in the US, it is time to find out the top-notch Japanese filers. Unlike the US where companies from diverse nations conduct business, innovate and protect, the Japanese patent office largely received patent applications from the companies that were based out of and operated in Japan.

Tokio Marine filed the highest number of applications while MS&AD had the highest number of granted patents. It should be noted that all the Japanese organizations filed at least 1 patent application in the US except Dai-Ichi and Japan Post Insurance, whose protection measures are focused solely on the Japanese market.

The litigation landscape in Insurance Sector

Now that we know the top filing geographies and the top players in each of these markets, it is time to answer an unresolved query: How often do insurance companies indulge in patent battles? Were they mere patent battles or frivolous patent wars too?

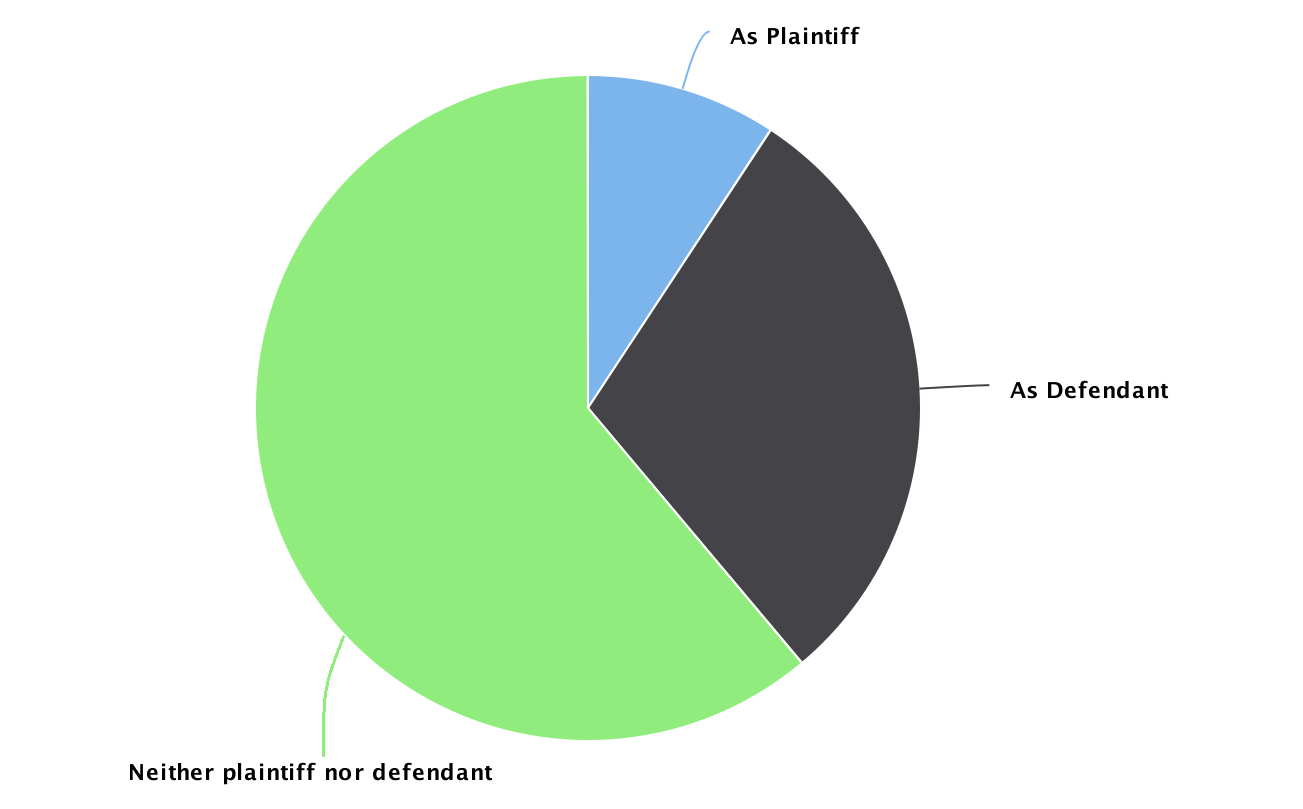

The analysis of the litigation behavior of these 50 organizations revealed that merely 5 companies had been in litigation as a plaintiff whereas 16 of them had played the role of the defendant in at least one of the litigations. Allstate faced the highest number of lawsuits, serving as a defendant for 37 litigation campaigns.

One interesting fact to note here is that majority of these defendants(with hundred others) were targeted for infringing one single patent – US 5412730 titled Encrypted data transmission system employing means for randomly altering the encryption keys, by a notable PAE TQP Development LLC. Though the patent is being challenged at Patent Trial and Appeal board currently, it will be worth watching whether any of these companies would be relieved of this frivolous lawsuit or not.

Having a look at the litigation landscape from a plaintiff’s view, it made us ponder – How good were the chances of being involved in litigation? How good were the chances of a patent being infringed by someone?

To find the answer, we evaluated the litigation probability of the patents of the top US filers. The results revealed that the patent with the highest litigation probability was US8489063 with a 51.6% probability of undergoing litigation.

Compared to other domains, the litigation score is pretty low, a plausible reason behind the low numbers of litigations waged by plaintiffs.

Though innovation and protection are given preference by the majority of these corporations, litigation will continue to remain in the shadows, unless the innovation rate in the insurance sector grows at a rate that it would get difficult for products to not overlap on patents, like many technological fields in existence.

But that’s a long way down the lane.

Conclusion:

At the moment, the insurance sector is growing at a good pace while embracing innovation. We strongly believe that insurance companies can easily overcome the traditional thought process that patents cannot be filed in our domain.

There is a lot of white space for innovation and patenting in the insurance industry, which if filled could not only lead to disruption of the entire sector but also help organizations get an edge. While innovations and innovative processes are easy to replicate, when paired with some form of IP protection, it could prevent others from replicating them, forming a barricade over an organization’s technology.

Though IP has not yet achieved maximum proliferation in the insurance industry, it is quite possible that in the near time, as more companies realize the benefit of protecting their processes and methods, there would be expansive patenting activity in the domain. It’s all a matter of time.

Authored By: Anjali Chopra, Analyst, Market Research and Deepika Kaushal, Manager, Patent Landscape.